By Harold de Boer – Head of R&D at Transtrend: Since early 2021, inflation has been firmly back on the agenda. Many investors are turning their eyes towards commodities, for good reason: commodities generally do offer inflation protection. However, we believe there are better ways to tap into this than via a passive investment in a commodity index. From an economic as well as from a responsible investing perspective, a more active way of investing in commodities seems more appropriate. For instance through a CTA trend program with a significant (potential) allocation to commodities.

Whether or not commodities do serve as an inflation hedge largely depends on the specific type of inflation — not all inflationary regimes are the same. Inflation is generally measured as the (increase in the) average price level of a basket of goods and services in an economy. Such a price rise can happen in different ways for different reasons and in different ingredients of the basket.

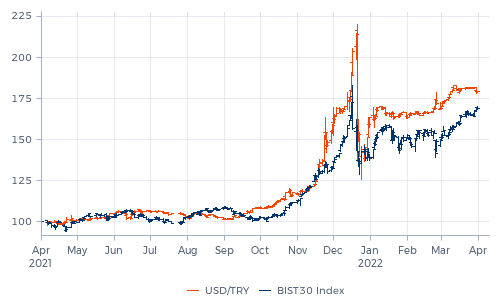

It could for instance be that the value of the goods and services itself isn’t really rising, but that the currency of the economy concerned is just falling. Who doesn’t remember the hyperinflation in Zimbabwe around 2008? By the time the Reserve Bank of Zimbabwe stopped printing them in April 2009, banknotes had denominations of up to one hundred trillion Zimbabwean dollars. Somewhat comparable, but much less extreme, is the recent inflation in Turkey. Largely driven by Turkish monetary policy, the Turkish lira fell strongly between April 2021 and March 2022. Prices of most goods in Turkey moved inverse to that.

If you live in such a country, you better spend your money before you receive it, as food and other goods and services will rapidly become more expensive. If you’re lucky, you invested some money in foreign currencies or local stocks. Even though 2008 was a dramatic year for most stock investors, the Zimbabwean stock market rose more than 30,000 percent that year! And since early 2021, the Turkish stock market has been the mirror image of the Turkish lira. When dealing with this type of inflation, commodities aren’t necessarily the best hedge, and surely not the easiest one.

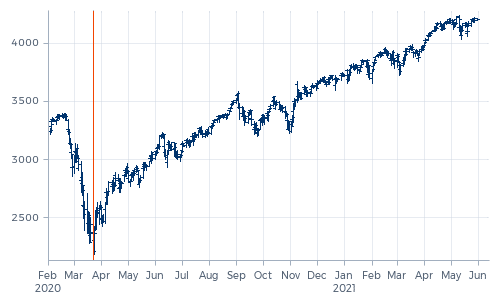

In principal, inflation can come from two directions. It can be demand-driven — i.e., fueled by an abundance of money to be spent. Or it can be supply-driven — i.e., caused by a shortage of goods and services. One could argue that the examples of Zimbabwe and Turkey are extreme cases of demand-driven inflation. But the Turkish economy isn’t the only economy that has experienced this type of inflation in the past two years. Soon after the outbreak of the covid pandemic in February 2020, governments and central banks from all over the world injected hundreds of billions of dollars, euro’s and other currencies into their economies. And most of that money was spent! Partly on basic necessities, but also on investments in among others real estate and crypto currencies, as well as in stocks.

In this respect, the remarkably fast and strong recovery of global stock markets after they bottomed on 23 March 2020 wasn’t fundamentally different from the stock market rise in Turkey and, earlier, in Zimbabwe. It was yet another manifestation of demand-driven inflation — in the first half of 2021 often referred to as ‘reflation’ — where stocks served as an effective hedge.

What about the commodity markets? After a little delay, most of them rose strongly too. From May 2020 to May 2021, copper rose 91 percent, aluminum 61 percent, crude oil 200 percent, soybeans 81 percent, corn 111 percent, sugar 57 percent and lean hogs 59 percent.

