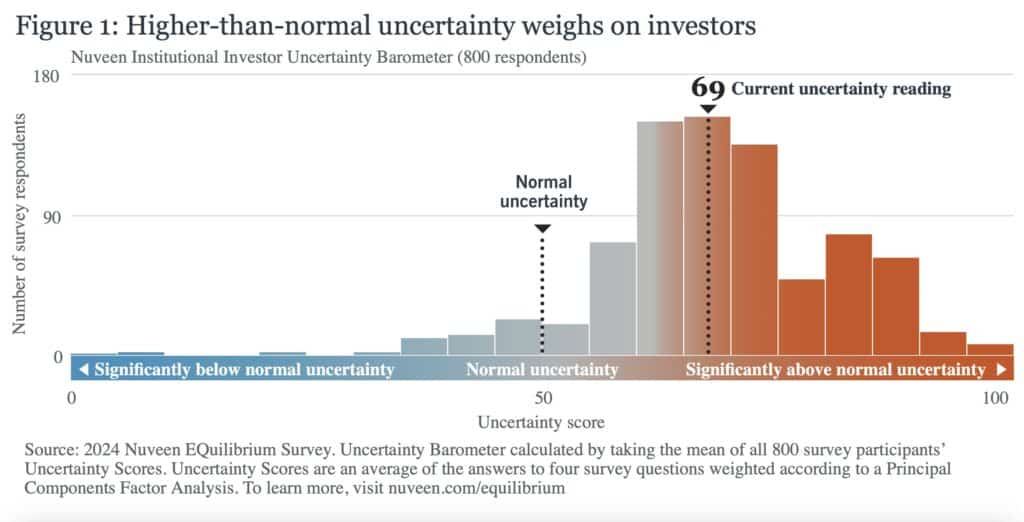

By Anders Persson, CIO, Head of Global Fixed Income – Nuveen: Investors have become increasingly uncertain of the investment landscape given the various economic and geopolitical factors which remain in flux. According to the Nuveen Institutional Investor Uncertainty Barometer, investors feel we are in a period of elevated macroeconomic and geopolitical uncertainty with 93% receiving an Uncertainty Score above the normal level of 50 (Figure 1).

Economic and geopolitical certainty seems a long way off in the current environment, and uncertainty is rarely good for investors. In such volatile conditions, it is important to diversify portfolios for the long term, identifying asset classes which offer resilience in strained market conditions. In the following sections, we explore how different alternative credit asset classes can provide this resilience for investors.

A greater emphasis on quality

Concerns of a full-blown recession have subsided somewhat, though the higher rate environment will mean that any economic slowdown will be more painful for investors, placing a greater emphasis on quality. The current environment continues to put a strain on duration positioning, with this acceptance of higher interest rates making it challenging to generate returns simply by lengthening duration.

The current environment continues to put a strain on duration positioning, with this acceptance of higher interest rates making it challenging to generate returns simply by lengthening duration.

This is where investors may find more success in entering the credit market, though selectivity is crucial. Complicating matters further is the continued geopolitical instability in different regions. The Middle East has been at the forefront of this in the first half of 2024, as Israel’s conflict with Palestine and Iran has threatened to unravel further. Elsewhere, Russia’s invasion of Ukraine continues to weigh heavily on Europe.

Advantages of alternative credit

Given these higher levels of interest rate and geopolitical uncertainty, traditional portfolios of equities and (mostly government related) fixed income may be too exposed external risks. Indeed, we have seen this trend materialise in the form of the erratic movements in fixed income and equity indexes so far this year. Instead, we think investors should fortify portfolios via broader diversification; alternative credit asset classes in particular can provide much-needed ballast to a traditional portfolio. In a high-rate environment, asset classes such as direct lending and private fixed income can actually benefit from heightened rates.

In a high-rate environment, asset classes such as direct lending and private fixed income can actually benefit from heightened rates. Meanwhile, uncertainty created by geopolitical events can be capitalised on through asset classes such as energy infrastructure debt and Commercial Property Assessed Clean Energy (C-PACE) loans…

Meanwhile, uncertainty created by geopolitical events can be capitalised on through asset classes such as energy infrastructure debt and Commercial Property Assessed Clean Energy (C-PACE) loans, which unlock opportunities that tap into the increasing importance of the energy transition and environmentally friendly construction as long-term trends.

Alternative credit strategies in focus

Direct lending: Loans of all types have benefited from the rising rate environment, and with interest rates remaining higher for longer, the asset class remains an attractive one for investors. Moderate and periodical cuts from central banks will likely help boost borrower activity, and alternative lenders should continue to benefit from opportunities as regulations for traditional lenders continue to tighten, creating a supply and demand imbalance.

