Stockholm (HedgeNordic) – It was just year ago CalPERS, the California Public Employees’ Retirement System announced it was exiting all its four billion USD of hedge fund allocations, in part because of the high cost of those investments, sparking up the fee discussion again.

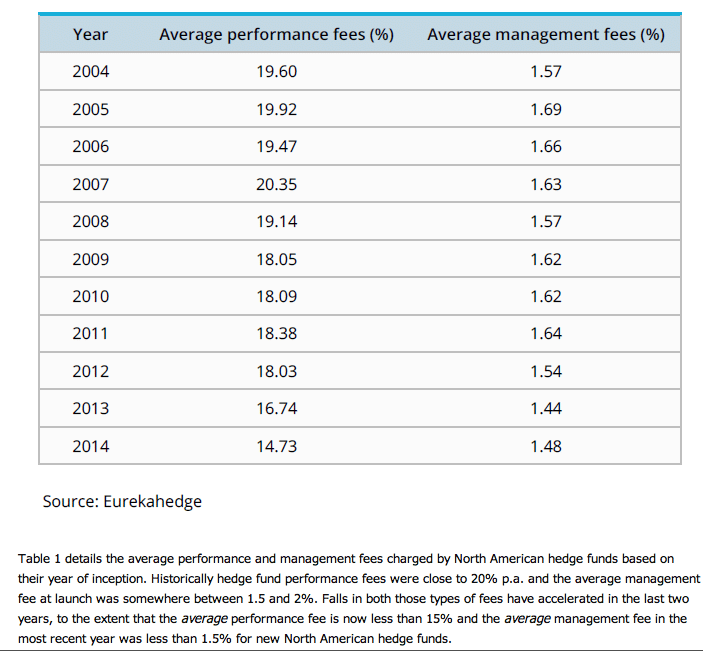

The glory days of hedge funds being able to charge the famed 2%+20% and above seem long gone on a global scene. Continued pressure, especially by large investors have pushed average management fees in the second quarter of this year down to 1.53% while average performance fees have declined to 17.78%, latest data show by HFR indicates.

Hedge Fund managers, especially smaller ones and those just starting out are squeezed from two sides: pressure on their fee driven income model accompanied by increasing cost level largely driven by regulatory requirements. The biggest hurdle to overcome however for the industry though is to find the way back delivering performance – which has been, well, sluggish.

In 2014, for example, the average hedge fund globally returned 3%. The Nordic Hedge Index, NHX did better, returning 5% but still significantly fell behind equities, such as the S&P which returned 14%. Depending on benchmarks, hurdles and high water marks, many managers were therefor able to cash in on performance fees, despite investors would have been better off – in hindsight – being exposed to cheaper equity index investments while earning over four times in returns, critics claim.

“The pressure in recent years has come in part from the low interest rate environment. The standard fee structure was developed in the late 1990s when the interest rate was much higher. Now fees seem more expensive by comparison”, Don Steinbrugge, CEO hedge fund third party marketer, Agecroft Partners analyzed in an interview for Euromoney.

2015 so far does also not look to be the hedge fund industries big moment in time in terms of performance. By the end of August, the HFRI fund composite index was down 0.11% while, once again, Nordic hedge funds did better with a positive return of 2,6% in the same period. The big difference of course is the increased volatility on equity markets which largely for the year are also under water.

“Investors are worried about interest rates rising, spreads widening and equity markets selling off. The next six to nine months there will be more demand for strategies not correlated to capital market so very different to last three to four years where money was going into distressed debt, structured credit, event-oriented strategies and long short equity.”

Despite the fee discussion and relatively poor performance, inflows to hedge funds are continuing to increase and the industry recorded net inflows of 40 BUSD in the first two quarters of 2015 and for the first time now is scratching to break through the three trillion Dollar mark.

“This year was a reminder to investors that equity markets are not going to produce 20% annually, and that means more money will move into hedge funds. As such, pressure to reduce fees will slow for the largest funds that have demand. Indeed, if interest rates start to rise they may even be able to justify a higher fee structure. But they will be in the minority.” Kenneth J. Heinz, CFA, President of Hedge Fund Research (HFR) told Euromoney in the same interview.

Perhaps we should postpone the discussion if 2%+20% vs 1,53%+17,87% really is so much more costly, especially in relation to index ETFs until after equity markets tanked by 20%, 30% or more. Who know´s…perceptions may change. What hedge funds must do, now and then, is deliver performance, uncorrelated to (equity) markets. That is what they are supposed to do, that is what it says on the box and that is what they get paid for.

Picture (c) OtnaYdur—shutterstock.com