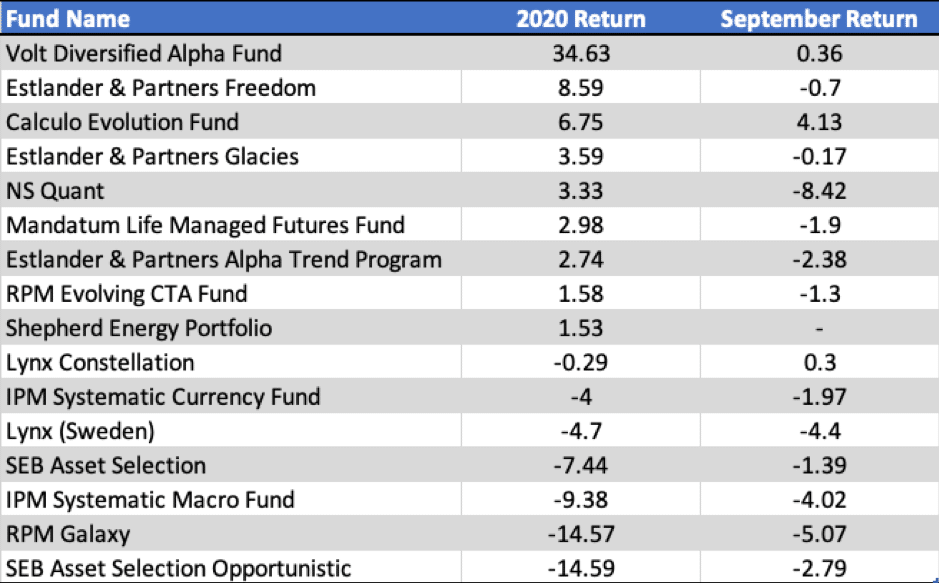

Stockholm (HedgeNordic) – Nordic CTAs as a group suffered their worst month this year as the overall “trendiness” across markets decreased, with trends in currencies, equities and metals reversing during the month. The 16 members of the NHX CTA sub-category were down an estimated 1.9 percent on average last month (94 percent reported), which brought the group’s year-to-date performance back into negative territory at minus 1.3 percent.

Only three members of the NHX CTA category reported gains for September, with Calculo Evolution Fund leading the gains. The artificial intelligence-assisted trend-following commodity fund managed by Philip Engel Carlsson (pictured) advanced 4.1 percent last month to bring the year-to-date performance to 6.8 percent. Calculo Evolution Fund’s September advance was mainly attributable to gains from trading grains – corn, soybeans and wheat – and shorting energy markets. Pointing out a possible reason for last month’s dispersion in the CTA space, Carlsson told HedgeNordic that “Calculo’s algorithms captured shorter-lived momentum-driven movements, differentiating the fund’s approach from classic CTA funds.”

Volt Diversified Alpha Fund steered by CIO Patrik Säfvenblad, one of the best-performing hedge funds in the Nordics this year, gained 0.4 percent in September to bring its 2020 advance to 34.6 percent. The diversified systematic trading vehicle, which uses machine learning and fundamental data to capture price moves across markets, is the best-performing member of the NHX CTA sub-category and the sixth best-performing Nordic hedge fund in 2020. According to a letter to investors, “September provided a classic reversal scenario as equities sold off after a long and strong rally. Thanks to the use of short-term, fundamental signals, we captured this reversal in both equities and fixed income.”

Machine learning strategy Lynx Constellation also edged up in September, gaining 0.3 percent last month to reduce the year-to-date decline to 0.3 percent. “Lynx Constellation was profitable in September as gains in interest rates, commodities and equities outweighed losses in currencies,” says a letter to investors by the team running Lynx Constellation. “Agricultural markets were profitable in aggregate, although gains were mitigated by losses in precious metals, specifically long positions in silver and gold,” the letter added.

At the other end of the table, Finnish systematic managed futures fund NS Quant gave up a big portion of its 2020 gains last month after declining by 8.4 percent. The fund is still in positive territory for the year at 3.3 percent, gains mainly attributable to the advance of about ten percent during the turbulent month of March. RPM Galaxy, a multi-CTA fund that invests in a group of large and established CTA managers with at least $500 million under management, was down 5.1 percent in September.