(Partner Content) – Europe stands at a crossroad. With rising global competition and ambitious climate targets, the need for transformation has never been greater. In response to these challenges, DWS introduces the “European Transformation Scorecard,” a framework tracking progress across 12 critical sectors. “It sheds light on Europe’s transformation needs, identifies pressing gaps, and highlights opportunities for private investments,” states Micheal Lewis, Head of ESG Research at DWS, in an interview in Stockholm.

While Europe’s strengths in sustainable practices are recognized globally, the region also faces challenges like increasing debt levels, poor industrial competitiveness, aging demographics and vulnerability of certain supply chains. This strains European wealth. “Europe needs to transform. It needs to secure its prosperity and address these problems. Substantial amounts of investments are required,” says Lewis. And investment opportunities exist.

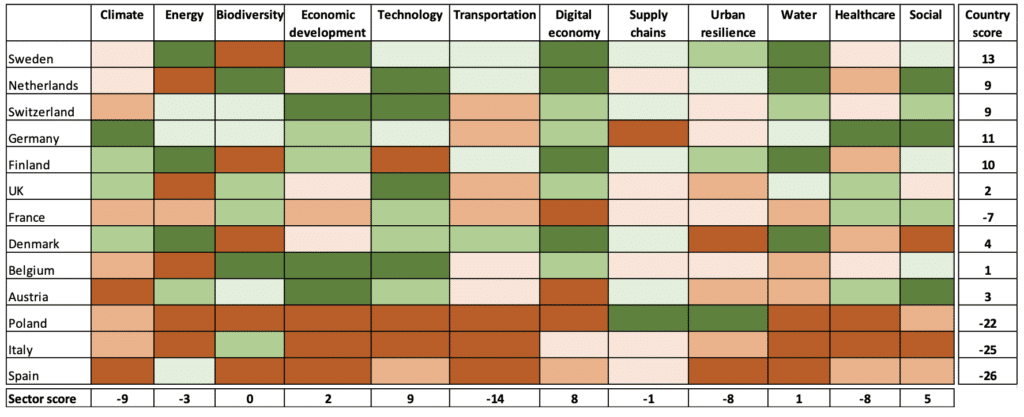

With the use of quantitative metrics measured against their respective 2030 targets DWS tracks 13 European countries in their transformational journey across 12 sectors that are critical target achievements*. The DWS Scorecard not only evaluates each country’s current position relative to EU targets but also tracks their rate of progress.

Figure 1. The European Transformation country-sector heat map. Download the report “Europe’s Transformational Scorecard”

Sweden ranks as number one among the countries, rewarded for its share of renewable energy amongst others. However, there are weak spots, particularly in the circular economy. “It is clear that each country, including high-ranking Nordics, must address particular sustainability gaps to support overall progress in Europe,” emphasizes Lewis.

Find out more about “The transformation of Europe”

EUR 6 trillion is needed by 2030

DWS inhouse analysis estimates that EUR 6 trillion is needed by 2030 to reach Europe’s key climate and digital transformation goals. “Part of this will be EU financed, leaving an investment gap of around EUR 2.5 trillion. This will be difficult to finance and will likely fall on the shoulders of the private sector.”

Private capital has an essential role, particularly in areas like infrastructure, real estate, and private debt, which can channel funds to small and medium-sized enterprises (SMEs) – important players in the transformation but often underserved by traditional capital markets. “SMEs are the backbone of Europe’s economy,” states Lewis. “They represent half of EU GDP and employ two out of three people. Plus, they generate 60% of the continent’s greenhouse gas emissions.”

Investment Solutions: Private Debt, Infrastructure and Real Estate

Lewis underscores private markets as the optimal pathway to bridge this shortfall in investment, emphasizing the role of direct lending for SMEs that struggle to access capital markets due to banking constraints. “We view direct lending as a vehicle to bridge that gap as well as an investment opportunity.”

Infrastructure remains as one of the most urgent investment areas in Europe. Modernizing the power grid to accommodate a renewable energy-based economy is vital. Lewis emphasizes that sectors such as EV charging infrastructure, telecommunications, and energy grids are crucial.

“Actually, transport emissions are a bit higher today than they were in 1990. Unlike other sectors, transport has not decarbonized over the last 30 to 35 years.” With transportation accounting for a large share of Europe’s total emissions, the pressure to transform this sector is increasing. Electric vehicles and the expansion of charging infrastructure, for instance, are key areas where both policy support and private investment will be essential.

Real estate, too, presents both a challenge and an opportunity. Given that buildings are among the largest sources of greenhouse gas emissions, energy efficiency upgrades and retrofits are necessary to reduce their environmental impact. “Real estate is the sector with the biggest investment gap,” Lewis highlights, “but it’s also the sector that, when improved, can provide multiple benefits, from higher property valuations to energy security and job creation.” Buildings with high sustainability ratings tend to command higher rent premiums, making this an attractive investment for asset managers focused on long-term returns.

The scorecard also extends beyond environmental transformation to include sectors like digitalization and healthcare, areas where Europe historically has lagged its global peers. “Of the world’s top 100 tech companies, 10 are European,” Lewis remarks, underscoring the EU’s need to bridge this digital divide.

Digital transformation could be particularly impactful for the European SMEs, which contribute significantly to the economy but are underutilizing the benefits of a single European market. “Only 8% of European SMEs are trading across one European border. These companies are not maximizing the benefits of a single market. Boosting digital capabilities across Europe could unlock vast potential for SMEs.”

Policy’s Role in Competitiveness

Policy interventions at both the EU and national levels will play an influential role for the sustainability in Europe. The Capital Markets Union and proposed revisions to the single market are positioned to foster greater competitiveness and innovation.

Additionally, targeted state aid, currently concentrated in large economies like Germany and France, has proven effective in sectors such as electric vehicle infrastructure. “With few natural resources, Europe has become increasingly dependent on sourcing raw materials for the climate transition and the digital transformation from outside the EU. To address this, the European Commission is prioritizing ways to create and secure resilient supply chains,” explains Lewis.

Moving Forward: Momentum and Caution

The EU’s sustainability agenda has made notable progress, but considerable work still remains. With a new European Parliament, with less green representation, questions arise around the region’s capacity to maintain its targets. There is a need for continued momentum, innovation, and public-private efforts to ensure that Europe remains a leader in sustainability in a bid to protect the region’s economic security and prosperity, even as it navigates complex geopolitical and economic landscapes.

Find out more about “The transformation of Europe”

In recognising the important role private markets can play in combatting the challenges threatening Europe, DWS set European Transformation as a strategic priority with the aim to mobilise private capital. Adopting a combined approach through industry, academia and company research, DWS has set out to help inform decision-making in politics and industry, and provide investment solutions to transform economies, reduce dependencies and build a sustainable landscape. The “European Transformation Scorecard” underpins DWS’ efforts by identifying policy actions and investment requirements across key areas.

*Forecasts are based on assumptions, estimates, views and hypothetical models or analyses, which might prove inaccurate or incorrect. No representation or warranty is made by DWS as to the reasonableness or completeness of forward looking statements. No liability for any error or omission is accepted by DWS. Opinions and estimates may be changed without notice and involve a number of assumptions which may not prove valid.

Marketing Communication

For Professional Clients (MiFID Directive 2014/65/EU Annex II) only. Not for distribution to private/retail investors. This document is intended to be a marketing communication. DWS is the brand name under which DWS Group GmbH & Co. KGaA and its subsidiaries do business. Clients will be provided DWS products and/or services by one or more legal entities as identified to them in relevant documentation.

DWS International GmbH_November2024_CRC103649