Copenhagen – (Jesper Rangvid): If someone had asked me a few years ago, when interest rates were still zero or even negative, what would happen if interest rates suddenly rose by 4-5%, I would have replied that we would have a recession, possibly even a severe one. Now interest rates have risen, but the recession has failed to materialise. And why? I first explain what we expected, then what happened, and finally why it happened.

The Fed’s first interest rate hike (in this tightening episode) was on 16 March 2022, which is now more than 1.5 years ago. The ECB’s first hike was on 21 July 2022. This is now 15 months ago. Since then, both central banks have raised interest rates many times.

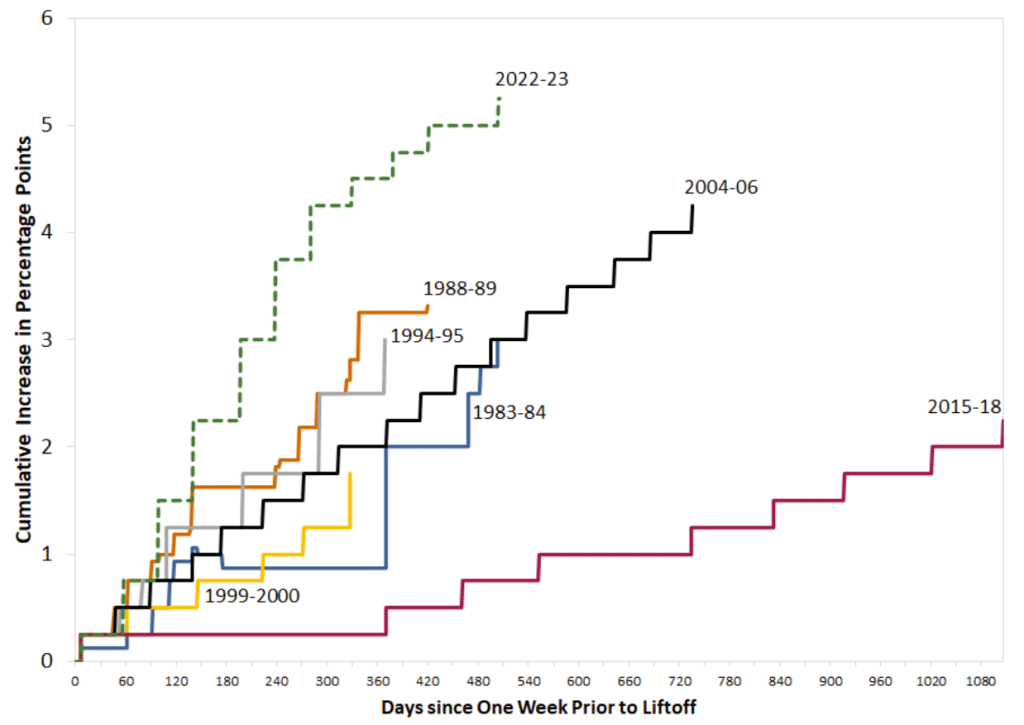

Figure 1 shows the fed funds rate during seven tightening episodes since the early 1980s.

Source: Fed St. Louis analysis (link).

This tightening episode has been the most aggressive of the seven shown in Figure 1. The policy rate has been raised by more than 500 basis points. The second most aggressive tightening phase was before the financial crisis, in 2004-2006, when interest rates were raised by about 400 basis points. Tightening has been similarly aggressive in Europe, where the ECB has raised rates by 450 basis points since July 2022.

