By Scott Roth and Chris Sawyer, Barings: High yield remains well-positioned against a macro backdrop that gives us both reasons for confidence and concern. On the confidence side, market worries about a near-term U.S. recession may have been premature. Following the U.S. Federal Reserve’s (Fed) interest rate cut in September, the market anticipated a fast and steep trajectory of rate cuts for the remainder of 2024 and 2025. With the recent strong jobs number in the U.S., and ongoing strength in housing demand and retail sales, the economy appears stronger than expected, potentially reducing the need for aggressive Fed action. This robust economic backdrop is a net positive for high yield issuers overall.

However, geopolitical risks continue to rise with the escalation of conflicts in the Middle East, and the ongoing war in Ukraine. The macro backdrop in Europe also looks less rosy than the U.S. We anticipate further central bank easing to combat slowing growth, but expect that even low to modestly negative economic growth would not materially impede the return prospects for most European high yield issuers. Additionally, the high yield market’s strong fundamentals and positive technical forces serve as a stable counterweight.

Strength in Fundamentals and Technicals

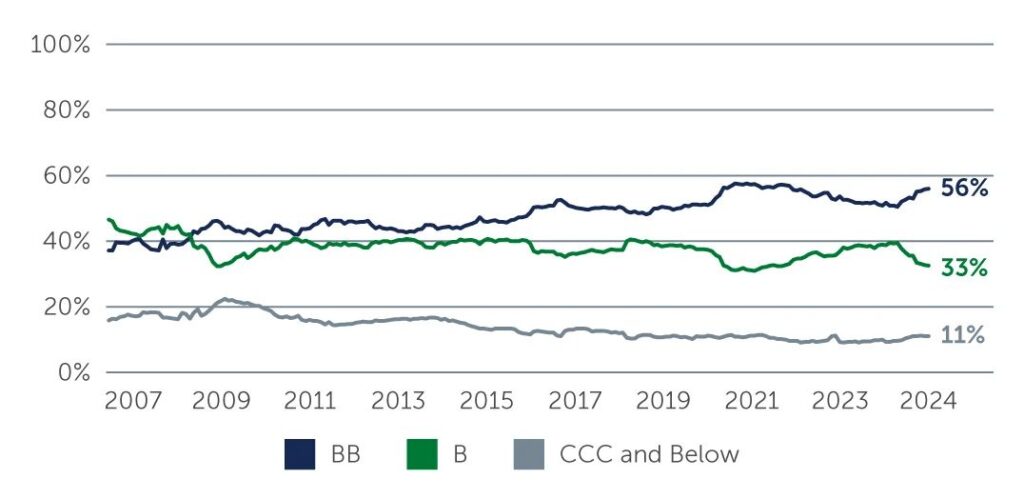

High yield issuers remain in good financial health overall, with earnings growth taking place at a slow and steady rate that is in line with expectations. While there is some divergence across sectors, the changing interest rate landscape—even if slower than some had expected—should offer some relief to issuers, particularly those in more cyclical sectors. Adding to this strong credit story is the robust ratings profile of the market. For example, the percentage of BB issuers in the global high yield bond index remains near all-time highs, at 56% (Figure 1).

Figure 1: A Higher-Quality Market

The strong technical forces that have prevailed in the high yield market throughout 2024 have grown even stronger in recent months. Simply put, demand for high yield bonds and loans has been considerably greater than supply. The low supply in the market is largely due to the continued dearth of M&A activity—and while lower rates should ultimately encourage M&A activity tick up, this could take some time and should keep the technical backdrop supportive in the coming months. On the bond side, given the improving credit quality of the high yield market overall, many issuers have been upgraded to investment grade status, contributing to a shrinking market and further pressuring supply. The attractiveness of potential returns in the face of this limited supply will likely remain a forceful market tailwind.

Compelling Opportunity Set in Loans & Bonds

Given the fundamental strength of the asset class, we continue to see benefits to a strategic allocation to both high yield bonds and loans. In particular, while some investors may try to opportunistically time their entry into the market, we believe this approach may miss the attractive income and risk-reward profile presented by long-term core allocations to the asset class.

We continue to see value in loans and this confidence has been further bolstered by the recent strong economic data in the U.S. In this still-elevated interest rate environment, loans continue to offer the potential for compelling returns. Specifically, the average coupon for global loans today remains above the long-term average at 8.6%.[1] Another benefit of loans is that unlike other fixed income assets, the majority of the return is coming from contractual income that is paid today rather than awaiting price recovery, resulting in a steadier return profile over time.

Within loans, there are also select discounted opportunities such as liability management exercise (LME) transactions. These have become more prevalent in financially stressed situations, essentially offering issuers ways to recast or restructure their existing debt arrangements. While these transactions must be navigated carefully, they can offer compelling value for managers that have the resources to rigorously analyze the attendant risks.

The bond market is also supported by tailwinds in the medium term. In particular, the total return story continues to be compelling today, with yields on BB and single-B bonds around 5.5% and 6.9%, respectively.[2] Against a backdrop of overall fundamental strength, we also see select opportunities in issuers in more challenged sectors that have already been through an earnings recession, such as chemicals, health care and technology. The companies in these sectors tend to have higher leverage, discounted prices and wider spreads. While it can be difficult to forecast the timing of individual credit turnarounds, many have good liquidity and are able to service their debt—and should ultimately benefit from central bank rate-cutting. That said, uncertainties remain, which means a cautious approach is required to identifying the potential winners and losers in this dynamic market.

Looking Ahead

We see material tailwinds supporting high yield for the remainder of 2024 and into 2025. But within the broader asset class, we expect that the best relative value at any given time will continue to move around—requiring managers to be nimble and able to move between geographies and asset classes.

While a number of risks remain on the horizon, which could trigger volatility, the market’s fundamental strength and diverse opportunities highlight the value investors can uncover—especially when partnering with experienced managers with deep resources and credit research capabilities.

Footnote

For Professional Investors / Institutional only. This document should not be distributed to or relied on by Retail / Individual Investors. Any forecasts in this material are based upon Barings opinion of the market at the date of preparation and are subject to change without notice, dependent upon many factors. Any prediction, projection or forecast is not necessarily indicative of the future or likely performance. Investment involves risk. The value of any investments and any income generated may go down as well as up and is not guaranteed by Barings or any other person. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. 24/3933861

[1] Source: Credit Suisse. As of September 30, 2024.

[2] Source: Credit Suisse. As of September 30, 2024.