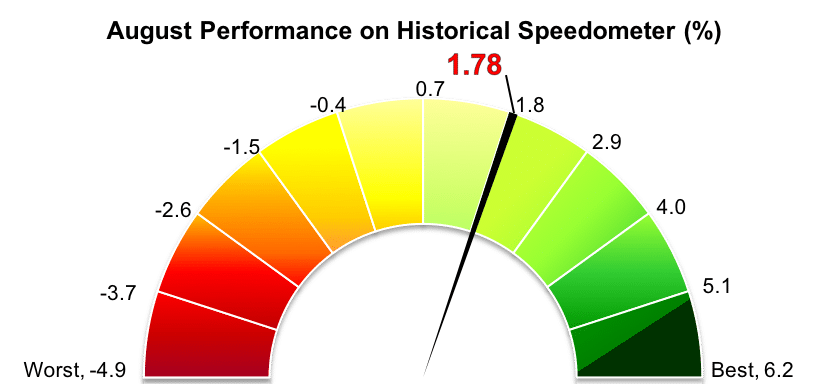

Stockholm (HedgeNordic) – Nordic CTA funds gained 1.8 percent on average in August (100 percent reported), recouping some of the losses incurred in February. The Nordic CTA Index is down 1.3 percent year-to-date through the end of August.

Global CTA funds generally performed strongly in August, but performance was different depending on which index one looks at. The Société Générale CTA Index, for example, gained 2.6 percent last month, cutting year-to-date losses to 2.8 percent. The SG CTA Index tracks the performance of the largest 20 CTAs by assets under management. The Barclay BTOP50 Index, meanwhile, was up 1.7 percent in August, taking its year-to-date performance through August to down 2.7 percent. Compared to the SG CTA Index, the Barclay index reflects the performance of the 20 largest investable CTA programs. The broader Barclay CTA Index, however, gained only 0.7 percent last month, cutting its year-to-date losses to 1.4 percent. In general, most trend-following managers reported stable positive returns, while diversifying strategies run by short-term traders, VIX traders and fundamental traders had mixed performance.

The majority of the members included the NHX CTA Index posted positive returns last month, with four in every five CTA managers ending the month of August in the green. Estlander & Partners Alpha Trend II, a higher leverage version of systematic medium-term trend-following strategy Alpha Trend, was the biggest gainer among Nordic CTA funds in August with a gain of 8.5 percent. The fund recouped a huge portion of the losses incurred in the first half of the year, bringing year-to-date losses to 4.1 percent.

Diversified multi-CTA fund RPM Galaxy, meanwhile, booked a 7.6 percent gain last month, which brought its year-to-date performance to down 6.7 percent. Swedish systematic trend-following hedge fund Lynx Sweden gained 6.4 percent, taking this year’s performance back into positive territory at 1.3 percent.

The two funds managed by IPM Informed Portfolio Management AB included in the NHX CTA Index suffered high losses last month. IPM Systematic Macro Fund was down 4.9 percent, whereas IPM Systematic Currency Fund booked a 4.3 percent loss. The former is up 0.6 percent year-to-date through the end of August, while the latter is up 4.0 percent so far in 2018.

Picture © By-Marian-Weyo—shutterstock