Was this also demand-driven? We cannot completely exclude that factor. But various commodities also rose due to production issues. And after May 2021 — when central banks made it clear they would stop supporting their economies with cheap money, seek repayment of outstanding loans, and started to consider raising their interest rates to halt inflation — various supply chain issues (not only related to the production of commodities) formed the dominant factor behind the further rise of inflation. So from that moment on, most economies were essentially dealing with a supply-driven inflation. Which is precisely the reason why some central banks were — or still are — somewhat reluctant to combat it by raising their key rates. A higher interest rate simply doesn’t fertilize crops.

Part of these supply chain issues were related to the covid pandemic. Everyone will have heard about the global chip shortage. Some of the world’s largest semiconductor factories in Asia were shut down early in the pandemic for up to a few months. Meanwhile, some demand for chips temporarily fell away, but people working from home created more demand for hardware that requires chips. So far, producers have not been able to catch up with demand. Covid also caused logistic problems. As a legacy from the Asian lockdown, western harbors are now filled with empty containers that should be in Asia for an efficient shipment of goods out of there. And travel restrictions caused problems in the labor market. Malaysian palm plantations are still dealing with a shortage of foreign workers to pick the fruits from their trees. This is one of the reasons why the price of palm oil has increased fivefold since April 2020.

Another part was weather related. In the summer of 2021, the temperatures in British Columbia climbed to 50 degrees Celsius. Without refreshing showers, that is absolutely not why canola once decided to start growing there. In other regions in the world, heat and drought harmed other crops. For instance in New Mexico. Chile peppers may be the hottest commodity, but they don’t do well above 95 degrees Fahrenheit. In July 2021, the temperature peaked above 100. That same month, many European farmers weren’t able to harvest a decent quality wheat crop due to heavy rains and floodings. And that same summer, rain shortage threatened the production of hydropower in Norway and shortage of wind above the North Sea reduced production of wind energy. These were only two of the factors contributing to a European energy crisis. European/Russian geopolitical tensions added to that.

The extreme weather conditions that caused these problems seem to have been manifestations of the ongoing climate change. For countries to reach their emission reduction targets, among others an energy transition away from fossil fuels to renewable sources is required. This development has made our economies more vulnerable to production issues relating to for instance wind and hydropower. And this transition is also increasing demand for metals like copper, nickel, aluminum and cobalt. A complicating factor is that the production process of for instance aluminum itself is highly polluting. Climate change is therefore a huge challenge for commodity markets — both combatting it and not combatting it causes supply chain issues.

The most recent factor adding to these supply chain issues has been the Russian invasion of Ukraine. Both countries are major producers and exporters of a wide range of commodities, including energies, metals and grains. The war itself has a direct impact on the production in, and export from Ukraine. The various implemented and threatened sanctions from both sides — imposed by the importing countries as well as by Russia — further limit the supply of many commodities. This for instance includes fertilizer, which could negatively impact the production of crops, also those far away from the battlefield.

So far, we predominantly talked about raw materials. That’s not the same as the goods in the inflation basket. We talked about wheat, not bread. And we talked about copper, not your electric car nor your next cab ride. But rising prices of raw materials typically contribute to rising prices of processed materials, which in turn contributes to rising prices of the tools and machines made from these materials, which contributes to rising prices of the services that require the use of these tools and machines, processed materials and/or raw materials. As such, more than an ingredient of inflation, rising commodity prices are an explanatory factor as well as an indicator for inflation to come. And this explains why an investment in commodities serves as an inflation hedge. At least, in the case of supply-driven inflation.

This indicative nature of rising commodity prices also explains why CTA trend programs with a significant (potential) allocation to commodities tend to do well in such an environment. It fits perfectly with what we consider to be one of the key determinants of the performance of a diversified trend approach: the program’s ability to be sizably invested near the ultimate source of a trend. In case of a commodity supply-driven inflation trend, futures on the commodities concerned are the ideal vehicles to ride that trend.

