Stockholm (HedgeNordic) – Risk is not merely an inherent aspect of financial markets; it also stands as a fundamental source of returns for asset classes. Each asset class embodies different risk factors, collectively contributing to its return potential and diversification benefits. While traditional investments compensate for conventional risks such as systematic equity risk, credit risk, or liquidity risk, among others, Ress Life Investments distinguishes itself by offering investors an alternative risk exposure and source of diversification and returns – longevity risk. This entails investing in life insurance policies in the secondary market in the United States.

“Often, investors receive compensation for the risks they are taking when investing, with these risks often tied to some form of economic variables,” explains Hanna Persson of Ress Capital, the investment manager for Ress Life Investments. “In the case of our fund,” she emphasizes, “the main underlying risk that investors are being compensated for is longevity, which makes it fundamentally uncorrelated.” Despite over a decade of experience in the asset class since founding Ress Capital in 2011, Jonas Mårtenson continues to surprise investors by revealing the existence of additional sources of risk. “It’s quite an unusual risk for investors,” he remarks. “Investors are not used to talking about longevity risk, which often leads to an ‘aha’ moment when speaking about this asset class.”

“In the case of our fund, the main underlying risk that investors are being compensated for is longevity, which makes it fundamentally uncorrelated.”

Hanna Persson

With a team of five individuals within the portfolio management team, Ress Life Investments aims to capitalize on this longevity risk by identifying policies in the market where there is a mismatch in price and the risk-reward potential. By combining such policies into a portfolio, the team aims to provide a diversified, positively skewed, and uncorrelated stream of returns. The key to successful investing in the U.S. secondary market for life insurance policies lies in accurately estimating an individual’s life expectancy. “When buying an insurance policy, we need to estimate the life expectancy of the individual who is selling the policy,” explains Persson. “Tons of historical and forward-looking data is taken into consideration to make a good estimate of the duration for which we will continue to pay the premiums. We then do a net present valuation to determine the amount we are willing to pay for each policy.”

With a portfolio comprising over 530 underlying insurance policies, the distribution of probable outcomes follows a bell-shaped curve. This suggests that 50 percent of individuals are expected to outlive their life expectancy, while the remaining 50 percent are anticipated to live shorter than their projected lifespan. “With an average age of 78 years in our portfolio,” notes Persson, “our estimate suggests that, on average, all the individuals are going to live an additional ten years, with an uncertainty interval of around six months.”

