Stockholm (HedgeNordic) – Nordic fixed-income hedge funds, as measured by the NHX Fixed Income Index, gained 0.1 percent in March, taking the performance for the first quarter of 2018 back into positive territory at 0.1 percent. Nordic fixed-income strategies as a group lost 0.5 percent in February, putting an end to a 23-month streak of positive performance.

In contrast to their Nordic peers, global fixed-income hedge funds recorded losses for a second consecutive month in March. The Eurekahedge Fixed Income Hedge Fund Index, an equally-weighted index of 320 fixed-income hedge funds, was down 0.1 percent in March, bringing the performance for 2018 down to 0.6 percent.

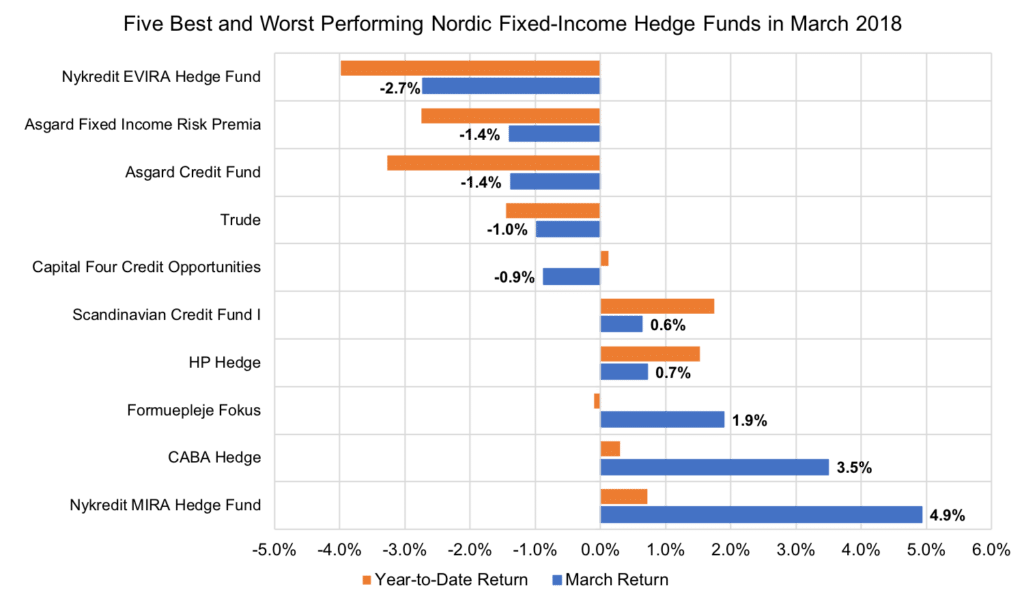

Around 44 percent of the 25-member NHX Fixed Income Index enjoyed positive performance in March. Nykredit MIRA Hedge Fund, awarded the top prize in the fixed-income category at this year’s HFMWeek European Hedge Fund Performance Awards, was the biggest gainer among Nordic fixed-income hedge funds in March. The fund gained 4.9 percent for the month, recouping the losses incurred in the first two months of the year (up 0.7 percent in Q1).

Danish fixed-income arbitrage fund CABA Hedge was up 3.5 percent in March, taking its performance for the first quarter back into positive territory (up 0.3 percent in Q1). Formuepleje Fokus, which mainly invests in Danish mortgage bonds, gained 1.9 percent in March (down 0.1 percent in Q1).

Three young fixed-income hedge fund dominated March’s list of underperformers. Nykredit EVIRA Hedge Fund was down 2.7 percent in March, extending its losses for the first quarter to 4.0 percent. Asgard Fixed Income Risk Premia and Asgard Credit Fund, winner of this year’s Rookie award, were both down 1.4 percent in March (down 2.8 percent and 3.3 percent in Q1).

Picture ©: Romolo-Tavani—shutterstock.com