In our March 2021 article Prepared for inflation, we wrote that besides (long) commodities also short bonds are a popular position for investors who fear inflation. The underlying idea is that yields will rise in an inflationary environment. But this is a harder trade for a trend following strategy. The reason is that rising yields aren’t really near the source of the trend. In the case of demand-driven inflation, fueled by cheap money, central banks typically keep their interest rates low. That will not motivate trend indicators to start shorting bonds. And in case of supply-driven inflation, central banks will only consider to raise rates after the inflation has actually shown up. This explains why trend programs with a large allocation to bonds significantly underperformed programs with a large allocation to commodities in 2021. Only since the start of 2022, the more bond-focused CTAs too are successfully riding the inflation trend.

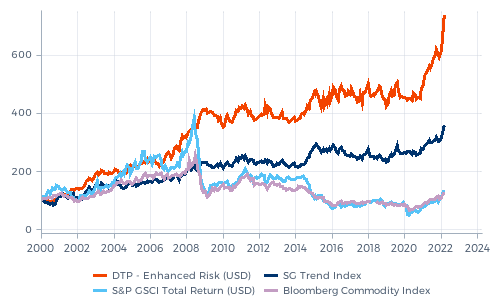

Fact is, commodity indices have done even better than most, if not all trend programs during the current inflationary regime. Between May 2020 and March 2022, The S&P GSCI Total Return (USD) rose a staggering 174 percent, and the somewhat less energy-heavy Bloomberg Commodity Index gained 97 percent. So why would an investor even consider an investment with a CTA to tap into the inflation protection offered by commodities?

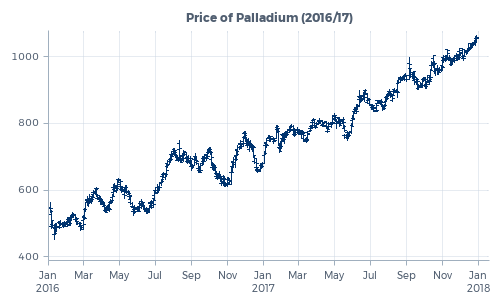

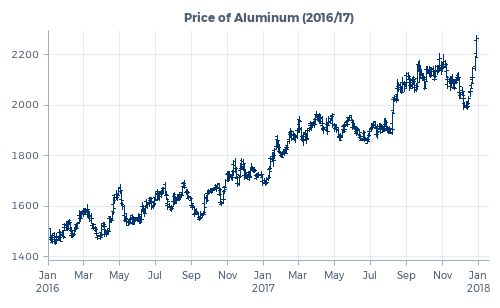

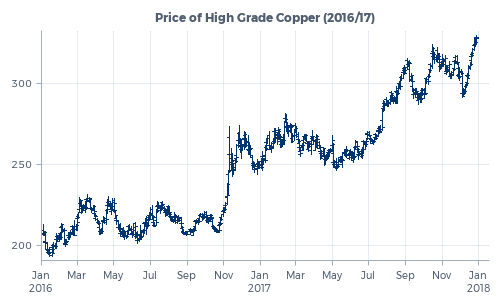

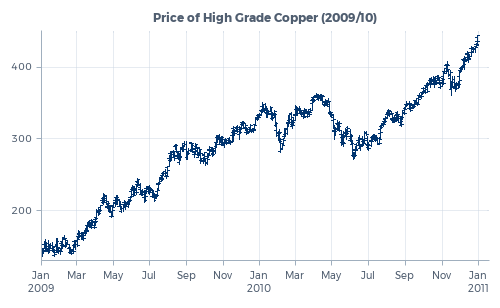

From a longer-term perspective, the performance of these commodity indices doesn’t seem that attractive. Granted, there wasn’t much inflation to hedge during the first two decades of this century, but that doesn’t mean that commodities did not rise during those years. For instance, the energy transition didn’t start in 2020. It increased demand for various metals already much earlier. In this specific trend, diesel-gate spurred a move away from polluting cars, which fueled a rise in prices of palladium already in 2016 and 2017. Copper and aluminum also advanced during those years. And copper prices also increased during 2009 and 2010, among others driven by strikes and other problems in South American mines.

