Stockholm (HedgeNordic) – With over 45 years of expertise in structured finance and debt asset management, Jørgen Beuchert has dedicated the last 15 years to investing in higher-yielding debt through his asset management firm, NCI Advisory. Overseeing Nordic Corporate Investments (NCI) since 2008, along with a newer fund initiated after the COVID-19 outbreak, Beuchert and his team of seven manage assets exceeding DKK 700 million, aiming for returns in excess of ten percent in the senior secured high-yielding debt markets.

“We focus on senior secured debt with financial covenants in markets where we have experience, particularly in the Nordics, Germany, Benelux, and the UK,” says Beuchert, who previously led a team of 14 professionals overseeing a portfolio of €3 billion in debt investments before establishing NCI Advisory. Beuchert has managed Nordic Corporate Investments (NCI) since 2008 and NCI Credit Opportunity Fund (NCIC) since 2020. Although both funds share the same focus and operate within the same market landscape, there are structural distinctions between them.

Apart from requiring different minimum investments, the distinction between NCI and the younger counterpart, NCIC, is that the older fund “has the flexibility to leverage up to one time equity and participate in direct lending arrangements,” explains Beuchert. “With NCI, we can selectively engage in direct lending deals, where we primarily provide senior secured financing with financial covenants and potential equity upside,” he elaborates. While direct lending transactions may entail longer closing times, Beuchert notes, “the advantage is that we typically generate returns in excess of 20 percent per annum in these deals.”

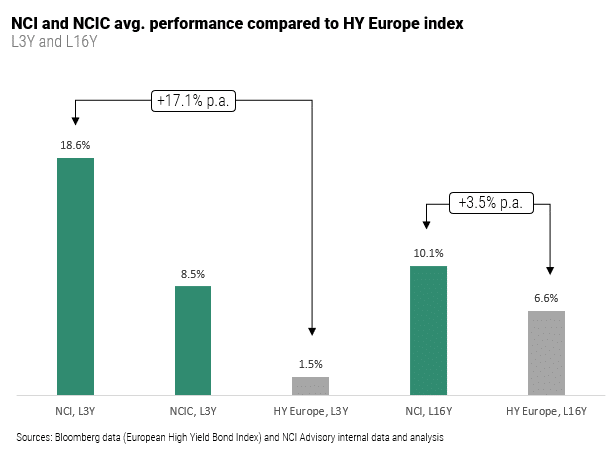

“The ability and flexibility to engage in direct lending deals and leverage investments have allowed us to generate an annualized return of 10.1 percent to our investors in Nordic Corporate Investments (NCI) since launching in 2008, with average annual dividends to investors of 9.3 percent.”

Jørgen Beuchert

“The ability and flexibility to engage in direct lending deals and leverage investments have allowed us to generate an annualized return of 10.1 percent to our investors in Nordic Corporate Investments (NCI) since launching in 2008, with average annual dividends to investors of 9.3 percent,” says Beuchert. Notably, NCI enjoyed an advance of 26.8 percent in 2023 alone, resulting in an average return of more than 18 percent over the three-year period from 2021 to 2023. For a long time, Beuchert and his team have focused on investments with a floating interest rate structure and shorter tenor. “This approach protected us in 2022,” according to Beuchert, enabling NCI to generate a positive return of close to five percent while most other debt funds experienced double-digit losses. “The positive return in 2022 helped us achieve a very strong average return of 18.6 percent in the three years between 2021 and 2023.”

“The positive return in 2022 helped us achieve a very strong average return of 18.6 percent in the three years between 2021 and 2023.”

Jørgen Beuchert

Same “Hands-on” Approach Across Both Funds

Despite their slight differences, both vehicles draw upon the experience of the same team and rely on the same strategy to achieve their objectives. “First and foremost, our investment strategy heavily relies on experience and thorough analysis,” begins Beuchert. “As we invest in high-yield debt, we do take risk. The most important objective in debt investments is to stay clear of losses,” he emphasizes. To mitigate the risk of investment losses, Beuchert and his team at NCI Advisory “undertake 360-degree fundamental analysis and adopt a hands-on approach to all our investments.”

