Stockholm (HedgeNordic) – After enjoying their best summer on record, Nordic equity hedge funds continued on an upward trend by posting their sixth consecutive month of positive returns. Equity funds in the Nordic Hedge Index advanced 1.3 percent on average (89 percent reported) last month to bring their year-to-date performance to 6.4 percent, which is just shy of the group’s 6.5 percent gain for the entire 2019.

Global equity markets gained 3.4 percent in Euro terms in the third quarter despite falling 1.3 percent last month, turning in a second quarter of gains to continue a stock market recovery few anticipated during the March downturn. Global equities are now down 3.0 percent in Euro terms for the first three quarters of 2020. Eurozone equities, meanwhile, declined by 1.7 percent in September to extend the year-to-date decline to 11.2 percent. North American equities were down 2.0 percent in Euro terms last month, bringing their performance for the year to 1.8 percent. The VINX All-Share Index, which includes all the firms listed on Nasdaq OMX Nordic Exchanges and Oslo Börs, delivered a net return of 0.9 percent in Euro terms in September and a 5.5 percent return for the first nine months of 2020.

Nordic equity hedge funds outperformed their European and global counterparts both in September and year-to-date. The Eurekahedge Long Short Equities Hedge Fund Index, which tracks the performance of close to 900 global equity hedge funds, was down an estimated 0.9 percent in September based on reported data from 24 percent of index constituents. This group gained 4.4 percent in the first three quarters of 2020. Another Eurekahedge index comprised of 156 European equity hedge funds was up an estimated 0.2 percent last month based on reported data from 34 percent of index constituents. The Eurekahedge Europe Long Short Equities Hedge Fund Index was down 0.5 percent in the first nine months of 2020.

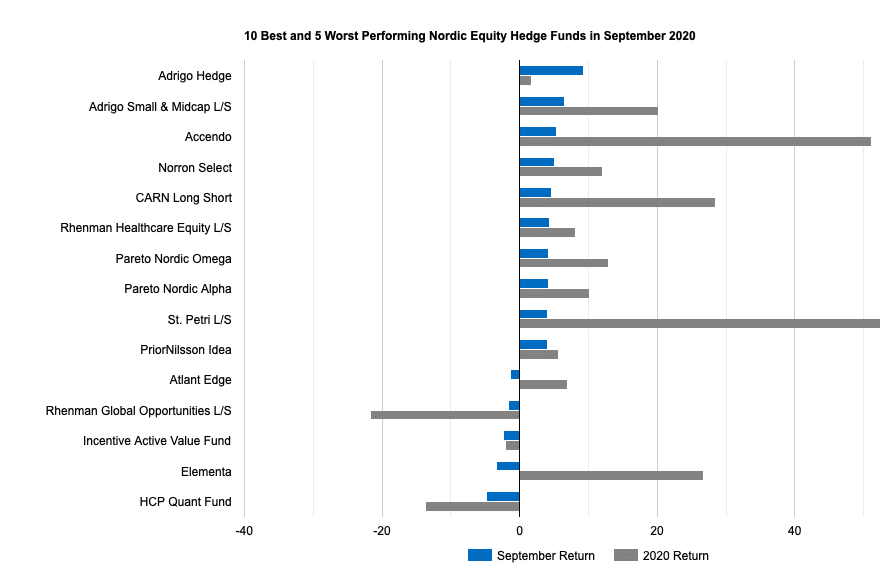

The dispersion between last month’s best- and worst-performing equity hedge funds in the Nordic Hedge Index remained broadly unchanged month-over-month. In September, the top 20 percent of funds gained 5.2 percent on average, whereas the bottom 20 percent lost 1.9 percent on average. In August, the top 20 percent gained 6.8 percent on average and the bottom 20 percent was down 0.5 percent on average. About two in every three members of the NHX Equities sub-index enjoyed gains for the month of September.

Adrigo Hedge, a long/short equity fund focused on larger and more liquid companies in the Nordics that was merged into the younger Adrigo Small & Midcap L/S on October 1, was last month’s best-performing member of the Nordic Hedge Index with a gain of 9.3 percent. The fund gained 1.7 percent in the first three quarters of 2020 and ended its journey of almost 14 years with an annualized return of about four percent. Adrigo Small & Midcap L/S, meanwhile, advanced 6.5 percent last month to take its year-to-date performance to 20.1 percent.

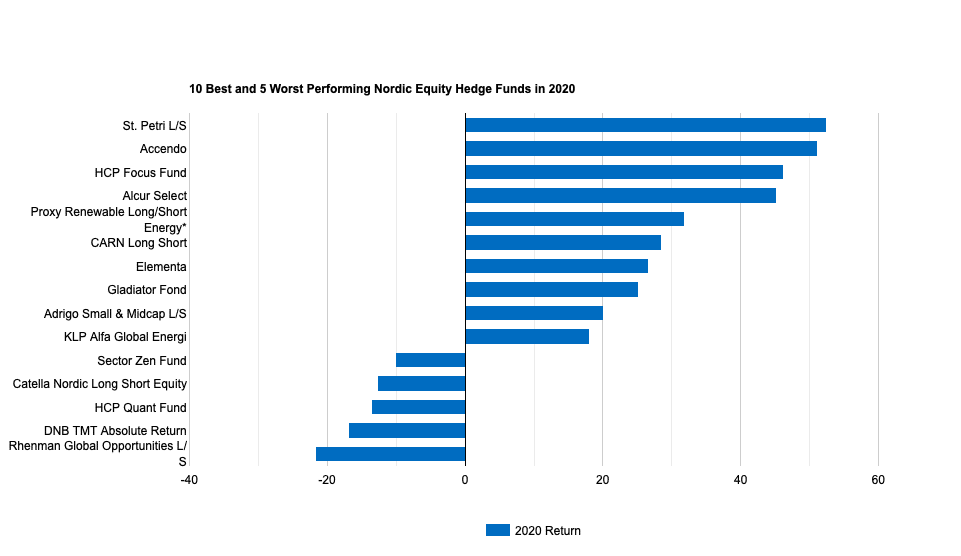

Activist investor Accendo gained 5.3 percent in September, bringing its performance for the first three quarters of 2020 to 51.1 percent. Accendo is currently the second best-performing member of the Nordic Hedge Index this year, trailing only thematic-focused long/short equity fund St. Petri L/S. Last month, Norron Select and CARN Long Short advanced 5.1 percent and 4.6 percent, respectively. CARN Long Short is now up 28.5 percent for the year, while Norron Select is up 12.0 percent.