Stockholm (HedgeNordic) – Crypto hedge funds benefited from a rally in cryptocurrencies in the first half of 2019, as the price of a single bitcoin soared to over $12,000 in late June from below $4,000 at the end of December. The Eurekahedge Crypto-Currency Hedge Fund Index, an equally weighted index of 15 crypto hedge funds, gained 94 percent in the first half of the year and enjoyed five consecutive months of positive performance.

Bitcoin started out 2019 below $4,000 and rose by more than 200 percent during the first six months of the year. According to Jeff Dorman, chief investment officer of asset manager Arca, the rally in the price of bitcoin was attributable to the “flight to safety from countries with capital controls” and growing awareness of the digital currency. The price of bitcoin fell below the $10,000-level toward the end of July.

Pantera Bitcoin Fund, a crypto hedge fund that celebrated its sixth anniversary at the beginning of July, returned 61 percent year-to-date through July 7. According to a recent Medium post, Pantera Bitcoin Fund returned 16,385 percent in six years and recorded only one down year. The fund seeks to provide institutions and high-net-worth-individuals “quick, secure access to large quantities of bitcoin – without the burdens of buying and safekeeping them.”

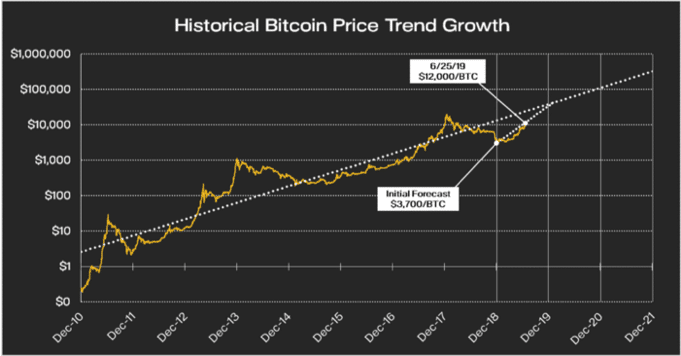

In the same Medium post, the Pantera team laid out a very bullish case for bitcoin. Using price data starting from December of 2010 and ending December 2018, the Pantera team released a forecast for the price of bitcoin going forward. “During that timeframe, Bitcoin grew at a 235% compound annual growth rate. We then added the trend line and then suggested a forecast with Bitcoin returning to the trend by the end of 2019 and continuing on into the future,” wrote the post.

The forecast shows that the price of bitcoin would reach $42,000 by the end of this year, $122,000 at the end of 2020, and $356,000 at the end of 2021. Mean reversion is a significant force, indeed. Nonetheless, mean reversion to a compounded annual growth rate of 235 percent is ludicrous.

The forecast shows that the price of bitcoin would reach $42,000 by the end of this year, $122,000 at the end of 2020, and $356,000 at the end of 2021. Mean reversion is a significant force, indeed. Nonetheless, mean reversion to a compounded annual growth rate of 235 percent is ludicrous.

Photo by André François McKenzie on Unsplash