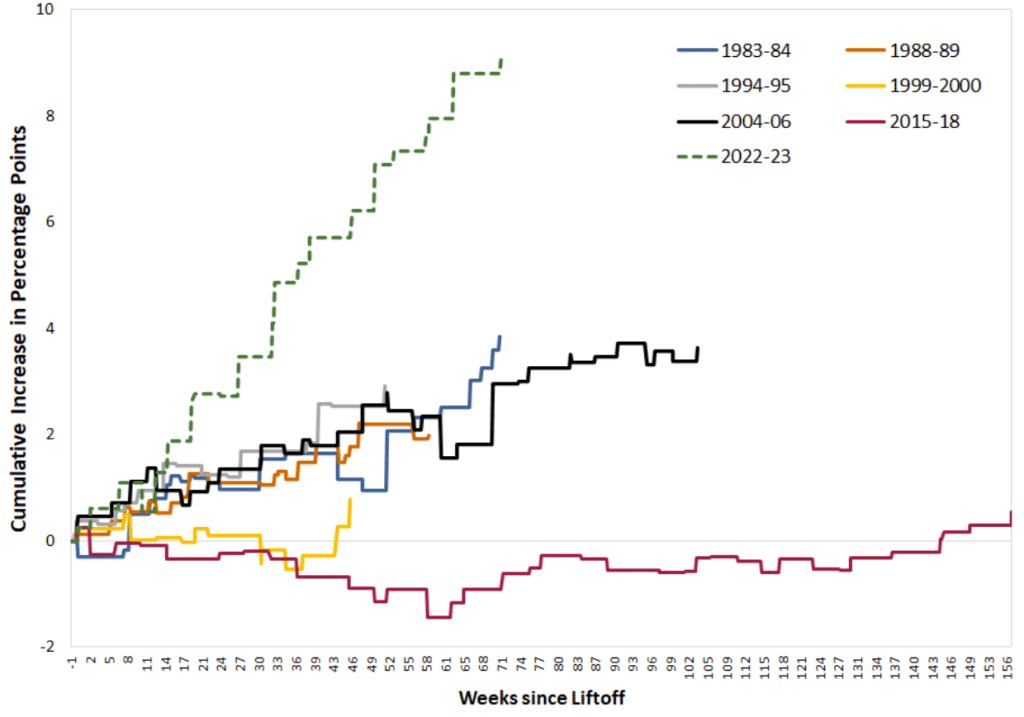

Central banks raise interest rates to cool the economy and reduce inflationary pressures. Macroeconomic models predict that economic activity reacts negatively to real interest rates. Complementing Figure 1, which shows the evolution of nominal interest rates, Figure 2 shows that real interest rates have risen even more than nominal. Real interest rates have risen by almost ten percentage points. In comparison, real interest rates rose by “only” four percentage points during the 2004-2006 episode.

Source: Fed St. Louis analysis (link).

Moreover, there is a difference between raising interest rates from 0% to 5%, as today, and raising them from 3% to 8%, for instance. All other things being equal, one would expect the former to have a stronger impact than the latter.

And yet here we are: interest rates have risen sharply, but the economy is strong. There has been no recession. Should we have expected one? And if so, why is the economy nevertheless doing so well?

Long and variable lags

Nowadays, most macroeconomic models include some form of an IS curve, i.e. a relationship that says that the current level of economic activity (or the output gap, i.e. current economic activity relative to potential economic activity) is negatively affected by the real interest rate. In many specifications, the coefficient to the real interest rate is even one, which means that economic activity should decline as much as real rates rise.

However, modern empirical models do not claim that economic activity responds immediately. Rather, the effects occur with a lag, the famous “long and variable lags”. This phrase goes back to Milton Friedman, who wrote in 1960: “There is much to suggest that monetary policy changes take a considerable lag and a long time to have their effect, and that the lag is quite variable.” Friedman found that the peak effect occurred after 12 to 16 months.

Much has been written since Friedman formulated his views in the early 1960s. So what do we conclude today? Roughly the same, i.e. that there are long and variable lags in monetary policy.

Valerie Ramey has this (link) great and comprehensive overview of the literature on the impact of monetary policy shocks. Table 1 of her paper summarises the findings of 12 important academic studies. The conclusion is that the peak effect on GDP (for a one percentage point increase in the monetary policy rate) occurs after 10-24 months. The peak effect is a decline in real GDP of between 0.5% and 2%, with an average of about 1.5%.

