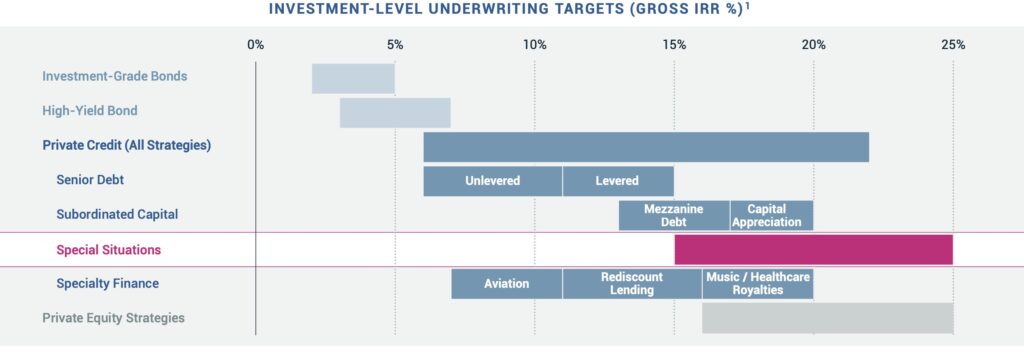

Most managers in both the public and private credit markets share a common goal: to steer clear of difficult and distressed lending situations. However, some managers such as Alcentra – a Franklin Templeton manager and one of the world’s largest alternative credit managers –in its Special Situations strategy actively pursue these distressed or special situations in private credit markets. This strategy can provide investors with equity-like returns while maintaining the risk profile of secured debt, along with diversification and, notably, a hedge against challenging market environments. Consequently, exposure to special situations in private credit can serve as a valuable complement to a traditional private credit portfolio.

“European special situations can deliver equity returns with the risk profile akin to a secured debt portfolio,” says Eric Larsson, Managing Director and co-Head and Portfolio Manager at Alcentra. “It’s the best of both worlds, where we buy debt at a discount, often with low loan-to-value ratios and secured debt,” he elaborates. In a downside scenario, investors benefit from access to collateral and a running yield of around seven percent, with the upside optionality of capital appreciation as the situation improves. “It’s a way to enhance returns while maintaining low risk and volatility in your strategy.”

It’s not just the equity-like yields that make a special situations portfolio attractive; it also offers both diversification and hedge benefits, according to Larsson. “A traditional private credit or direct lending portfolio typically focuses on four or five core sectors, such as IT services, healthcare, and others,” Larsson explains, highlighting the sector diversification of special situations. Since special situations can arise across various sectors, “adding a special situations manager can enhance portfolio diversification. Our sector-agnostic approach ensures that investors gain exposure to a wide range of opportunities in various sectors, leading to a more diversified portfolio overall.”

“European special situations can deliver equity returns with the risk profile akin to a secured debt portfolio.”

Eric Larsson, Managing Director and co-Head and Portfolio Manager at Alcentra.

The hedge aspect is especially important for investors with exposure to traditional credit, which can struggle in challenging economic conditions. When businesses face challenges in a weaker economy, “how can we turn that into an opportunity instead?” asks Larsson. The Alcentra team “actively scans the market for such opportunities and seeks to turn them into strong investments.” This approach, he adds, introduces a valuable hedge to a private credit portfolio.