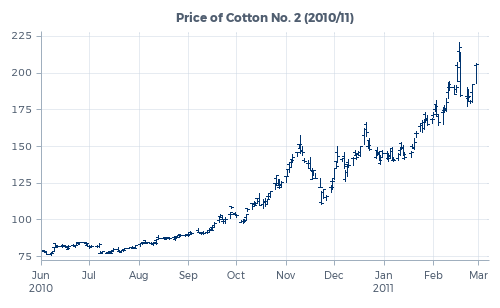

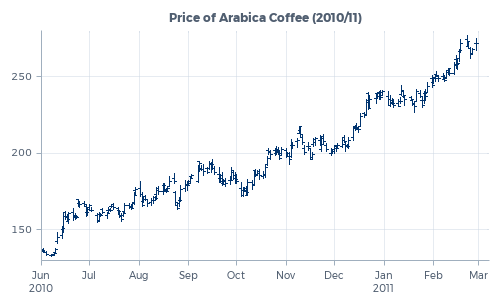

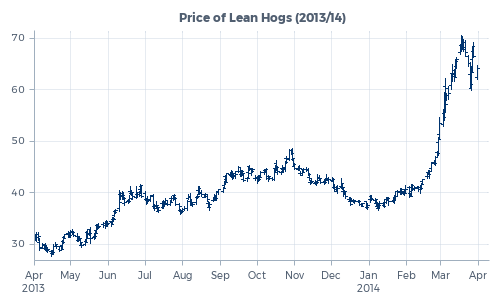

Different commodities typically rise for different reasons in different periods. Cotton prices advanced strongly in the second half of 2010, driven by freezing cold weather in China’s cotton production area, floods in Pakistan and a ban on exports from India. Around the same time, arabica coffee rose due to too much rain in Colombia and a drought in Brazil. But lean hog prices didn’t rise in that period. They did, however, in 2013/14 when pigs got sick due to a coronavirus that caused Porcine Epidemic Diarrhea.

Different commodities rise for different reasons. Why would you buy oil or natural gas when pigs are sick? Why would you buy gold or copper when canola and chile peppers are withering in the scorching sun? Or why would you buy wheat or cocoa when the car industry is moving from diesel to electric? And would you profit from that? Most of the time, you will not. That’s what the commodity indices demonstrate. To profit from a commodity trend, you have to be positioned in that specific commodity, not in the index.

Commodities are not an asset class. And commodity futures are definitely not an asset class. That doesn’t fundamentally change when their returns are combined into an index. Different commodities experience different risks. Which means that different commodity futures should rise for different reasons — not because large investors are buying a commodity index as an inflation hedge.

What could happen if investors choose to do so anyway? We are mostly concerned about the potential consequences for the agricultural markets. These markets tend to be more vulnerable to disturbances caused by uninformed capital flows generated without a view on the specific markets. And many people who depend on these markets are even more vulnerable, consumers as well as producers. If the price of a crypto asset or the stock price of a movie theater increases tenfold, we don’t really care that much. But if the price of wheat, cocoa or rice increases or decreases excessively, people will simply die.

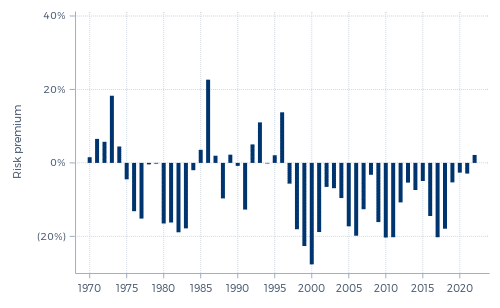

We often read stories like: “We invest in food to help feed the world.” or “By buying wheat futures we carry the price risk that farmers are not able or willing to bear. And we receive a risk premium for that.”. But as we’ve endeavored to illustrate in our June 2020 article From mortgages to wheat – part 2, those stories are somewhat shaky. Most of the time it’s not the producing farmers who hedge their risk by shorting futures on the crop they hope to produce, but the wheat processors that hedge their risk by buying futures on the wheat they plan to process into baking products. These are the participants that are willing to pay a risk premium for their hedge. Investors who want to receive that risk premium shouldn’t be long futures contracts, but short. Investors who are long wheat futures — for instance as part of a passive long commodity investment — essentially pay that risk premium. As we’ve shown in the article, that premium has been as high as 20 percent in certain years. Paying such a premium is part of the return of commodity indices and it to a large extent explains their mediocre long-term performance.