Current Fed policymakers agree that lags are long and variable. This paper (link) mentions that Atlanta Fed President Bostic said in November 2022 that monetary policy takes its greatest effect after “18 months to two years or more”, while Federal Reserve Governor Christopher Waller said in January this year that “lags are more like nine to 12 months”.

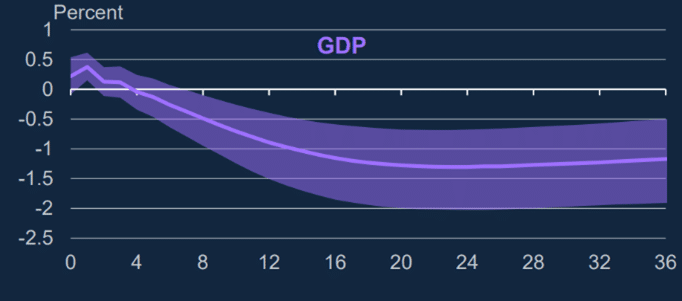

The international results are similar. Figure 3 contains a picture of a typical impulse-response function, this time from the UK.

Source: Bank of England (link).

Like results from the US, the BoE paper finds that “real GDP barely moves on impact and falls slowly, with a statistically significant peak response of -1.25% after about two years – consistent with the 18 to 24 months of long and variable lags.” Results from other countries are similar.

We conclude that academic research finds that GDP is usually adversely affected a few months after monetary policy is tightened. The peak of the impact is reached after 10-20 months.

Policy rates are raised gradually. The first hike in the US was in March 2022, the next in early May 2022, then again in June and so on. In October 2022, 12 months ago, the policy rate had been raised by 300 basis points. Let us pause.

Let us assume a peak effect of 1.5%, which is roughly the average of the studies examined by Ramey (see above), and let us assume that the peak effect should occur now, i.e. after 12 months. Then US GDP should now be 4.5% lower than it would have been without the interest rate hike. With a peak effect of 1%, GDP should be 3% lower. As the Fed has continued to raise interest rates during 2023, these estimates should be conservative. The expected effects might in fact be even larger.

An expected decline of US GDP of 3%, 4.5% or even more (compared to what GDP would have been without monetary tightening) means a recession. Arguments like these are why people have called this “the most expected recession” (link). However, the recession has not happened.