Energy infrastructure credit (EIC): EIC is successfully tapping into long-term drivers, setting the asset class up as a well-positioned allocation capable of weathering multiple market conditions. Significant need for power, driven by increasing computing and data processing and power intense manufacturing, coupled with the push to decarbonise many industries, means demand for infrastructure to meet these needs is set to increase substantially over the long term.

Real estate debt: The market correction following spikes in interest rates seems to be past its peak. While rates will remain higher for longer – which is good news from a debt perspective, the fundamentals of real estate remain strong. We believe the asset class is entering a new vintage, with real estate debt investors benefitting from higher interest rates and better spreads.

The following sector insights do not showcase all of Nuveen’s capabilities in alternative credit, nor all our expectations for the asset class. To learn more about the alternative credit services available, reach out to your Nuveen representative.

Direct lending

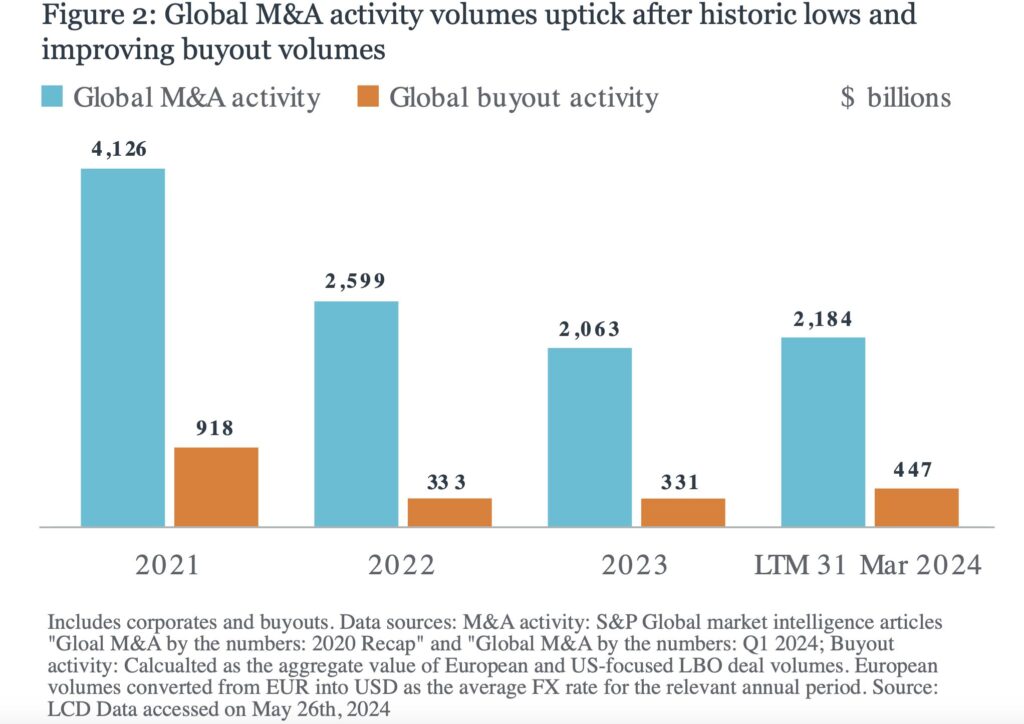

United States: Despite some shocks to inflation data in May, there is an air of greater economic clarity, interest rates appear to have stabilised, and we continue to see an increase in deal flow as buyers and sellers engage in price discovery unlocking additional opportunities (figure 2).

A returning appetite for dealmaking will see increased investment opportunities and more risk. Direct lending managers who have experience in navigating deals effectively and identifying non-cyclical market segments will be better positioned to provide investors with opportunities that take advantage of the high-rate environment, offering shelter from volatile conditions.

Europe: Throughout the first quarter of 2024, the direct lending investment environment has continued to exhibit attractive characteristics, with strong pricing deal volumes, prudent protections, and borrowers, with robust credit characteristics. With the recent rate hiking cycle now appearing to have concluded, we see a more certain macroeconomic environment emerging across Europe, with greater confidence being exhibited by both businesses and investors alike.

The supply/demand imbalance in European direct lending is expected to become further embedded, providing further opportunities for the asset class to grow. Pricing compression in deals has been noted, though all-in yields of direct lending remain attractive, helped by the higher interest rate environment.

Energy infrastructure credit

Energy infrastructure investment should be propelled by several long-term trends ratcheting demand for capital, with the biggest being a step change increase in electricity demand. There are several catalysts predicted to spur demand growth, led by increased need for data centres to support cloud services and artificial intelligence (AI), which account for approximately 40% of the growth rate.

Onshoring of power-intensive manufacturing, such as semiconductors and electric vehicles, and electrification of transportation are two other emerging power demand sources, as western governments look to ease the reliance on foreign supply chains via tax incentives and other schemes. This protectionist shift offers the asset class an additional layer of defence.