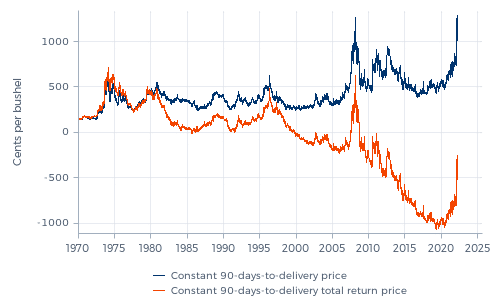

The graph above is an updated version of Graph 3 from our wheat article. The blue curve shows what the return of a ‘passive’ long position in Chicago soft red winter wheat futures would have been without the abovementioned risk premium. The orange curve shows the real return including this risk premium, which has to be paid most of time. As the graph below (an updated version of Graph 4 from the article, depicting the difference between the changes of the two curves in Graph 3) shows, also in 2020 and 2021 investors holding a long position paid a risk premium. Only in the first quarter of 2022, these investors received a premium. But we wouldn’t interpret that as a sign of regime change — during the past 50 years, long investors generally received such a risk premium during the first three months of the calendar year. (Also see Graph 5 of the original story.)

The fact that investors most of the time pay a risk premium for holding a long position in wheat futures doesn’t imply that they should better not be long wheat futures (or any other crop futures) at all. If the current price is lower than what investors expect the price to be at delivery, they can better buy. By doing so, they contribute to one of the important roles of (especially the futures) markets: facilitating price discovery. For markets to function, there should be a continuous interaction between prices, supply and demand. For instance, when shortage looms, prices should rise in time to give producers an incentive to raise their production and/or to give consumers an incentive to find alternatives.

I’ve witnessed up-close how this process works. My brother, who has continued my parents’ farm, recently decided to seed a species of corn that he had never seeded before. And he is not the only farmer who adapted his sowing plan this spring. The current (high) prices of the new crop futures contracts in various grains and oilseeds form an important guide for them. A comparable situation, but then on the demand side: last summer, when the futures prices of Dutch natural gas rose to unprecedented levels, many people rushed to the DIY stores, as they decided to better insulate their homes ahead of winter. This is exactly how the futures markets are supposed to function. And investors who actively contributed to that by buying these futures at an early stage will have profited from their contribution.

The recent strong returns of both commodity indices and CTA trend programs with a significant allocation to commodities demonstrate that commodity futures can indeed serve as an effective inflation hedge. However, these futures contracts do not exist to offer investors an opportunity to accumulate uncorrelated returns and an inflation hedge. They exist to facilitate price discovery and to offer participants in the physical markets a way to offload (part of) their market risk. Investors can play an important role in this process, but this requires an active approach. Which includes: only buy those futures contracts that you believe to be underpriced. And sell those that you believe to be overpriced.

This cannot be done by buying and holding a commodity index. But it is grist to the mill of a trend program like our Diversified Trend Program (DTP). In its long history, DTP most of the time held short positions in crop futures. But in an inflationary environment like the one we’re in since May 2020, it has mainly been long crop futures as well as long many other commodity futures. And on top of that, it has — also through futures contracts — been positioned in various trends in interest rates, currencies and stock markets, many of which are directly or indirectly linked to inflation as well. Because when inflation is the dominant trend, the program has the tools to ride it.

The article was originally published here.

Explanatory notes & important information

- Source of price data used in the graphs in this article: Refinitiv, Bloomberg, BarclayHedge and Transtrend.

- All performance data of DTP presented in this article are composite net performance figures of DTP – Enhanced Risk (USD) and should be viewed in conjunction with the explanatory notes, which are an integral part of this performance data.

- All SG Trend Index, S&P GSCI Total Return (USD) and Bloomberg Commodity Index performance data should be viewed in conjunction with the description of indices used.

- The value of your investment can fluctuate. Past performance is not necessarily indicative of future results.