By Laura Parrott – Nuveen: The private credit market has experienced remarkable growth, reaching $1.7 trillion in assets under management and 13% annual growth since the 2008 financial crisis¹. Rather than signalling a bubble, this expansion represents the evolution of a maturing asset class, offering institutional investors compelling opportunities for those who can navigate its increasing complexity.

Coming of age

Contrary to overheating concerns, institutional investors remain confident. According to Nuveen’s 2025 EQuilibrium survey, nearly half (49%) of the 800 global institutional investors surveyed plan to increase their private credit allocations over the next two years, with Nordic investors showing a similar appetite at 45% planning increases². Further, nearly 95% of global institutional investors who hold alternatives now allocate to some form of private credit, up dramatically from just 62% four years ago².

The key question is not whether private credit has become too large, but how investors can discern quality and operate effectively in an increasingly sophisticated landscape. For institutions capable of separating signal from noise, this growth allows investors to focus on segments, structures and the managers most capable of delivering durable outcomes.

Segmented ecosystems

Private credit has matured into a diverse ecosystem encompassing distinct strategies, each with unique risk profiles, borrower attributes and regional dynamics¹. This segmentation spans three critical dimensions that institutional investors must understand for optimal portfolio construction.

Geographic diversity reveals differences between markets. Direct lending in the U.S. maintains its standing as the most developed and liquid market, while Europe exhibits greater fragmentation, requiring pan-European platforms with dedicated regional teams and jurisdiction-specific expertise.

Capital structures in private credit spans the breadth of the debt capital stack, ranging from investment-grade corporate private placements to junior capital and NAV based lending. While investment-grade corporate placements and middle-market direct lending emphasize stability, covenant protections and predictable cash flows — ideal characteristics for liability-driven investors — they focus on different areas of the market and employ different amounts of leverage.

Relationship dynamics remain a cornerstone of direct lending. While sponsor-backed entities represent a small fraction of the market, they tend to be recurring revenue businesses with strong management teams and ambitious growth strategies.

The investment-grade corporate private placement market exemplifies this diversity, featuring utilities, energy companies, infrastructure projects and even sports leagues. These borrowers often could access public bond markets but choose private placements for confidentiality, flexibility and long-term fixed-rate financing that traditional markets cannot provide.

Supply and demand fuels opportunities

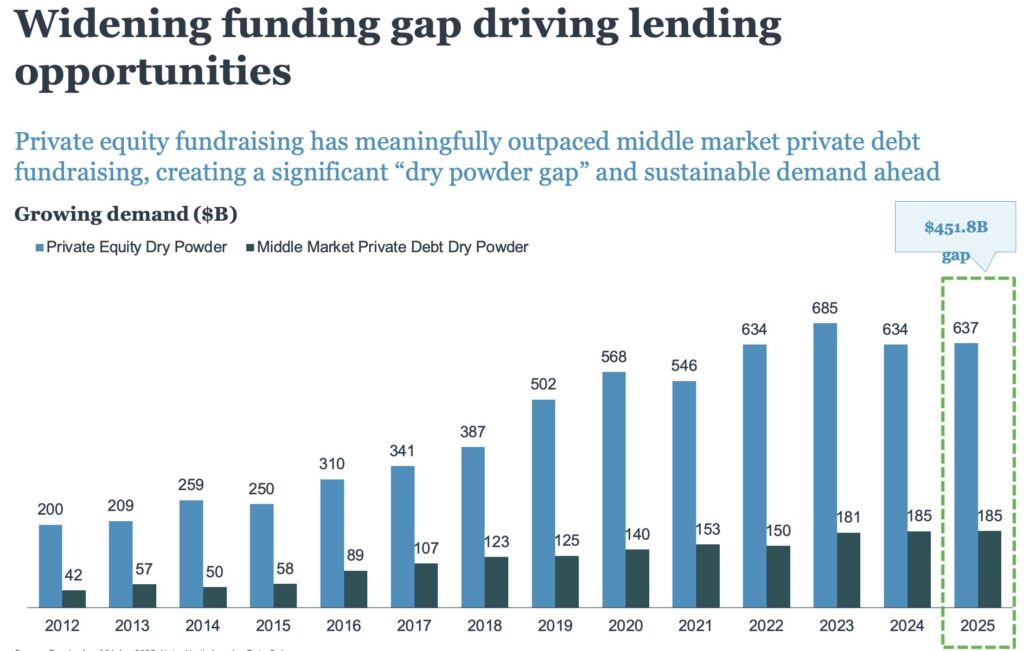

The private credit opportunity is underpinned by compelling supply-demand dynamics. In the U.S., a $452 billion gap exists between private equity dry powder ($685B) and middle market private debt dry powder ($185B)⁴. This imbalance creates sustained deal flow opportunities for well-positioned lenders, particularly as middle market companies represent one-third of all U.S. private sector GDP⁵.

