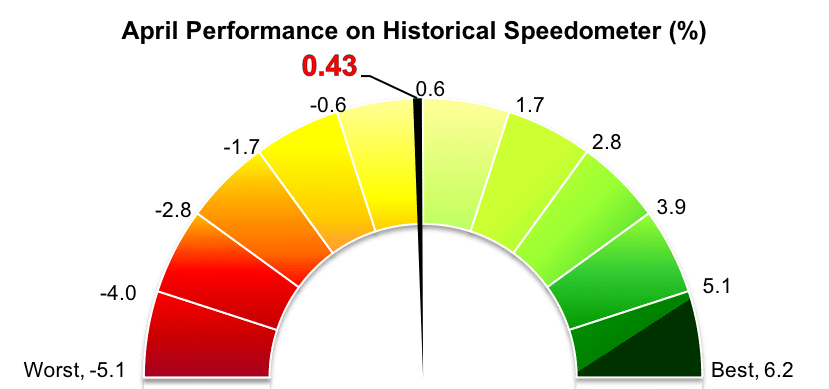

Stockholm (HedgeNordic) – Nordic CTAs as a group enjoyed a positive month in April, a month characterized by mixed performance across managers and sub-strategies. Nordic trend-following CTAs, as measured by the NHX CTA Index, were up 0.4 percent in April (100 percent reported), recouping some of the losses incurred in the first four months of 2018 (down 2.2 percent YTD).

The largest global CTA programs slightly underperformed their Nordic counterparts in April. For example, the SG CTA Index, which tracks the largest 20 CTAs by assets under management, gained 0.1 percent last month. The Société Générale index is down 2.7 percent in the first four months of the year. Meanwhile, the Barclay BTOP50 Index advanced 0.3 percent in April, bringing the losses for the first four months of the year to 2.6 percent.

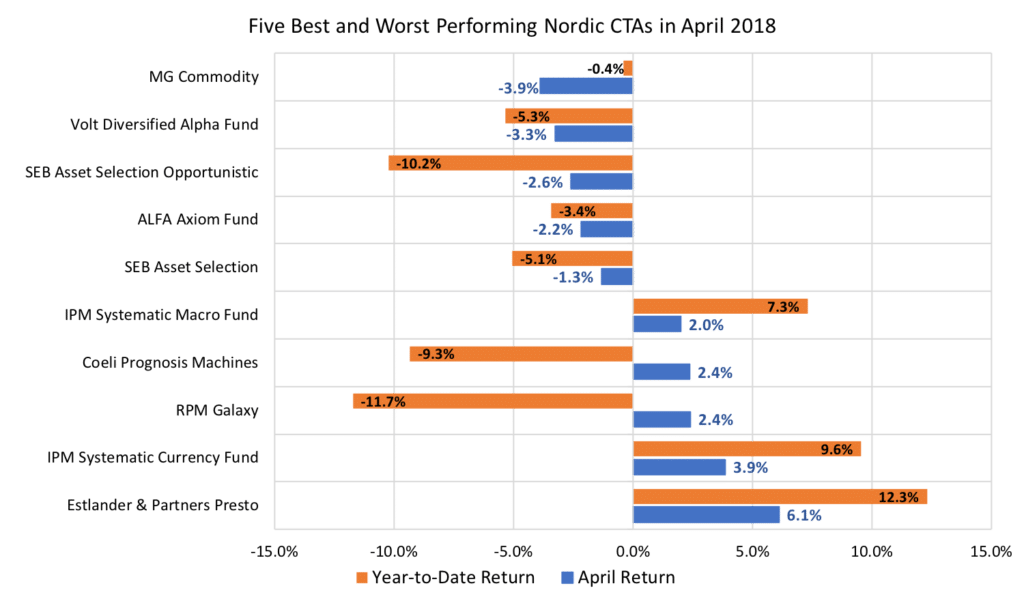

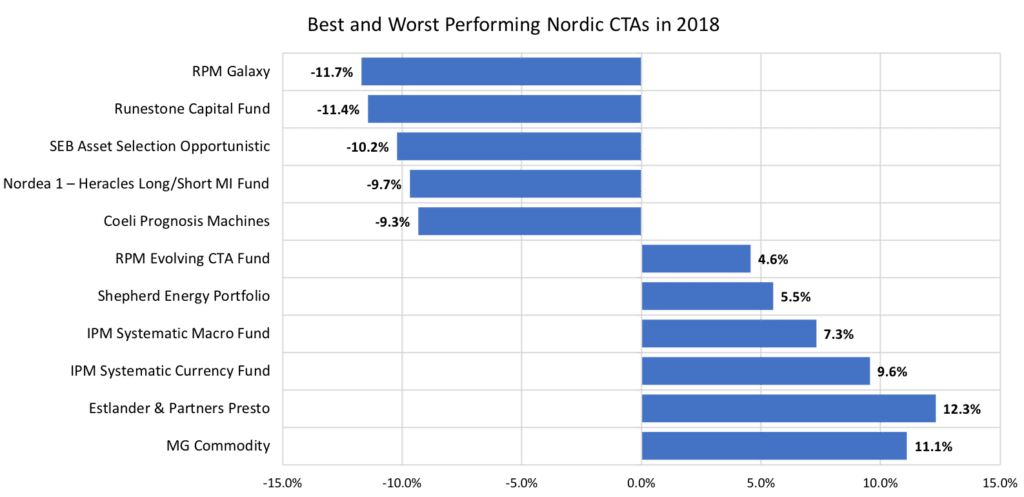

60 percent of the 20 members of the NHX CTA posted positive performance in April, with Martin Estlander´s (pictured) fund Estlander & Partners Presto topping the ranking of both the best-performing Nordic CTAs in April and 2018 overall. Presto, a program that runs short-term trend-following models with an average holding period of 10 days, gained 6.1 percent last month and is up 12.3 percent in 2018.

IPM Systematic Currency Fund, IPM’s systematic currency strategy, and RPM Galaxy, which invests in a concentrated pool of CTA managers, were up 3.9 percent and 2.4 percent in April, correspondingly (up 9.6 percent and down 11.7 percent YTD, respectively). Artificial intelligence-driven Coeli Prognosis Machines gained 2.4 percent last month, ending a three-month run of negative performance (down 9.3 percent YTD).

MG Commodity tumbled 3.9 percent in April, incurring the first monthly loss of 2018 (down 0.4 percent YTD). Volt Diversified Alpha Fund and SEB Asset Selection Opportunistic were down 3.3 percent and 2.6 percent, respectively (down 5.3 percent and down 10.2 percent YTD, respectively).

Picture © HedgeNordic