Stockholm (HedgeNordic) – CTAs had another good run in February as continued worries for the health of the global economy translated into profitable positions in fixed income. In the energy sector, the price of natural gas fell sharply also benefiting momentum-based strategies in particular.

Among CTA benchmarks, the Barclay CTA Index climbed 1.6% (+2.8% YTD) while the SG CTA Index added 3.0% (+7.3% YTD). The HedgeNordic CTA Index (NHX) gained 4.3% (9.6% YTD).

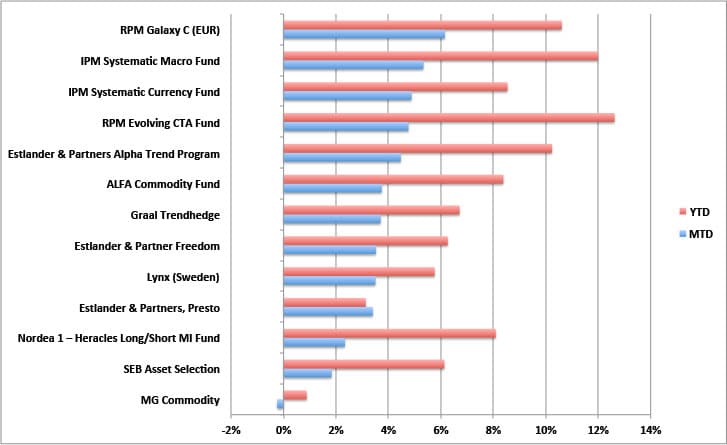

Nordic CTAs overall posted solid returns for the month with only one manager (MG Commodity) showing negative numbers. Top performers included funds from Swedish CTA specialist RPM and Swedish quant macro shop IPM.

In the case of RPM, the GALAXY fund which includes both trend following and short-term CTAs added 6.2% on the month (10.6% YTD) while the RPM Evolving Fund, investing into early stage CTAs carrying smaller AuM gained 4.8% (12.6% YTD). IPM recorded continued gains for both its Macro (+5.3%) and Currency (+4.9%) programs, these are now up 12% and 8.5% respectively for the full year.

Among the large names, Lynx gained 3.5% while SEB Asset Selection added 1.8% on the month.

Nordic CTA-rank, February 2015

Picture: (C) ramcreations – shutterstock.com