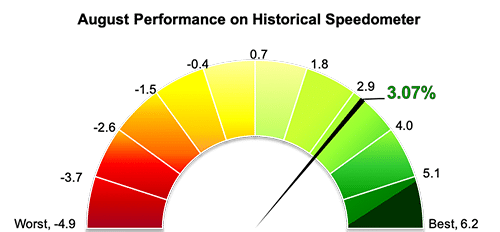

Stockholm (HedgeNordic) – Nordic CTAs gained seven percent during the three summer months after advancing 3.1 percent in August alone (88 percent reported). Nordic CTAs, as expressed by the NHX CTA, recorded their best summer on record, with the seven percent-gain bringing the group’s year-to-date performance to 7.5 percent.

The world’s largest CTAs performed slightly better. The SG CTA Index, which reflects the performance of a pool of CTAs selected from the larger managers open to new investment, was up 3.5 percent in August. The 20-member SG CTA Index, which includes three members of the Nordic Hedge Index, advanced 12.3 percent year-to-date through the end of August.

The Barclay BTOP50 Index, which tracks a similar group of large investable CTAs, was also up 3.5 percent last month, which brought its year-to-date performance to a similar 12.3 percent. The broader Barclay CTA Index, comprised of over 500 CTAs, gained an estimated 2.1 percent last month based on reported data from 67 percent of index constituents. The Barclay CTA Index gained 7.5 percent in the first eight months of 2019.

Estlander & Partners Alpha Trend II – Class P, a higher leverage version of systematic trend-following fund Estlander & Partners Alpha Trend, was last month’s best-performing member of the Nordic Hedge Index with a monthly gain of 18.7 percent. The August performance brought the fund’s year-to-date return to 34.3 percent and catapulted the fund to the leading position in the list of best-performing CTAs in the Nordics so far this year.

RPM Evolving CTA Fund was the second best-performing member of the Nordic Hedge Index last month with a gain of 9.6 percent, which brought its year-to-date return to 17.6 percent. RPM Evolving CTA Fund is a diversified multi-CTA fund investing in CTAs that are in their so-called evolving phase.

Estlander & Partners Freedom, the most diversified vehicle of Estlander & Partners, followed suit with a 9.2 percent-gain in August, which brought the fund’s year-to-date performance further into positive territory at 10.1 percent. The Swedish-domiciled systematic fund Lynx (Sweden) advanced 8.4 percent last month and currently ranks as the second best-performing member of the NHX CTA in 2019. The Lynx Fund (Sweden) is up 29.3 percent year-to-date through the end of August.

Estlander’s flagship Estlander & Partners Alpha Trend Program gained 5.8 percent in August and was up 10.9 percent in the first eight months of 2019. SEB Asset Selection Opportunistic, a more aggressive version of trend-follower SEB Asset Selection, had a great summer too after gaining 12.1 percent during the June-August period. The fund was up 4.2 percent in August alone and 14.8 percent in the first eight months of 2019.

Photo by Ksenia Makagonova on Unsplash