By Peter Elam Håkansson and Jacob Grapengiesser, East Capital: While the last few years have presented a challenging backdrop for risk assets, particularly in emerging and frontier markets, 2024 should provide a more benign environment. Falling rates, a somewhat recovering China and a USD that is unlikely to significantly strengthen should be positive performance drivers for our markets. Nevertheless, with global economic growth slowing as higher interest rates start to bite, it will not be plain sailing, especially as a lot of the good news is already reflected in prices.

Hence, the ‘fat and flat’ (volatile and not particularly spectacular) returns remain our base case for 2024. A lot will depend on how soon the Fed is able to start cutting rates and, of course, what happens in China.

A Brief Look Back at 2023

Partner & CIO East Capital

It would be an understatement to say that the last few years have presented a difficult backdrop for equity market performance, thanks to rising inflation and interest rates, slowing economic growth and (for emerging markets) a widely discussed set of structural issues in China. In this context, markets have been surprisingly resilient, even outside the ‘magnificent seven’ in the US.

This includes emerging markets, which have been flat since the first Fed rate hike, despite a stronger USD. This is a clear testament to the improved fiscal and monetary frameworks in most countries, with the consensus that emerging markets have generally managed Covid and the subsequent inflationary pressures better than their developed market counterparts.

Indeed, China currently has inflation hovering around zero, and for 15 months over the last two years inflation has been higher in the US than in India. It is perhaps even more surprising that several emerging economies have outperformed developed markets since the start of the rate hike cycle, including Mexico and India, which have strong structural growth stories.

Rates to Remain in the Driving Seat

Although US yields have come down slightly in the last few months, they are still hovering around their highest levels since 2006. This is likely to put considerable pressure on equity markets, both in terms of theoretical valuations, i.e. future cash flows should be discounted at higher rates, and because financing costs have gone up considerably.

Chairman & Group CIO

One of the most direct impacts of interest rates is on exchange rates, which are a key driver for emerging and frontier markets. As interest rates come down gradually, we would expect the weakening trend in the USD that we’ve started to see over the last few months to continue, although we do not expect any drastic moves.

USD strength is one of the primary impediments to EM performance, not least due to pure translation impacts (when earnings growth is lower in USD). However, it also requires central banks to raise rates to defend their currencies, increasing borrowing costs (for FX debt) and impacting trade balances/inflation, due, for example, to oil becoming more expensive in local currency.

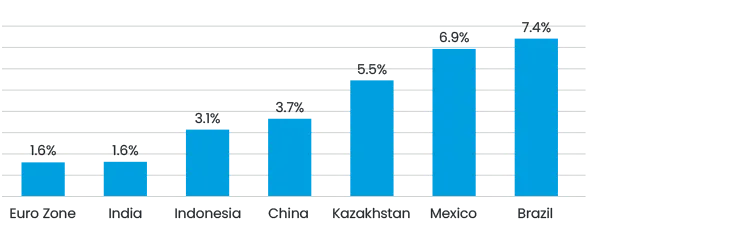

The final point on interest rates is that central bank rates in the countries we invest in are also crucial, given that most of our companies pay debt linked to these rates. It’s clear that emerging markets’ central bankers have generally been ahead of the curve when it comes to inflation and rates, and hence have significant headroom to cut rates, most obviously in Latin America. This can be clearly seen in real interest rates (Figure 1). The main reason this hasn’t happened sooner is the increase in Fed rates. As US rates start to come down, we would expect steeper declines in central bank rates in our core countries.

China Will Recover, Slowly

The list of China’s structural issues has been widely discussed; a struggling real estate sector, overleveraged local governments and poor consumer sentiment with a geopolitical backdrop that remains tense. We follow many macro statistics but the most striking is inflation, which has been hovering around zero for many months. This is due to both prudent macroeconomic policies, i.e. no massive handouts post Covid, and weak demand.

The major problem with the real estate sector is that it totally dominates the Chinese economy, accounting for 30% of Chinese GDP, compared with 7% in India and around 17% in the US (estimates vary). Its impact on the Chinese – and global – economy is therefore very significant and it has long been the major engine of overall economic growth. Going forward, however, this will not be the case; property sales in China’s 30 largest cities were down 15% YoY in November, and new construction starts were down 23% YoY in October.

We have seen a raft of policy measures that are helping, and we believe that by the second half of 2024, due partly to the base effect, we will start to see some very modest growth. However, it is difficult to see a return to the solid low double-digit growth seen over the last decade. This has had a correspondingly negative impact on consumer sentiment, which is reflected in flagging retail sales.

The on-the-ground view in China is that the next growth driver will be higher-end products such as renewable energy, electric vehicles and other advanced technologies. This will certainly be a massive benefit for the world as significant investment is driving down costs globally for key technologies. It is more difficult for equity investors, however, as these sectors in China tend to receive broad-based government support, which, combined with a strong growth mentality, leads to overcapacity and risk of anti-dumping tariffs.

The good news is that this will help the world reach climate goals as the economics of solar projects improves significantly. Combined, these sectors currently represent some 8% of GDP, so it will be harder for them to move the growth needle compared with real estate. We therefore believe that long-term growth for China will be closer to 4% as opposed to the 5-6% investors were used to previously, but this still represents a very significant 30–40% of global growth.

