Stockholm (HedgeNordic) – Nordic hedge funds rose 1.6 percent on average in July (94 percent reported) to bring industry’s year-to-date performance back into positive territory at 0.7 percent. Nordic CTAs led the gains last month, with the group advancing three percent on average.

All five strategy categories in the Nordic Hedge Index enjoyed gains in July. The 17 CTAs in the Nordic Hedge Index gained 3.0 percent on average, bringing their performance for the year back into positive territory at 0.9 percent. Equity hedge funds, meanwhile, advanced 1.7 percent on average to take their year-to-date performance to 2.0 percent. Fixed-income and multi-strategy hedge funds rose 1.3 percent and 1.2 percent last month, respectively. Funds of hedge funds were up 0.5 percent in July, trimming their year-to-date decline to 2.0 percent.

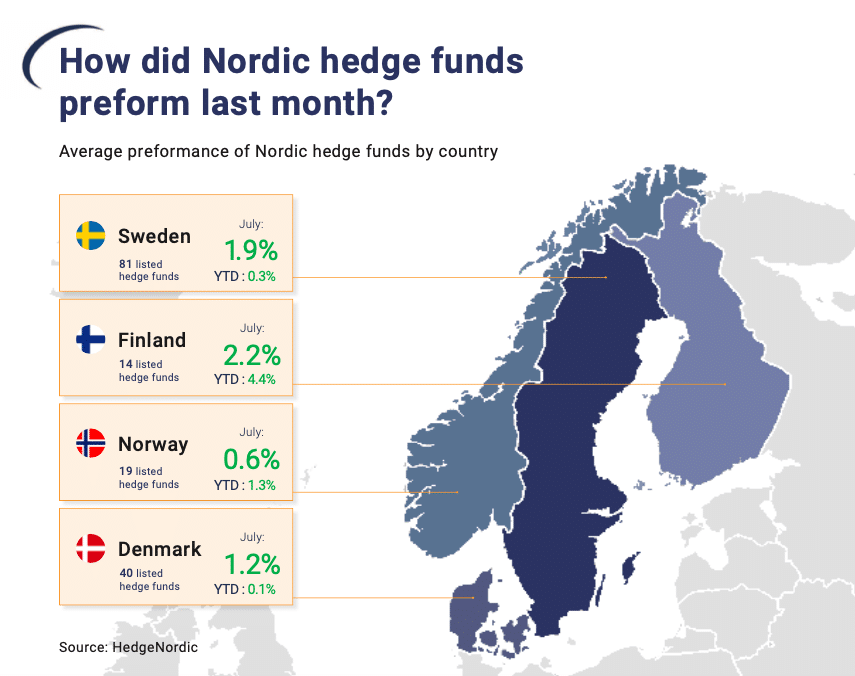

At a country level, the Finnish hedge fund industry gained 2.2 percent last month, reflecting the strong performance of several CTAs and two equity funds under the umbrella of Helsinki Capital Partners: HCP Quant and HCP Focus. Swedish hedge funds, which account for the largest portion of the Nordic hedge fund industry with 81 listed funds out of 154, advanced 1.9 percent last month. The Danish hedge fund industry, mostly populated by fixed-income funds, was up 1.2 percent in July. Norwegian hedge funds edged up 0.6 percent last month.

The dispersion between last month’s best- and worst-performing members of the Nordic Hedge Index decreased slightly month-over-month. In July, the top 20 percent of Nordic hedge funds advanced 5.5 percent on average, whereas the bottom 20 percent lost 1.2 percent on average. In June, the top 20 percent were up 5.0 percent on average and the bottom 20 percent lost 2.2 percent. About four in every five members of the Nordic Hedge Index with reported July figures posted gains last month.

HCP Quant, a quant-heavy systematic fund investing in undervalued small- and mid-sized companies, was the best-performing member of the Nordic Hedge Index in July with a return of 8.8 percent. The fund managed by Pasi Havia is now down 9.5 percent year-to-date through the end of July. Last month’s gain of 8.6 percent catapulted precious metal-focused Pacific Precious into the top ten best-performing hedge funds in the Nordics in 2020. The fund gained 20.6 percent in the first seven months of 2020.

Energy transition-focused Proxy Renewable Long/Short Equity, meanwhile, gained 8.3 percent in July to extend the year-to-date advance to 25.9 percent. Systematic trend-following fund Lynx (Sweden) was last month’s best-performing CTA in the Nordics with a gain of 7.5 percent after enjoying profits across all asset classes. Lynx (Sweden) ended the first seven months of 2020 down 0.3 percent. IPM Systematic Currency Fund, a vehicle that trades liquid instruments in developed and emerging market currencies, closely followed suit with a gain of 7.3 percent for July.

The Month in Review for July can be downloaded below:

Photo by Glen Carrie on Unsplash