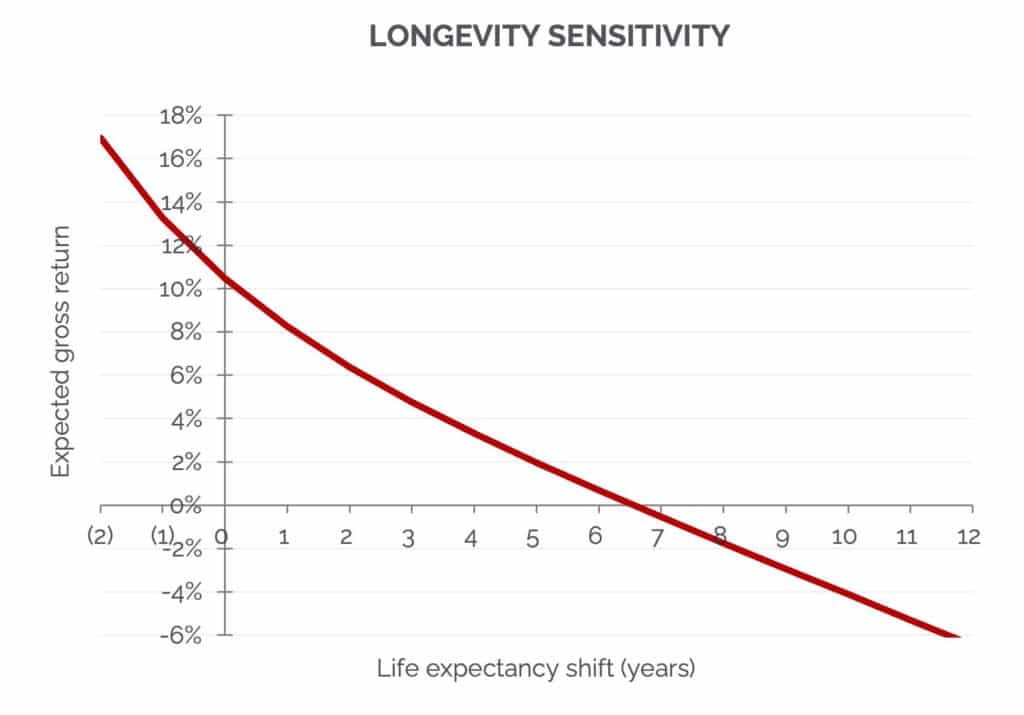

Ress Life Investments anticipates a gross annual return exceeding 10 percent at the average estimated life expectancy. However, if the entire group’s life expectancy increases at the portfolio level, the expected return of the portfolio decreases accordingly. “The key is to build a large portfolio of policies, and the outcomes align more closely with our estimates as the portfolio grows in size.”

The Return, Diversification, and Protection Characteristics

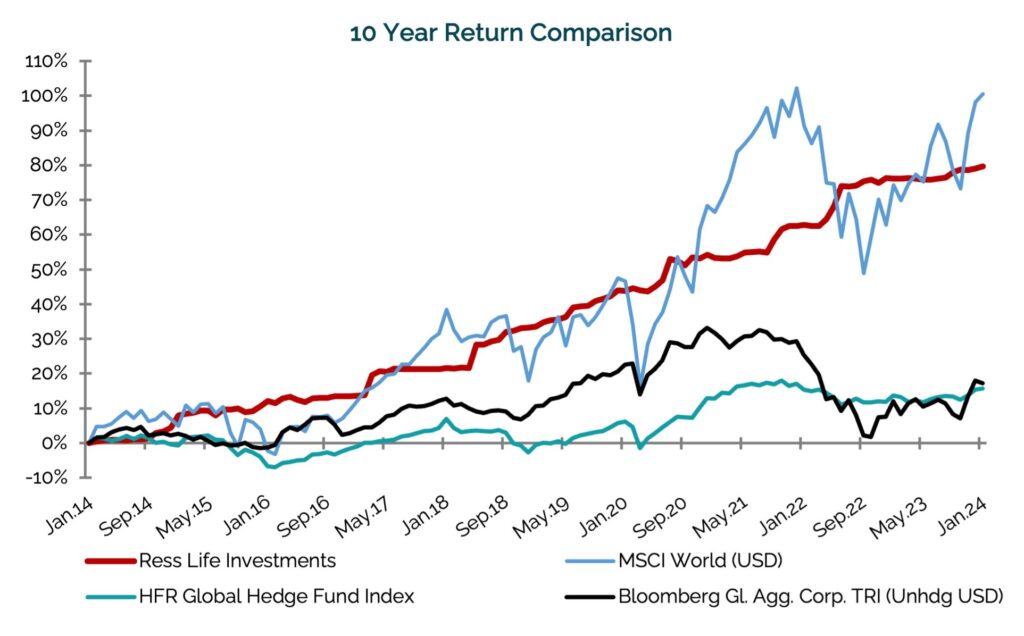

Launched in 2011 as an alternative investment fund, the team behind Ress Life Investments has demonstrated proficiency in accurately estimating life expectancies and generating appealing uncorrelated returns for investors. Targeting a net return of seven percent annually in U.S. dollars, Ress Life Investments has achieved an annualized return of 6.7 percent over the past seven years and 6.0 percent over the past decade. “Our long-term return in recent years was above seven percent until 2023, a year marked by lower-than-average payouts,” remarks Jonas Mårtenson. “If we get an above-average return in 2024, we will be returning to our target levels.”

“Our long-term return in recent years was above seven percent until 2023, a year marked by lower-than-average payouts. If we get an above-average return in 2024, we will be returning to our target levels.”

