Stockholm (HedgeNordic) – Hedge fund investors are planning to increase allocations to emerging markets in 2018, this according to JP Morgan Chase & Co’s latest institutional investor survey released Thursday.

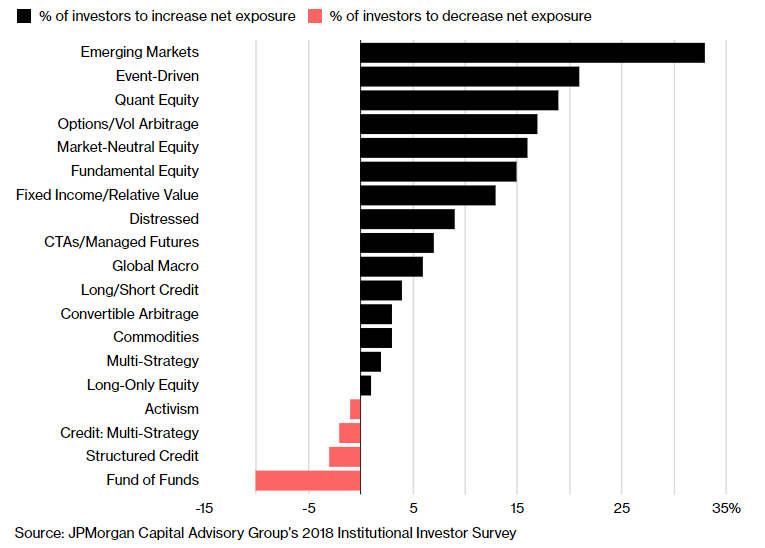

According to the report, referenced by Bloomberg, about 33 percent of institutional investors plan to give more capital to emerging-market strategies this year. Approximately 20 percent expect to increase allocations to event-driven and quantitative-equity funds, while about 10 percent will devote less capital to fund of funds.

After years of underperformance by the hedge fund industry, investors are chasing returns in Asia. Hedge funds focused on emerging markets, particularly China and India, were the top-performing strategies last year, surging 20 percent and reaching a record of about $230 billion in assets under management in the fourth quarter, according to Hedge Fund Research.

In terms of regional exposure, 42 percent of investors expect to boost exposure to Europe while 18 percent plan to cut it in North America, according to the survey.

“Institutional investors have been under-allocated to both Europe and Asia and performance in both regions has been so strong that you can’t ignore it now,” said Alessandra Tocco, managing director and global head of JPMorgan’s Capital Advisory Group. “We’re also seeing more and more fund launches in China, as the markets continue opening up to outside investors.”