Stockholm (HedgeNordic.com) – The Nordic Hedge Index, NHX, supported by gains in all substrategies, advanced by 0,97% in December to lock in its strongest annual gains since its record year in 2009 (+14,95%) to finish 2013 7,43% higher. The index value of 152,6 represents an all time high for NHX.

HedgeNordic will be publishing a comprehensive and in depth report on the Nordic hedge fund universe during February, highlighting developements in the different sub categories and strategies, new fund launches and closes, manager introductions and interviews. The report will also try to introduce an asset index based asset flow report, monitoring subscriptions and redemptions to publicly available collective investment schemes.

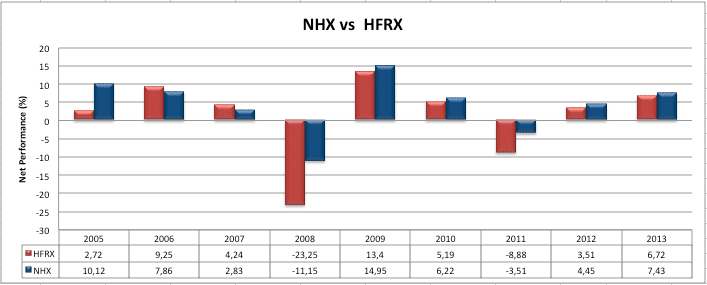

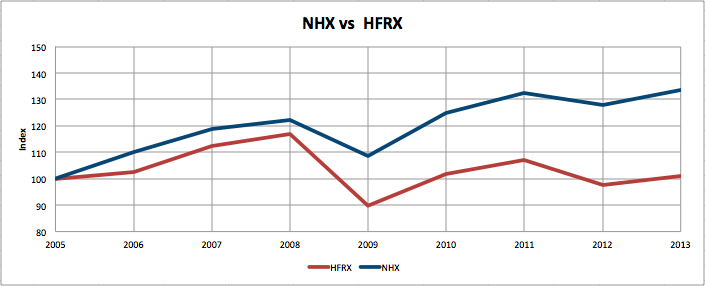

Included will also be a comparison of the Nordic Hedge Fund Index, NHX to its international peers, such as the HFRX Global Hedge Fund Index. As sneak peek, below are to charts comparing net performances of Nordic hedge fund managers to HFRX. Both indices were set to values of 100 as of December 31st 2004 for the charts. Results may reflect a “survivorship bias”.

Graph 1: NHX vs. HFRX – year by year net performances since 2005

Graph 2: Performance comparison NHX vs. HFRX since 2005, assumed Index value start at 100

The HFRX Global Hedge Fund Index by Hedge Fund Research, Inc. is described on their website as:

The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

Hedge Fund Research, Inc. (HFR) utilizes a UCITSIII compliant methodology to construct the HFRX Hedge Fund Indices. The methodology is based on defined and predetermined rules and objective criteria to select and rebalance components to maximize representation of the Hedge Fund Universe. HFRX Indices utilize state-of-the-art quantitative techniques and analysis; multi-level screening, cluster analysis, Monte-Carlo simulations and optimization techniques ensure that each Index is a pure representation of its corresponding investment focus.

The Nordic Hedge Fund Index (NHX) is described on the website as:

The Nordic Hedge Fund Index (NHX) is an equal weighted hedge fund index derived from the performance of hedge fund managers and advisors within the universe of Nordic hedge funds. The index is largely based on data reported directly to HedgeNordic by the hedge fund managers themselves. As of January 20th 2014, 159 funds and programs were listed in the NHX.

Picture: (c) Pincasso—shutterstock.com