Opinions and views expressed reflect the current opinions and views of the date of this material only. Nothing contained herein is intended as a prediction of how any financial markets will perform in the future and nothing contained herein should be relied upon as a promise or representation as to past or future performance of a fund or any other entity, transaction, or investment.

Despite strong capital inflows, the core U.S. middle market appears less crowded than pre-Covid. As larger managers moved upmarket toward larger transactions and smaller players moved downmarket, the number of scaled competitors in the traditional sponsor-backed segment has contracted. The most successful lenders maintain long-standing relationships with private equity sponsors and capacity to fund complete deals, securing proprietary opportunities without unfavorable pricing or structural concessions.

European dynamics mirror this concentration trend. European direct lending is primarily driven from the top-five managers, who provide 48% of funds, up from 35% three years ago⁶. Meanwhile, European private equity maintains 4.7 times the dry powder of private debt⁶, reinforcing opportunities for established platforms with scale, local knowledge and structuring expertise.

Portfolio management advantage

Success in mature private credit markets increasingly depends on post-investment value creation through continuous monitoring and proactive intervention. The best managers implement regular dialogue with borrowers and sponsors, evaluating financial performance relative to covenant thresholds to identify issues early and collaborate on solutions before problems escalate.

In today’s higher-rate environment with greater economic uncertainty, effective managers can intervene proactively through conversations or re-underwriting before more drastic measures become necessary. This active approach proves especially valuable across different segments, from maintaining stable ratings in investment-grade corporate lending to engaging with sponsors on sector trends in middle market transactions.

Strategic Positioning for the Next Phase

Private credit has entered a new era characterised by greater visibility, heightened complexity and a rapidly expanding investor base. Rather than overheating, the asset class is evolving in ways that reward institutional investors who can partner with managers possessing scale, relationships and structuring expertise to originate proprietary deals and secure strong terms.

The sustained overhang of private equity dry powder in both U.S. and European markets continues underpinning long-term deal flow, highlighting opportunities for investors who can access and execute on these opportunities. For institutions seeking reliable cash flows with structural protections in an increasingly unpredictable world, private credit offers compelling risk-adjusted returns when approached with appropriate manager selection and portfolio construction discipline.

Success requires partnering with experienced managers who have mastered sourcing through relationship-driven pipelines, structuring through bespoke covenant packages and terms, and stewardship through proactive portfolio management. For those capable of discerning quality in this maturing landscape, private credit’s next phase promises both durability and expansion.

Learn more in our latest research: Private credit’s next phase: finding opportunity in a maturing market.

Sources:

¹ Preqin; As of 30 Sep 2024

² Nuveen’s 2025 EQuilibrium survey

³ The Alts Institute, Brookfield Oaktree, Understanding Private Credit: Sponsored VS. Non-Sponsored Financing. Data as of 31 Jan 2025

⁴ Preqin; As of 01 Apr 2025. Note: North America data only

⁵ World Bank Open Data Database as of 31 Dec 2024; Middle Market assumption based on the definition by National Center for the Middle Market as of 31 Dec 2024

⁶ Preqin, November 2024 and December 2024

⁷ Thomson Reuters and Bank of America Securities. Data as of 31 Dec 2024

⁸ TIAA General Account as of 30 June 2025

Important information on risk

Investors should be aware that alternative investments including private equity and private debt are speculative, subject to substantial risks including the risks associated with limited liquidity, the potential use of leverage, potential short sales and concentrated investments and may involve complex tax structures and investment strategies. Alternative investments may be illiquid, there may be no liquid secondary market or ready purchasers for such securities, they may not be required to provide periodic pricing or valuation information to investors, there may be delays in distributing tax information to investors, they are not subject to the same regulatory requirements as other types of pooled investment vehicles, and they may be subject to high fees and expenses, which will reduce profits. Real estate investments are subject to various risks associated with ownership of real estate-related assets, including fluctuations in property values, higher expenses or lower income than expected, potential environmental problems and liability, and risks related to leasing of properties. Investments in middle market loans are subject to certain risks such as: credit, limited liquidity, interest rate, currency, prepayment and extension, inflation, and risk of capital loss. Private equity and private debt investments, like alternative investments are not suitable for all investors given they are speculative, subject to substantial risks including the risks associated with limited liquidity, the potential use of leverage, potential short sales, concentrated investments and may involve complex tax structures and investment strategies. Nuveen, LLC provides investment solutions through its investment specialists. This information does not constitute investment research as defined under MiFID.