There is no recession

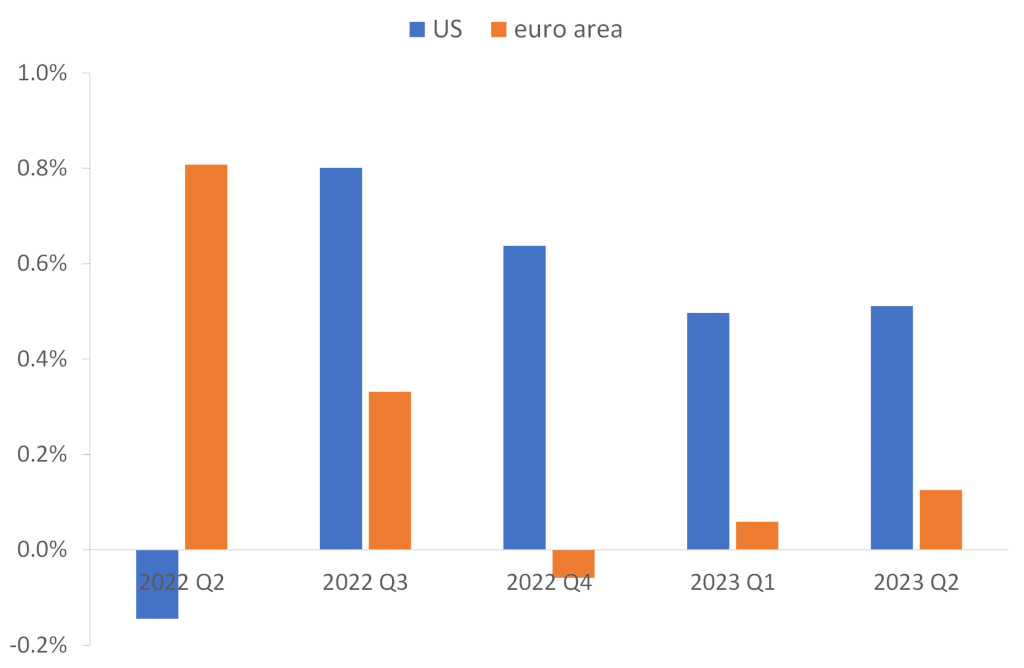

Although nominal interest rates have increased by more than five per cent in the US (see Figure 1), and almost as much in Europe, economic activity has not declined. Figure 4 shows quarterly growth rates of real GDP in the euro area and the US. Growth in the euro area declined temporarily at the end of last year, but quickly returned to positive territory. Growth in the US was consistently positive. The Atlanta Fed’s GDPNow estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 4.9% (link). This might seem implausibly high, but this is what it is. The economy has surprised on the upside.

Source: FRED of St. Louis Fed and J. Rangvid.

Labour markets are also very strong. Unemployment in the US has not changed in this tightening episode, as I showed in this post (link). Unemployment in the US was 3.6% in March 2022 when the Fed started raising interest rates and is virtually the same today. In Europe, unemployment has actually fallen. In the euro zone, unemployment was 6.7% when ECB started raising interest rates and it is 6.4% today. After more than a year of ever higher interest rates, unemployment is still very low.

We could go on. The important message is that the strong negative impact on economic activity that we expected based on the available evidence has not yet materialised.

And why?

Economic activity and inflation were strongly influenced by the pandemic and what followed from it, i.e. extremely expansionary fiscal and monetary policies combined with supply chain disruptions (link). This caused this flare-up in inflation and the subsequent rise in interest rates.

But the pandemic also had another effect: we could not spend as much as we usually do. We could not travel, go to restaurants, cinemas, etc. Spending fell. At the same time, governments distributed a lot of money to households in the form of various aid packages.