Elsewhere, Emerging and Frontier Markets Look Strong

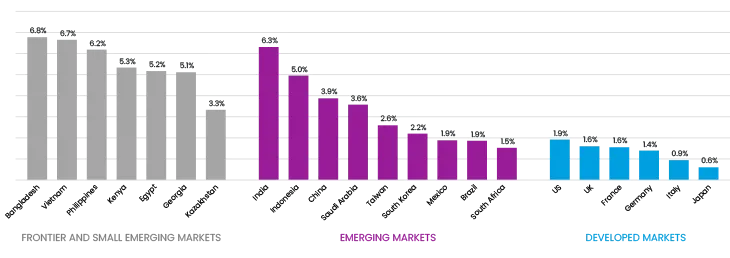

Outside China, the picture is much clearer. Strong GDP growth combined with falling interest rates (both in the US and domestically) set a good backdrop for equity performance. Countries like Vietnam, Indonesia and the Philippines should provide fertile ground for stock pickers, given the very strong structural growth on offer.

The jewel in the crown of emerging markets is, of course, India. Expected to grow at 6.3% annually between 2023 and 2028, the country is firing on all cylinders at the moment. This is highly visible in the market performance, both in the last few years and over a longer period, with 10-year CAGR at 10% in USD, compared with 6% in developed markets. This strong performance has meant the country is now the second largest in the emerging markets benchmark.

Going forward, we expect GDP growth to remain comfortably above 6%, inflation to moderate and earnings growth to remain strong, especially in the mid-cap names that we prefer. Consequently, we believe the strong performance will continue. The general election in May is the key risk; while recent state election results suggest Prime Minister Narendra Modi is poised to win a strong majority and a third term, we don’t rule out volatility in the run-up to the vote.

Aside from pure structural growth, a key driver for emerging markets performance is the electronics cycle. The biggest beneficiary is Korea, which produces over 70% of DRAM and 50% of NAND (both types of computer memory). The memory market has undergone one of the worst downcycles ever in 2023, with multiple quarters of inventory destocking. This has resulted in unprecedented production cuts across the board, which are continuing. However, thanks to prudent capex control and production cutbacks, as well as a cyclical demand recovery from consumer applications, the memory market is beginning to show gradual improvement, which is expected to continue throughout 2024.

Elsewhere across the emerging market universe, the Middle East has grown from 2% of the emerging market benchmark in 2019 to 7% today and is benefiting from both higher oil prices and more structural long-term shifts. Saudi Arabia is set to host World Expo in 2030 and the FIFA World Cup in 2034, while it also continues work on megaprojects like the brand-new city Neom. Aside from driving infrastructure growth, we expect these projects to also drive social reform, partly to avoid the PR difficulties that Qatar had with regard to its hosting of the World Cup. While Saudi Arabia’s oil dependency can be seen as a weakness, it also provides a useful hedge when geopolitical tensions arise around the world. Saudi Arabia also has ambitious plans for decarbonising its own power production, targeting 50% of renewable power generation by 2030 vs around 1% today.

Latin America remains an investor darling and a clear beneficiary of falling rates. We think Mexico looks particularly good value, given the strong tailwinds from US nearshoring and the likelihood of falling interest rates. While the country will also elect a new president next year, the most important election will be in the US; clearly, a Donald Trump presidency would not be positive for Mexico. For some of the mid-cap growth companies we like in both Brazil and Mexico, a 200bps fall in interest rate costs could increase earnings by over 100% – something we don’t think the market is pricing in at the moment.

It would also be remiss not to mention Eastern Europe, partly as our two regional funds are some of the best performing equity funds available to the Swedish market over the last 12 months, returning 34%–36% in EUR. The results of Poland’s recent parliamentary elections, and subsequent expectations of improvements in the rule of law, mean that the country should receive another large tranche of EU funds (up to 1% of GDP in H2 2024). Meanwhile, Greece continues to go from strength to strength, thanks in part to a new ‘year-round’ tourist model. We therefore remain positive on these markets too.

Overall, frontier markets are in a better position than in previous years, with economic rebalancing processes beginning, or already advancing, in markets that have recently faced challenges such as Egypt, Pakistan and Nigeria. Indeed, equity markets have started to price in the improving dynamics, with a number of rallies taking place. Apart from these individual recovery cases, economies should remain resilient in fast-growing markets like Vietnam, the Philippines, Kazakhstan, the UAE, Bangladesh, Morocco and Romania, giving equity investors good reason to expect appealing returns.

Conclusion

Despite the improving economic outlook and decent returns of late in most equity markets, emerging markets, and particularly China, remain much unloved. Given that emerging markets are trading at 11.4x P/E for 2024, with earnings growth at 18%, the risk-return profile for this asset class appears favourable.

So, while we are not suggesting that investors ‘sell the house’ to invest in emerging and frontier markets, we do think it makes sense to have some allocation, particularly with such stretched valuations and high earnings expectations in the US. On top of high expected returns, frontier markets can also offer further diversification benefits due to low correlations among individual markets and with other asset classes.

The original version of this article can be accessed here: Emerging and frontier markets outlook 2024 – emerging from the rates storm?