Stockholm (HedgeNordic) – The Digital Platform Dominance theme embodies the transformative rise and influence of digital platforms that have revolutionized industries by building highly scalable ecosystems with significant barriers to entry. Giants such as Google, Meta, and Amazon exemplify the disruptive power of platform-based business models by redefining industries and disrupting traditional competitors. While the theme may have reached a mature phase, Danish thematic asset manager St. Petri Capital highlights the emergence of new “verticals” driven by advancements in artificial intelligence, which have the potential to further reshape industries and disrupt business models.

“This theme, in our terminology, is actually very mature,” says Jens Larsson, co-founder and portfolio manager of thematic-focused fund St. Petri L/S. “This theme has been the most profitable theme in investing for a long time,” he notes. Platforms such as Amazon, Google, Facebook, and LinkedIn thrive on network effects, where increased usage enhances value for all participants. “Many of these digital dominance companies succeeded because they connect a vast network of people and businesses online, creating a positive flywheel effect. This makes them the go-to destination because of the increased activity,” Larsson explains. As a result, these businesses become “extremely profitable with very high barriers of entry.”

“We’re entering a new phase where this theme could make some of these players even more profitable, while others could see their business models disrupted.”

Some of the world’s largest companies have capitalized on this theme, generating significant value for shareholders. But does this theme still have room for growth and the potential to deliver outsized returns? In investing, expectations are often priced into share prices, which is why the team at St. Petri Capital isn’t necessarily betting on all giants to grow even larger –though that remains a possibility. “In our view, this is a very mature theme,” says Jens Larsson. “We’re entering a new phase where this theme could make some of these players even more profitable, while others could see their business models disrupted,” he argues.

Larsson highlights that the theme remains highly relevant for certain companies, as many new industry verticals can benefit from positive dynamics. He explains that the rise of new verticals – driven by the increasing use of artificial intelligence – creates fresh opportunities for companies to leverage and capitalize on.

