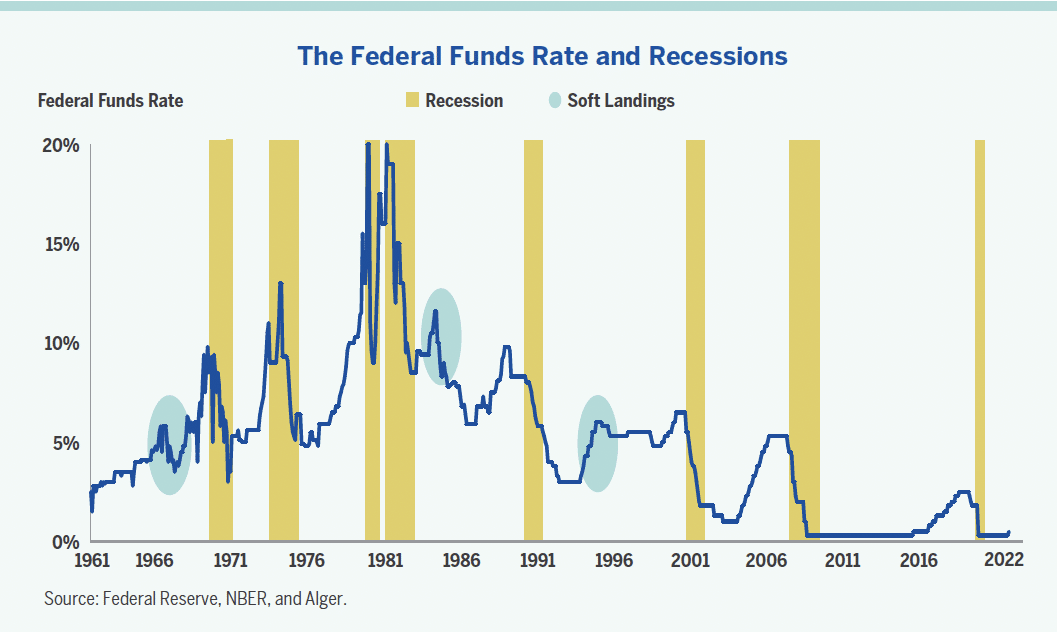

The Federal Reserve (the Fed) has undoubtedly caused many U.S. recessions over time when attempting to fight inflation through tighter monetary policy. However, sometimes it has engineered so-called “soft landings” whereby inflation slows and real growth continues. How likely is a soft landing in this cycle?

As shown above, most of the times when the Federal Funds rate rises, a recession follows – “hard landings.” However, the circled areas show when the Federal Reserve raised interest rates, but a recession did not follow – “soft landings.”

In all three cases, the Fed tightened 300 basis points or more, but economic growth continued. That amount of tightening is about what is anticipated by the Fed’s own projections released in March. Note that the Fed also tightened materially from 2015 to 2018 with the economy growing solidly in 2019, only to be upended by the pandemic.

At a time when the Fed appears to be increasingly hawkish on inflation, it may be comforting to know that monetary tightening doesn’t always lead to recession and that soft landings have been kind to investors in recent history. Indeed, in the 12-months following the end of Fed tightening in 1985 and 1995 as well as after the Fed relented in 2018, equities generated double-digit returns.

A piece written by Alger – a La Française partner firm. La Française AM Finance Services, in accordance with the terms of an agreement signed with Alger Management, Ltd, is a distributor of the Alger SICAV in Europe.

Title Pic by pixabay.com