The movement to onshore the manufacturing of clean energy components in the U.S. was initially driven by the supply chain challenges observed during the COVID-19 global pandemic, but even more so has been accelerated by legislation which provides various incentives for domestic supply chains. Subsequently, U.S. construction spending has skyrocketed from less than $80 billion in 2020 to nearly $200 billion in 2023, which is its largest percentage contribution to real GDP growth in more than 40 years. Canada and the European Union have created similar programs which are catalysing a robust global investment opportunity set.

Real estate debt

Commercial real estate (CRE) loans originated during the recovery from a market downturn tend to be the best performing vintage of their period, and we believe 2024 will see the start of a new vintage of strongly performing loans as the CRE investment market enters a new cycle. We believe that higher interest rates and better spreads will deliver stronger returns for CRE debt investors than we have seen over the last 10 years, while stabilising capital values are reducing lending risk.

Capital values are now stabilising after a downward correction that was caused by the shift to a higher interest rate environment. The adjustment happened at different speeds in different markets but impacted most CRE formats across most major investment markets. The fall in collateral values has caused particular problems for existing loans in the most vulnerable CRE formats, and for loans at higher LTVs. But that adjustment is now largely over and new lending takes place against a capital value outlook of stabilisation and upcoming growth outside the most vulnerable CRE formats.

We believe that alternative CRE lenders are set to see higher returns at lower risk levels than were possible in the previous market cycle. In addition, for lenders who are able to successfully navigate the CRE landscape to operate across core plus and value-add risk levels in the upcoming environment of stable and rising collateral values, returns should be even more attractive as changes to banking sector regulation reduce competition among lenders.

Commercial Property Assessed Clean Energy (C-PACE)

The universe of investible C-PACE opportunities continues to expand, driven by tailwinds in decarbonisation and resiliency needs in the U.S., offering investors attractive risk/reward returns, duration and diversification.

Continued growth is expected from geographic expansion, with new C-PACE policy and program launches expanding the addressable market of eligible commercial buildings in the U.S., as well as continued institutionalisation of the market.

Collateralised loan obligations (CLOs)

The CLO market is celebrating its 30-year anniversary in 2024, with the asset class growing into an important portfolio diversification tool in that time and becoming increasingly popular among investors. Between the start of the year to July 1, 470 U.S. CLOs (broadly syndicated, private credit and middle market) have priced totalling $207.4 billion. This compares to 133 U.S. CLOs totalling $57.1 billion for the same time period last year. Year to-date, 53 private credit and middle market U.S. CLOs have priced totalling $26.1 billion and private credit and middle market CLO issuance is 19% of new issuance for the first half of 2024 (source: JP Morgan as of 1 July 2024).

The higher-for-longer environment continues to suit the CLO market, with the asset class demonstrating strong scalability as the loan structure is able to capitalise on market liquidity.

The CLO market is demonstrating its role as an important portfolio diversifier in the current market environment. With market growth being driven by the continued rise of alternative financing, the asset class’s liquidity offers huge scalability potential.

Partnering for resilience

Uncertainty is rarely welcomed by investors, and in such times, investing for resiliency has proven to help provide some shelter for portfolios. The current market volatility, driven by continued hawkishness from central banks on interest rates and a troubling geopolitical stage, mean portfolio diversification based around long term, low volatility investment opportunities become increasingly important. Across asset classes in alternative credit, we see how economic uncertainty continues to work in its favour, giving investors an effective tool for diversification.

Read the full article on Nuveen’s website. (https://www.nuveen.com/global/insights/alternatives/investing-for-resiliency)

Important information on risk

Investors should be aware that alternative investments including private equity and private debt are speculative, subject to substantial risks including the risks associated with limited liquidity, the potential use of leverage, potential short sales and concentrated investments and may involve complex tax structures and investment strategies. Alternative investments may be illiquid, there may be no liquid secondary market or ready purchasers for such securities, they may not be required to provide periodic pricing or valuation information to investors, there may be delays in distributing tax information to investors, they are not subject to the same regulatory requirements as other types of pooled investment vehicles, and they may be subject to high fees and expenses, which will reduce profits. Real estate investments are subject to various risks associated with ownership of real estate-related assets, including fluctuations in property values, higher expenses or lower income than expected, potential environmental problems and liability, and risks related to leasing of properties. Responsible investing incorporates Environmental Social Governance (ESG) factors that may affect exposure to issuers, sectors, industries, limiting the type and number of investment opportunities available, which could result in excluding investments that perform well. Investments in middle market loans are subject to certain risks such as: credit, limited liquidity, interest rate, currency, prepayment and extension, inflation, and risk of capital loss. Private equity and private debt investments, like alternative investments are not suitable for all investors given they are speculative, subject to substantial risks including the risks associated with limited liquidity, the potential use of leverage, potential short sales, concentrated investments and may involve complex tax structures and investment strategies. Nuveen, LLC provides investment solutions through its investment specialists. This information does not constitute investment research as defined under MiFID.