Understanding Special Situations

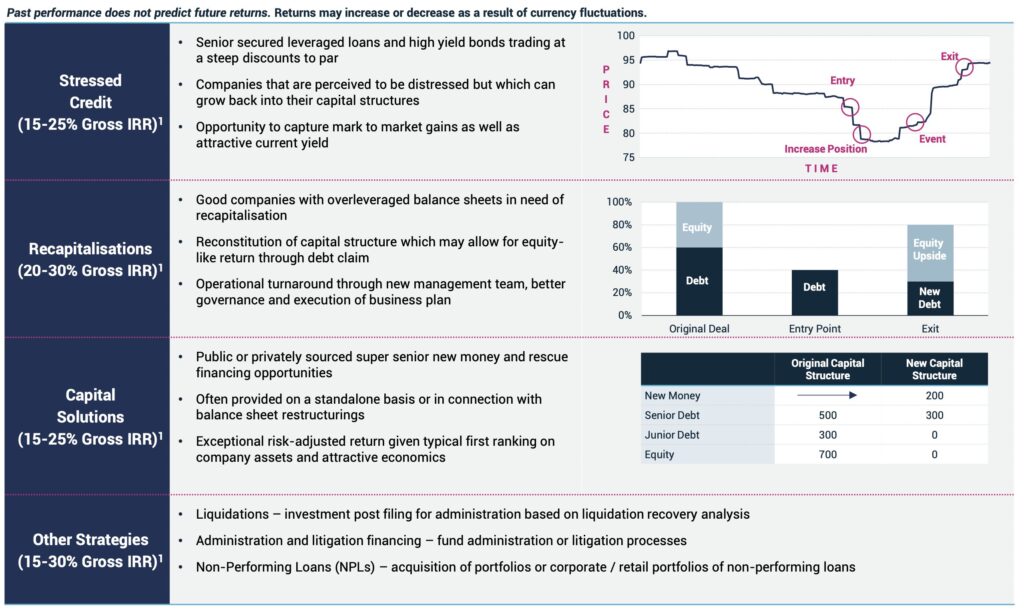

In private credit markets, special situations refer to unique, non-standard investment opportunities that arise from a company’s specific financial or operational challenges or transitions. These situations often require tailored financing solutions and involve higher complexity compared to traditional credit investments. Eric Larsson, who has nearly 20 years of experience in the European stressed and distressed credit markets, categorizes the whole universe into corporate special situations, non-performing loans, asset-backed lending, and other sub-categories. Within the corporate special situations space – the largest and the one Alcentra focuses on – Larsson breaks the space down into three main sub-categories: stressed credit, recapitalizations, and capital solutions.

“Stressed investments involve purchasing a bond with the expectation that things will improve, either through the company’s recovery or an injection of capital by the sponsor, with the goal of selling at a higher value once that event occurs,” Larsson explains stressed credit investments. “Next, we have recapitalizations, where creditors step in as shareholders after the company undergoes restructuring,” he continues. Finally, there are capital solutions, which have become a buzzword lately in the industry, according to Larsson.

“Capital solutions, as we define it, involve providing new capital to corporates facing some form of stress or in need of assistance to navigate a difficult situation,” explains Larsson. “This may include companies that need to sell a division but lack access to traditional sources of financing, and therefore require more flexible capital to help them through this period,” he elaborates. Alcentra categorizes the broader special situations market into these three areas, with the firm actively participating in all of them and constructing its portfolio based on where the team identifies the most attractive opportunities at a given time.

Key Ingredients for Success in European Special Situations

Success in special situations investing, particularly within private credit, hinges on several key elements coming together. These include proactive deal sourcing through extensive networks and market intelligence, specialized expertise in industry and restructuring, and the ability to offer tailored financing solutions. As one of the largest alternative credit managers globally, Alcentra has built a robust sourcing channel for its investments, including those in special situations.

Alcentra Special Situations was founded in 2007 with the idea of leveraging Alcentra’s position as a leading platform in the CLO market. “At the time, we had a massive library of information on target investment opportunities, covering both syndicated and private transactions,” recalls Larsson. “We source between 50 and 60 percent of our investments internally, which means that we are often dealing with companies we’ve already lent to or have been involved with for an extended time, and we possess comprehensive information and data on them.” This gives Alcentra a significant advantage in the space of special situations. “Sourcing in this space, in particular, is extremely key.”

As one of Europe’s longest-standing special situations platforms, having deployed over €3 billion in capital since its inception in 2007, Alcentra is well-positioned to navigate the nuances and complexities of the European special situations market. This market is characterized by private market dominance and jurisdictional intricacies, which require deep expertise and strategic sourcing. With 40 years of combined industry experience, Laurence Raven and Eric Larsson, Co-Heads of Special Situations at Alcentra, play a crucial role in guiding the firm through the European landscape, which differs significantly from the more mature and established market in the United States.

“You need to understand the specific dynamics of each country you operate in, and information is typically harder to access.”

Eric Larsson, Managing Director and co-Head and Portfolio Manager at Alcentra.

“The European market is much younger and smaller than the US market,” explains Larsson. “Issuers are generally much smaller, and the market is more complex, given the many jurisdictions within Europe, each with its own legal and regulatory framework,” he continues. “You need to understand the specific dynamics of each country you operate in, and information is typically harder to access.” Unlike the U.S. space, which has a more broadly syndicated and high-yield market, Europe is largely a private market.

Larsson also points out that cultural and language differences further add to the complexity, contributing to pricing inefficiencies. “These inefficiencies can be an advantage if you know how to navigate them,” he adds. “The market may be obscure and difficult to penetrate, but that can work in our favor. Understanding these differences and how to leverage them is crucial for success in the European special situations space.”

Growing Opportunities Post-Pandemic

The opportunity set in special situations investing has expanded significantly in the wake of the COVID-19 era when many businesses took advantage of low interest rates to borrow extensively. Now, as those loans mature in a higher-rate environment and economic conditions tighten, a wave of restructuring and refinancing challenges is emerging, creating fertile ground for special situations investors. “Given the current macroeconomic environment, we believe we will continue to see a strong supply of opportunities in the market,” concludes Larsson.

“We expect European economies to remain largely stagnant, with limited room for fiscal support, although there will be some monetary easing as central bank rates come down,” he elaborates. “However, we are also dealing with a significant number of overleveraged capital structures that were created during the bull market pre-Covid, when debt was cheap,” notes Larsson. These structures have just been carried forward, and there haven’t been many defaults so far. “Yet, they are still out there, trying to survive in increasingly challenging macroeconomic conditions.”

Views expressed are those of Alcentra as of the date of this article and are subject to change.