Partner Content (SHoF) – Short selling in financial markets is controversial. It is variously blamed for causing excess volatility and harm to investors. At the height of the corona crisis, several countries banned short selling altogether. At the same time, activist short-sellers continue to unearth fraud among listed companies, including recently at Luckin Coffee. Should short selling be banned? Does it need to be restricted? Or should it be left alone?

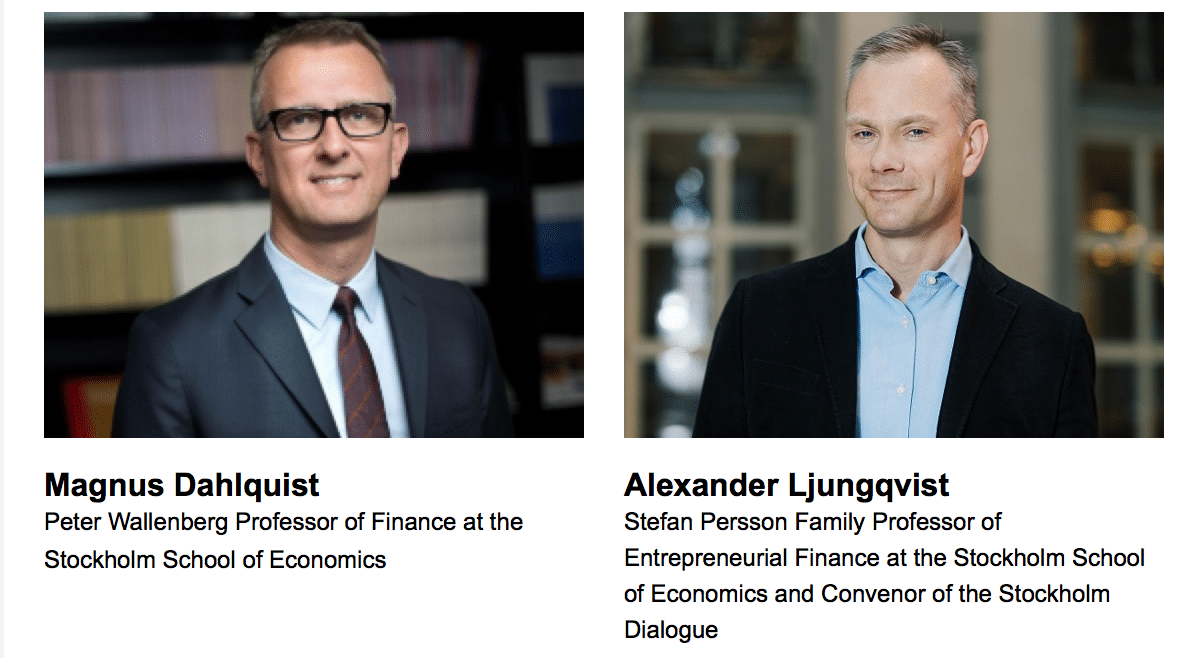

Watch Magnus Dahlquist, Peter Wallenberg Professor of Finance at the Stockholm School of Economics, and Alexander Ljungqvist, Stefan Persson Family Professor of Entrepreneurial Finance at the Stockholm School of Economics and Convenor of the Stockholm Dialogue, present their views on short selling restrictions. They are joined by a panel of internationally acclaimed experts:

Scott Bauguess, director of the Center for Enterprise and Policy Analytics at the University of Texas and former acting chief economist at the U.S. Securities and Exchange Commission

John C. Coffee, Adolf A. Berle Professor of Law and director of the Center on Corporate Governance at Columbia University Law School

Nandini Sukumar, CEO of the World Federation of Exchanges

|

Time: 15:30-17:00

Duration: 90 minutes Call in details: To be able to attend the webinar you need Zoom. If you need to download it you can use this link Zoom |

|---|

|

|---|

About us

The Swedish House of Finance at the Stockholm School of Economics is Sweden’s national research center for financial economics. It hosts internationally distinguished researchers, and enables financial research and development of the highest quality.

The center serves as an independent platform where academia and both the private and public financial sectors can exchange knowledge, foster new ideas and gain access to a global network of the most prominent researchers in finance.

The Swedish House of Finance is an equally private and government funded, nonprofit, nonpartisan organization. It hosts approximately 70 researchers, consisting of resident and affiliated professors as well as PhD students.

Sweden’s national research center in financial economics

Drottninggatan 98, 111 60 Stockholm |

|---|