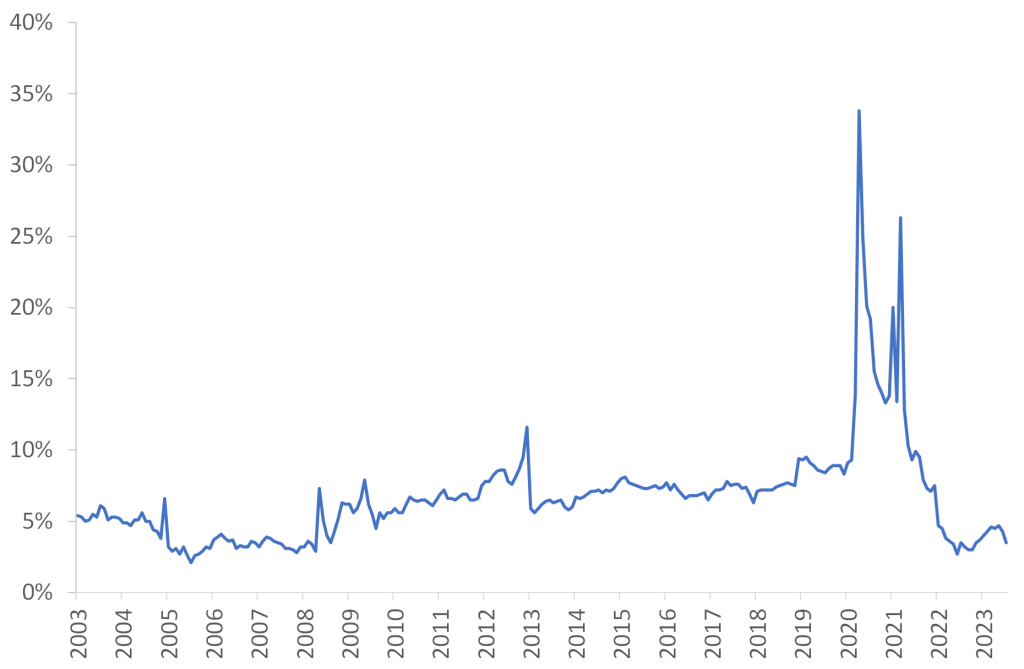

When we receive a lot of money but cannot use it, we save. Figure 5 shows the personal savings rate in the US. It exploded during the pandemic. Normally, American households save about 5% of their disposable income. In April 2020, Americans saved $34 out of every $100 of disposable income. In 2020-2021, the savings rate averaged 14%, double the average savings rate in the 2010-2020 decade.

Source: FRED of St. Louis Fed and J. Rangvid.

If you have a lot of savings, you can withstand the negative effects of high inflation and rising interest rates. Even if you must pay more for your car loan, you still have money left over to go out to eat. Despite higher interest rates, consumption remains high and supports economic activity. I think this is the main explanation why the economy has surprised so positively.

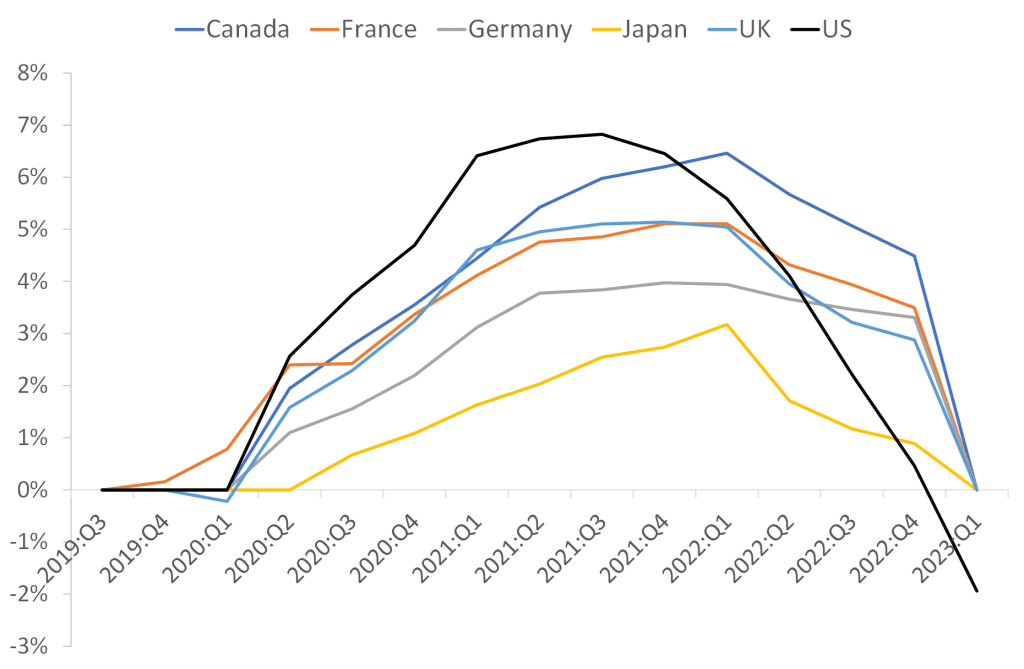

This is not just a US phenomenon. The pandemic was global. All over the world, people could not spend their money, so they saved it. Figure 6 uses data from a Fed study (link). The study calculates “excess savings” in different economies, defined as “the amount of savings arising from above-trend savings rates”. When central banks around the world started raising interest rates in 2022, people had excess savings of about 5-7% of GDP. People were able to afford the extra costs that came with high inflation and high interest rates. Therefore, there was not the negative impact on economic activity that would otherwise have occurred.

