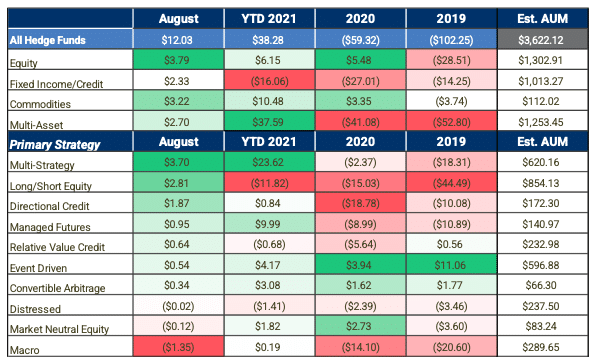

Stockholm (HedgeNordic) – The hedge fund industry has now broken through the next mark in terms of assets under management, reaching a new record level of $3.62 trillion at the end of August, according to eVestment. Investors injected a combined $12 billion to hedge funds in August to bring year-to-date inflows at $38.3 billion. The year-to-date inflows and performance gains enjoyed by hedge fund managers brought the industry’s assets under management to $3.62 trillion.

“The global hedge fund business continues to set, then break, new overall AUM records as investors pour more money into hedge funds and performance gains bolster industry AUM further.”

“The global hedge fund business continues to set, then break, new overall AUM records as investors pour more money into hedge funds and performance gains bolster industry AUM further,” writes eVestment. “This year has been a good one for hedge fund AUM growth, and August net flows and performance continued the trend,” comments Peter Laurelli, eVestment’s Global Head of Research. “Inflows were well distributed, with about 57% of managers reporting to eVestment seeing inflows and overall, there are many underlying metrics of hedge fund industry health.”

Multi-strategy hedge funds received the highest net inflows in August, with the group receiving a combined $3.7 billion during the month. Multi-strategy vehicles attracted a combined $23.6 billion in net inflows in the first eight months of 2021, earning the top spot among the ten eVestment-defined primary strategies. eVestment data shows that concentrated outflows among a small number of long/short equity funds pulled the group’s net asset flows in the red over the past several months. Long/short equity managers received an estimated $2.8 billion in net inflows in August, marking the group’s first monthly net inflow since February this year and the largest monthly net inflow since November of last year.

Managed futures funds continue to attract capital for a sixth consecutive month. The group received an estimated $950 million in net inflows in August to bring the year-to-date figure for net inflows to about $10 billion. About 60 percent of the managed futures funds reporting to eVestment enjoyed net inflows this year. Meanwhile, macro hedge funds were the biggest asset losers in August among the primary strategies defined by eVestment, with the group experiencing net outflows of $1.4 billion. Macro managers still attracted an estimated $190 million in net inflows in the first eight months of the year.

“It can be a positive for the hedge fund business to have those assets unlocked and potentially redistributed broadly across the industry.”

“Outflows have absolutely existed last month and this year,” says Peter Laurelli. “It can be a positive for the hedge fund business to have those assets unlocked and potentially redistributed broadly across the industry.”

Photo by Visual Stories || Micheile on Unsplash