This hands-on approach is facilitated by the decision to maintain a highly concentrated portfolio of investments. Each fund holds approximately 25 to 30 investments, carefully avoiding concentration in any particular industry or borrower. “We screen more than 100 investments annually, and only undertake ten to 15 investments a year,” states Beuchert. In addition to maintaining a focused portfolio to closely monitor all aspects of an investment, the team at NCI Advisory also seeks protection in case things turn sour. “We have exited more than 100 investments since 2008, and experienced only two credit losses during the coronavirus pandemic-induced crisis,” Beuchert points out.

“We have exited more than 100 investments since 2008, and experienced only two credit losses during the coronavirus pandemic-induced crisis.”

Jørgen Beuchert

“While our loss rate remains very low, we are very strict in our requirements for security and covenants,” emphasizes Beuchert. “These measures protect us in case of default and ensure a high level of recovery.” The fund’s annualized return exceeding ten percent since 2008 is partly attributed to “our very hands-on approach to investments,” according to Beuchert. “If there is a problem, we do not just sell the investment as most other portfolio managers. Instead, we work very hard on each investment to ensure we get our principal investment back and secure an attractive return,” he elaborates. “If necessary, we take the lead on any restructuring initiatives.”

Given the commitment to staying invested and recovering capital in the event of default, “the financing structure becomes very important as we want security that gives us the possibility to get full control of the operational companies if default occurs,” according to Beuchert. As part of their strategy to mitigate default and capital loss risks, the team prioritizes evaluating credit risk, company performance, management quality, and ownership. “We only engage with reputable companies and owners, as business ethics is important for us as debt investors,” Beuchert affirms. “Our focus primarily lies on cash and to a lesser extent on asset cover.”

With a few exceptions, the team at NCI Advisory remains industry-agnostic in security selection. “There are certain industries in which we do not participate, such as upstream oil and gas, shipping, chemical and real estate,” notes Beuchert. He explains that the rationale behind avoiding real estate is that “most of our investors already directly invest in real estate and real estate funds.” The decision to steer clear of other sectors is driven by their inherent volatility.

Portfolio Duration and Interest Rate Environment

Partially influenced by the structure of the Nordic high-yield market, the team at NCI Advisory predominantly favors investing in bonds with variable interest rates and short durations. “Our average portfolio duration is about 2.2 years and we do not invest in tenors beyond four years,” explains Beuchert. As a result, the impact of a higher interest rate environment has been less pronounced on short-duration portfolios like those managed by NCI Advisory. “As evidenced by our performance in 2022, interest changes do not impact us directly,” states Beuchert. However, he acknowledges the indirect impact of high interest rates on the creditworthiness of borrowers. Consequently, the team has “tightened our credit policy” in response to the higher interest rate environment.

“Based on our strong performance track record of more than 15 years, I anticipate that we will continue to deliver returns of ten percent in the future.”

Jørgen Beuchert

Beuchert holds a less optimistic view regarding interest rate cuts compared to the general market sentiment, noting that “cuts will come slower and probably only down to a level of three percent.” Irrespective of the direction of interest rates, the investment portfolios managed by NCI Advisory are well-positioned for the short-to-medium term, offering yields-to-maturity in the range of 13 to 14 percent and a duration of approximately 2.2 years. “Based on our strong performance track record of more than 15 years, I anticipate that we will continue to deliver returns of ten percent in the future,” concludes Beuchert. “Considering the current interest rate environment, we expect returns to be even higher.”

In addition to high yields, NCI Advisory’s investor base of charitable foundations, family offices, and high net-worth individuals, many of whom have been invested since the firm’s foundation, receive complete transparency regarding underlying investments. High-profile and highly experienced individuals within the investor base also serve on the boards of both the two funds and the asset management firm. “They receive monthly and quarterly reports detailing our portfolios, credit, and ESG rating,” assures Beuchert. This includes detailed information on any problematic cases, along with explanations of the issues and the strategies for resolution. Furthermore, investors have direct access to the investment team, with Beuchert noting that “we handle all matters in-house, and therefore, can provide immediate answers to any questions.”