Kristian Myrup Pedersen, Quant Director – CABA Capital: The late summer of 2024 marked a turning point for financial markets with global central banks starting their first cutting cycle since the early days of the corona crisis in 2020. Although lower rates tend to be positive for risky assets, it is worth noticing that the background for this cutting cycle is a combination of declining economic activity, less heated labor markets and falling inflation, which in itself might not be particularly positive for risky assets. Therefore, now could be a good time to allocate capital towards strategies within asset classes that are likely to directly benefit from this cutting cycle.

Since the financial crisis in 2008, cutting cycles have often been accompanied by quantitative easing programs focusing on government and covered bonds. Should the general economic activity continue to decline, leading to negative risk sentiment, exposure towards bonds qualifying for quantitative easing programs could turn out to be a good protection. First and foremost, this will be government and covered bonds. Given the credit weakness of both the US and most European countries, we believe Scandinavian bonds, where both government and covered bonds are truly AAA-rated, is the right place to be.

Traditional Strategies to Capture the Opportunities

With a market size of more than EUR 825 billion, the Scandinavian AAA-rated covered bond market offers attractive opportunities that can be utilized through a variety of different investment strategies.

Firstly, long only investors who do not use derivatives can obtain exposure towards interest rates, spread premium, and in the case of callable bonds, also volatility premium through covered bonds. Therefore, Danish banks, investment funds, and pensions funds are large buyers of covered bonds and use them as the foundation of their fixed income portfolios. A key feature of this investment strategy is that – in the absent of trading – the risk will naturally decline over time as the bonds approach maturity.

Secondly, the above-mentioned investors often also optimize part of their covered bond portfolios through the use of derivatives, where they for example reduce their interest rate risk – but keep their exposure to spread premiums and volatility premiums – by selling interest rate swaps. This strategy comes with a higher expected return than the reduced interest rate risk would otherwise allow. A key feature here is the separation of spread premiums and volatility premiums from interest rate risk.

Thirdly, fixed income hedge funds often invest in covered bonds, reducing the interest rate to zero by selling swaps, and thereby leaving nothing but the spread premiums and volatility premiums. This is in itself a low-risk strategy, and therefore hedge funds increases the expected return by leveraging the exposure by borrowing money using the covered bonds as collateral. A key feature of this strategy is to increase the attractive risk-adjusted return of spread premiums and volatility premiums to match the expected returns of equities, just with a different risk-return profile adding to portfolio diversification.

The three investment strategies above come with their own pros and cons, and as the typically serve different purposes from a broader portfolio perspective, they all have their justification for existence.

The new CABA Flex Strategy

At CABA Capital, we have designed a new investment structure to combine the best of all three AAA-rated covered bond investment strategies above. In the two funds, CABA Flex and CABA Flex2, we invest in covered bonds that are likely to directly benefit from the coming cutting cycle, and we do it in such a way that we are able to obtain “equity-like returns with bond-like risk-profiles.”

In short, we invest in Scandinavian AAA-rated covered bonds, where we isolate the spread premium and increase the expected return by appropriate leverage. The funds are wrapped in 3-year maturity structures with declining risk profiles from start to end, leading to both a profound transparency throughout their lifespans and a high accuracy in return forecasting.

