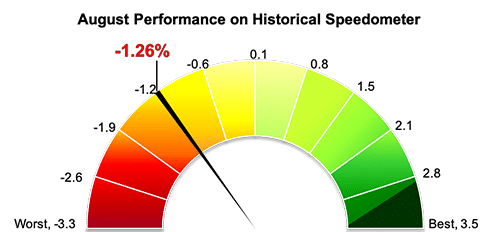

Stockholm (HedgeNordic) – After reporting the third-best first half since 2009 in the first half of this year, Nordic equity hedge funds gave up some gains in August. Nordic equity hedge funds, as expressed by the NHX Equities, were down 1.3 percent on average last month (82 percent reported), which cut the year-to-date performance to 2.9 percent.

Nordic equity hedge funds as a group performed broadly in line with local and global equities last month. Nordic equities, as expressed by the VINX All-Share index, returned a negative 1.4 percent in Euro terms in August. The index includes all firms listed on Nasdaq OMX Nordic Exchanges and Oslo Börs. Global equities, as measured by the FTSE World Index, were down 1.1 percent in Euro terms last month. Eurozone equities fell 1.3 percent, whereas North American equities were down 0.6 percent in Euro terms.

Based on preliminary estimates, European and global long/short equity funds slightly outperformed the group of equity funds in the Nordic Hedge Index. The Eurekahedge Europe Long Short Equities Hedge Fund Index, which tracks the performance of 174 European equity hedge funds, was down an estimated 1 percent last month based on reported data from 21 percent of index constituents. The Eurekahedge Long Short Equities Hedge Fund Index, a broader index comprised of 955 global funds, fell an estimated 0.9 percent based on reported data from 12 percent of index constituents. In the first eight months of 2019, European and global equity hedge funds gained 3.6 percent and 6.3 percent, respectively.

Only one in every three members of the NHX Equities posted positive returns for August. Fundamental equity long/short fund Bodenholm was last month’s best-performing member within the group of 50 equity hedge funds in the Nordic Hedge Index with reported data for August. Bodenholm was up 5.6 percent in August, marking the fund’s best month since launching in September 2015. The fund founded by Per Johansson gained 15.6 percent year-to-date through the end of August.

Activist fund Accendo closely followed suit with a monthly return of 4.9 percent, which brought the fund’s year-to-date gain to 22.2 percent. Accendo currently ranks as the fourth best-performing equity fund in the Nordic Hedge Index in 2019. Systematic market-neutral fund QQM Equity Hedge was up an estimated 2.0 percent last month, extending its year-to-date gain to 12 percent.

Proxy Renewable Long/Short Energy, a long-biased long/short equity fund focusing on renewables, gained 1.8 percent in August, strengthening its position as the best-performing member of the Nordic Hedge Index in 2019. The fund managed by Stockholm-based energy specialist Proxy P Management was up 35.9 percent in the first eight months of 2019. Pareto Nordic Alpha was up 1.7 percent in August.

Photo by David Clode on Unsplash