The S-Curve and New Verticals

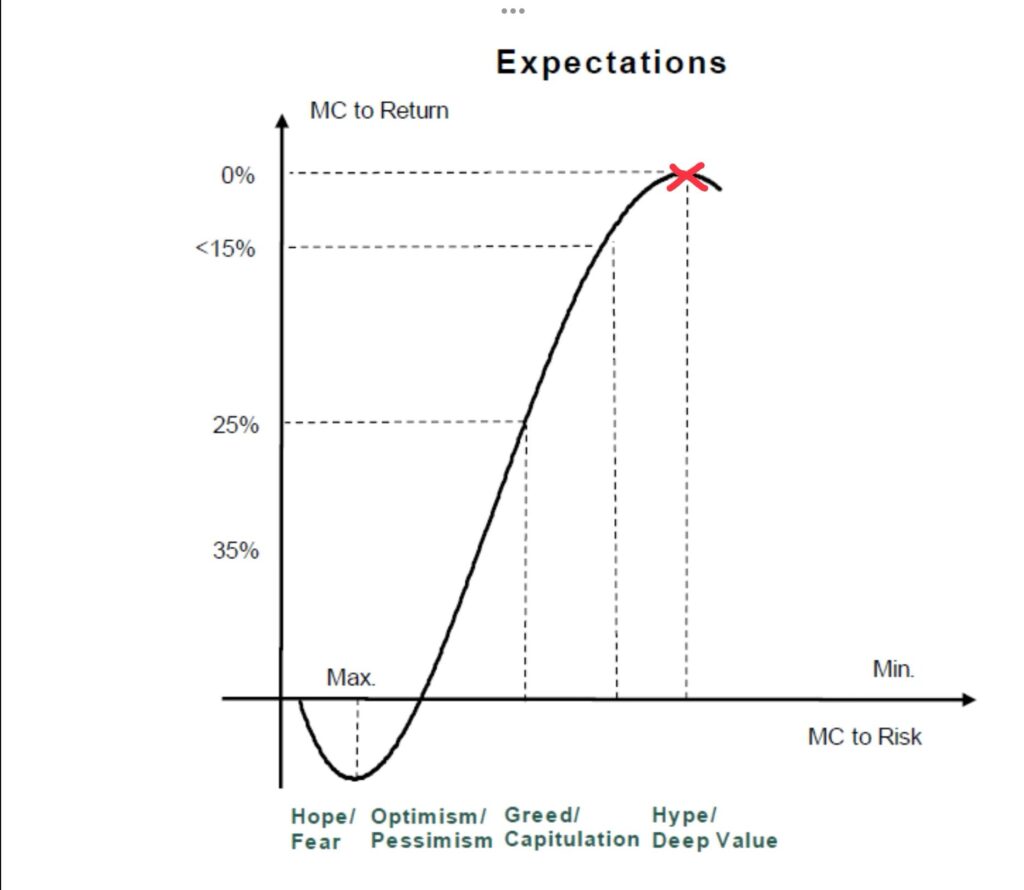

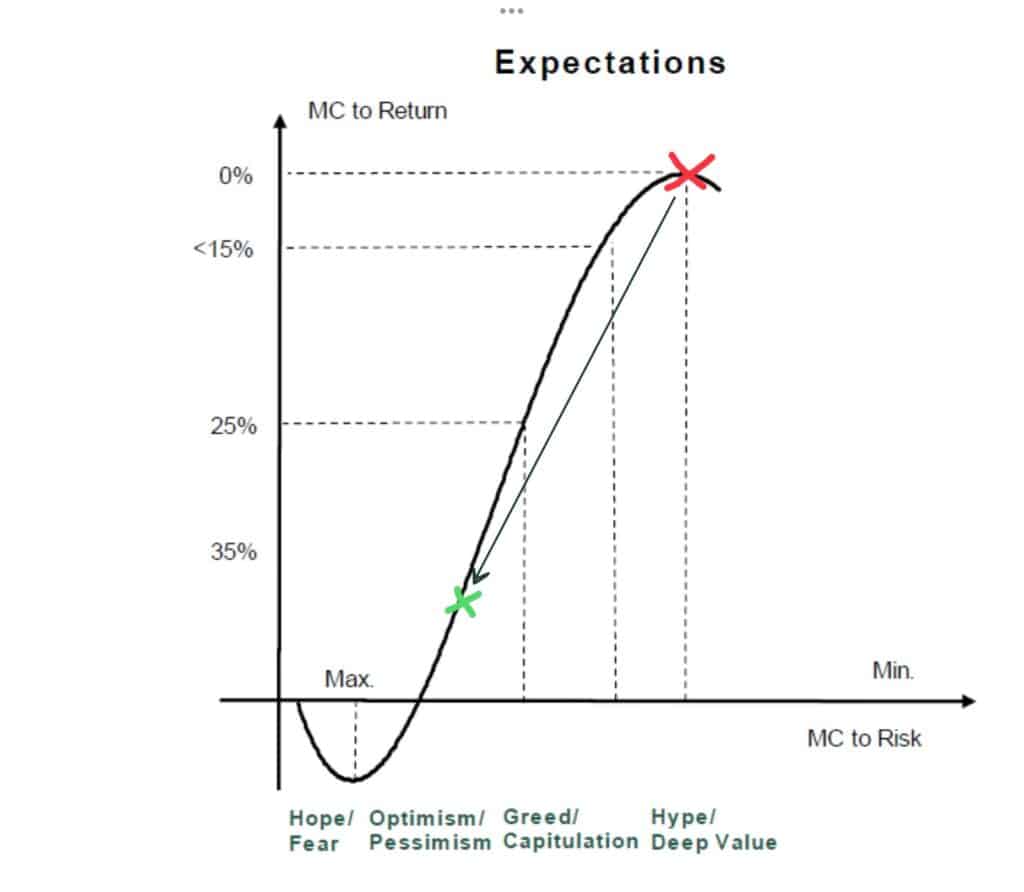

The Digital Platform Dominance theme has reached a mature stage, with widespread market consensus on its trajectory. As a result, the expected returns from this theme have diminished, and its associated risks have decreased. “As a theme gains consensus and moves down the S-curve, the marginal contribution to returns decreases, and the risk also diminishes,” explains Johann Grøndahl, investment analyst at St. Petri Capital. This theme has been evolving for nearly 20 years, or more, and is represented on the graph by the red X, indicating its current stage. At this point, the theme offers low expected returns and low risk, according to Grøndahl. However, a new set of verticals within this theme is emerging and shifting down the S-curve towards the green X, signaling the rise of high-risk, high-reward opportunities.

“One of the key aspects of the AI story for us is access to data, and these large digital platforms hold vast amounts of it,” says Grøndahl. AI has the potential to either strengthen the market position of these already dominant platforms, making them even more powerful or disrupt entire business models, as seen with the threat posed by ChatGPT to Google’s search engine. “We believe that these new dynamics could shift some verticals down the S-curve once again, breathing new life into this theme and opening up fresh opportunities for return,” adds Grøndahl.

“One of the key aspects of the AI story for us is access to data, and these large digital platforms hold vast amounts of it.”

Grøndahl points out that “it’s still quite challenging to identify new verticals that do not yet have an already dominant player.” However, with the aid of AI, new verticals may emerge. One example could be a “Lawson for Lawyers” platform offering legal services. The vast amount of data and AI’s growing ability to leverage that data could enable the creation of a dominant player in the legal space, where users referring others to the platform could generate a powerful network effect, according to Grøndahl. “We believe AI unlocks potential across a wide range of new verticals, though which ones will emerge is still uncertain – that’s why we continue to monitor this space.”

A Long and a Short

Before new verticals and opportunities within the Digital Platform Dominance theme fully unfold, the St. Petri team behind their long/short equity fund is already targeting both long and short opportunities within this space. One of their long positions is the Danish consumer review platform Trustpilot. “There is currently no completely unbiased, peer-to-peer verification system that you can fully trust,” says Grøndahl. “From a broader lifecycle perspective, this theme would typically be nearing the end of its cycle. However, with the added complexity of AI, which can both enhance and disrupt, we believe the theme has moved down the S-curve again, making it compelling once more.”

“With the added complexity of AI, which can both enhance and disrupt, we believe the theme has moved down the S-curve again, making it compelling once more.”

“AI makes trust even more critical because distinguishing what is real from what isn’t becomes increasingly challenging, and trust issues are already more prominent,” adds Larsson. Trustpilot, as a consumer review platform, can stand to benefit significantly from AI and network effects to enhance its value proposition, scalability, and competitive advantage. AI algorithms can detect fake reviews or malicious activities by analyzing patterns, while Natural Language Processing (NLP) can assess sentiment and categorize feedback into actionable insights.

On the short side, ChatGPT and other generative AI technologies have begun to challenge Google’s core search business. “Before AI, ChatGPT, and similar technologies, short opportunities were mainly driven by regulatory concerns, where large players like Google might be forced to split due to their size,” explains Grøndahl. However, Larsson argues that the regulatory angle has not yet played out. Now, it’s technologies like ChatGPT that threaten to disrupt Google’s search business. “How do you provide an excellent answer to a question on Google without jeopardizing your advertising revenue?” Larsson questions. “If you want knowledge, Google just isn’t good enough. Even if they manage to replicate ChatGPT’s functionality, they no longer have a viable business,” he concludes. “They are in a very difficult position.”