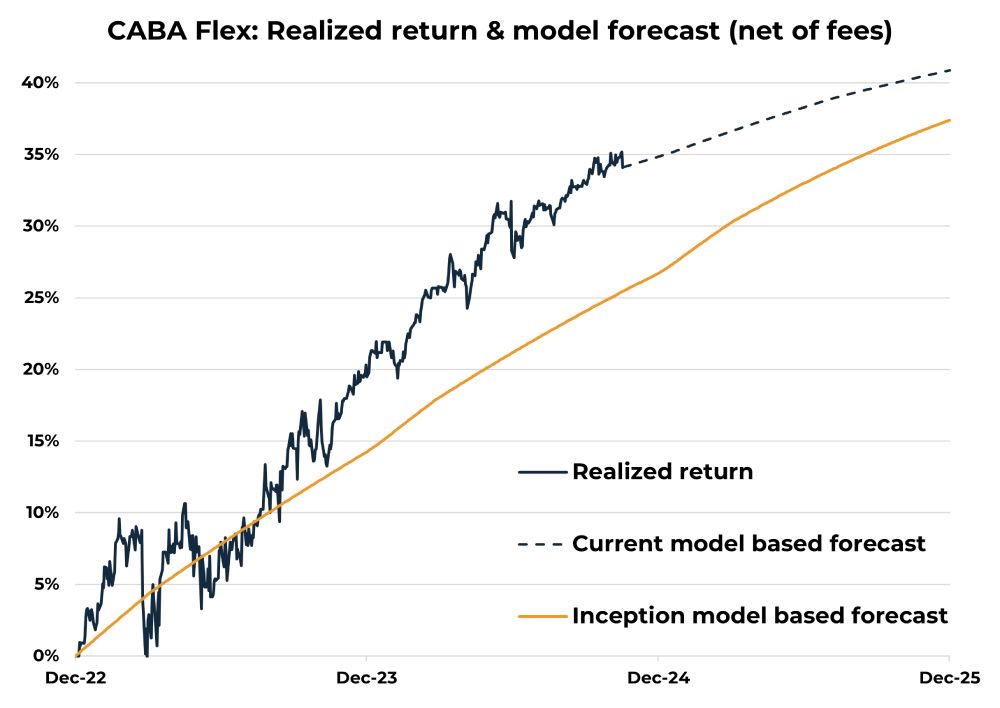

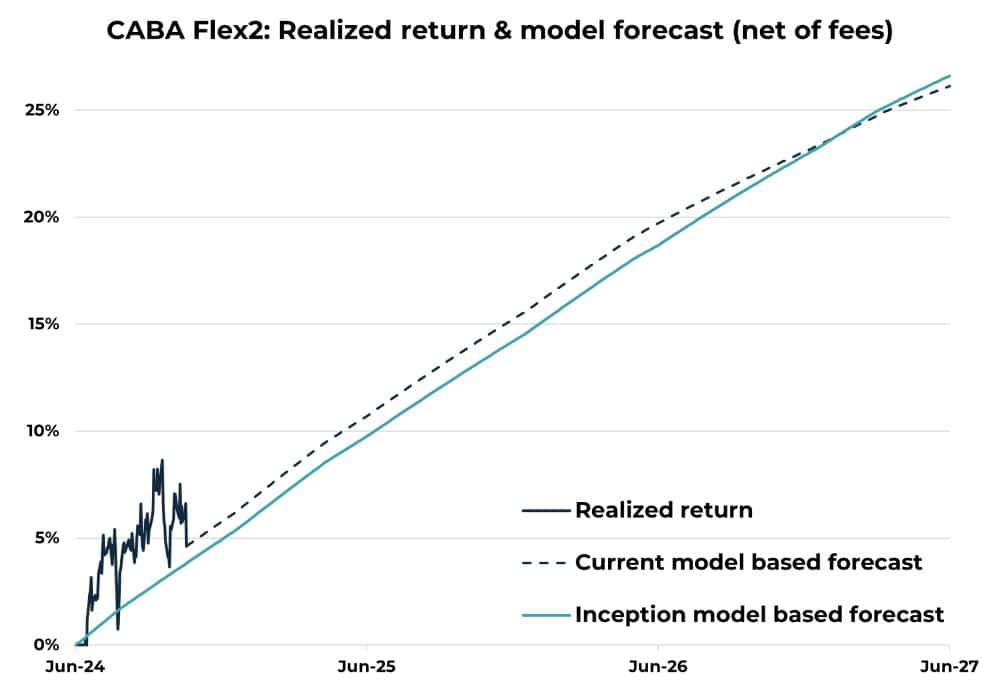

In the two performance charts, we have illustrated the expected return path at inception, the realized return up until now, and the expected return path until maturity for the two funds (all returns are after fees). As the charts show, both funds are performing well with realized returns in the high end of the return expectations at inception. Moreover, as especially the CABA Flex chart show, the volatility of the funds tends to decline over time, which is a feature that is built into the very structure of the funds.

More Risky Assets without More Risk

Diversification is known to be the only “free lunch” in financial markets, and with the CABA Flex funds, investors can have a higher share of risky assets without higher portfolio risk. Over the past 20 years, the underlying CABA Flex strategy would have delivered yearly returns of almost 10 percent, matching the global equity market, with a standard deviation of only half the size of equities. Looking ahead, in an all-else equal scenario, the CABA Flex funds will perform according to their expected return paths, and should we end up in a negative scenario with a severe economic downturn, they have potential to benefit directly from a deep cutting cycle with revitalized quantitative easing program. Therefore, now could be a very good time to allocate from traditional risky assets to our newest fund, CABA Flex2.