Jonas Mårtenson

This appealing return stream comes with a blend of uncorrelation and limited downside risk. Over the past five years, for instance, Ress Life Investments has exhibited a negative 0.1 percent correlation with the MSCI World index, nearly zero correlation with bond investments as reflected by the Bloomberg Aggregate Bond Index, and a negative 0.04 correlation with a broad index tracking the performance of global hedge funds. “Throughout the strategy’s decade-long journey, it has remained unaffected by external factors that commonly impact most other asset classes,” says Persson.

“In addition to the attractive risk-adjusted return, the investment provides capital preservation and diversification benefits,” reiterates Persson. Ress Life Investments has shown minimal drawdowns since its inception. Excluding the initial two years, which marked the portfolio’s build-up phase when the portfolio was too small in size and policies were purchased with limited payouts, the largest drawdown has been around minus 1.3 percent. The investment strategy in life insurance policies entails paying premiums until policies mature and then pay out the insurance amount in one lump sum.

“In addition to the attractive risk-adjusted return, the investment provides capital preservation and diversification benefits.”

Hanna Persson

The investment’s stability is further evidenced by its low volatility, typically fluctuating within a narrow 3-4 percent range over the past decade, rendering the fund suitable for capital preservation, as highlighted by Persson. Interestingly, the fund’s limited volatility in returns does not stem from infrequent valuation, a characteristic common in most other private asset classes. “We perform the mark-to-market valuation of our life insurance portfolio twice per month,” notes Mårtenson.

While the value of life insurance investments tends to appreciate with age and can be influenced by mark to market effects due to changes in discount rates, the primary driver of returns for Ress Life Investments each year remains the actual realized value of matured or sold policies. “The value of owning a policy increases over time. This is logical, as we would pay more for a policy with a five-year life expectancy than for one with a ten-year life expectancy,” explains Mårtenson. However, the realized returns from sold or matured policies have consistently accounted for the majority of the fund’s annual returns. “The realized value from matured or sold policies is truly the driver of performance one would want in the portfolio rather than a model-based re-valuation,” emphasizes Persson.

Last Year’s Return and Future Expectations

After experiencing one of its strongest years in 2022 with a return of 8.5 percent, 2023 presented an anomaly due to the low payouts for Ress Life Investments, resulting in a return of 1.6 percent. “The performance in 2023 reflects a lower-than-expected number of policies paying out,” explains Persson. “While still within the confidence interval, indicating it’s a plausible event, it was somewhat to the extreme,” she elaborates. The performance reflects not only a reduced number of payouts but also the payouts from policies with below-average face values.

The average policy face value in the portfolio stands at $2.7 million, yet the average policy that paid out in 2023 was less than $1 million. This lower-than-expected occurrence of payouts is expected to result in a higher number of policies paying out in the upcoming years. Gustaf Hagerud, CEO of Ress Capital and Ph.D. in financial statistics, along with his team, expects a reversion to the mean in terms of the number of policies paying out. “We are hesitant to say that the number of policies paying out will be higher this year, but over a longer period of time, these figures tend to regress to the mean,” says Persson. “We anticipate higher numbers of policies paying out over time, whether it’s this year, next year, or within a three-year span. It’s impossible to predict with certainty.”

“Interest rates may come down in the future, but we will continue to deliver seven percent.”

Jonas Mårtenson

Mårtenson and his team remain confident that Ress Life Investments is on track to reaching its long-term objective of achieving a seven percent return in U.S. dollars net of fees. “While we may have fallen short of our seven percent target in recent years due to the subdued performance in 2023, we had been above our target for many years,” he notes. Acknowledging that a higher interest rate environment may diminish the attractiveness of this return stream in the short term, Mårtenson highlights its inherent benefits of limited downside, low volatility, and lack of correlation. “Interest rates may come down in the future, but we will continue to deliver seven percent.”

This article is part of HedgeNordic’s Nordic Hedge Fund Industry Report.