Source: FEDS notes and J. Rangvid

Another important insight from Figure 6 is that the stock of excess savings accumulated during the pandemic have now been used up. This means that higher interest costs will now start to eat into people’s consumption options.

Additional reasons

While the accumulation of savings is the main reason for the resilience of current economic activity, it is not the only one.

The share of adjustable-rate mortgages has declined in most OECD countries over the past decade (link). In the US, for example, the share of adjustable-rate mortgages fluctuated between 10% and 30% in the 1990s and 2000s, but has hovered around 5% since the financial crisis (link). When fewer households have an adjustable-rate mortgage, fewer households feel the pain of rising mortgage rates. Monetary policy becomes less effective.

Housing markets have also developed surprisingly well in many countries. This also has to do with the low proportion of adjustable-rate mortgages. If current homeowners have secured low interest rates through fixed-rate mortgages, they will not be affected by rising interest rates if they stay in their homes. So current homeowners do not want to move because they would then have to take out a new mortgage at a higher interest rate. This reduces the supply of houses for sale, which supports house prices. Conversely, in countries like Sweden and the UK, where mortgage rates are largely adjustable, house prices have fallen.

Finally, there are circular arguments. The labour market, as mentioned earlier, is strong, which means that people have an income. When people earn money, they can consume and support economic activity. I call this circular reasoning because saying that the labour market supports economic activity is true, but it does not explain why the labour market is strong. It is for the reasons mentioned above.

Not no effect

I am not saying that monetary policy has had no effect. Rather, I am saying that it has had less effect than expected.

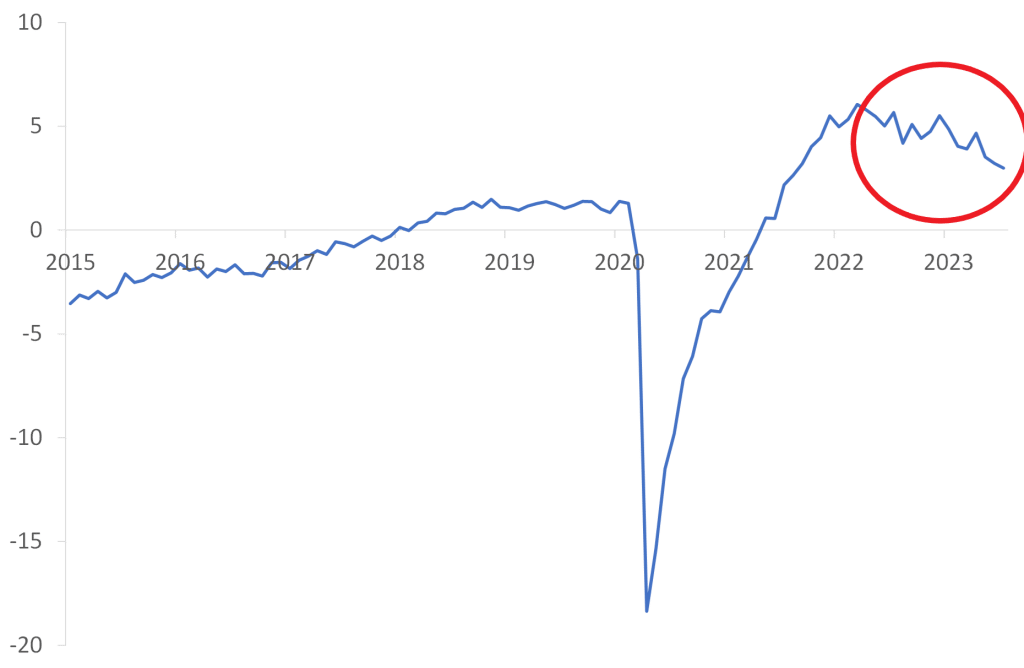

The US labour market has started to tighten. The number of new jobs created (job openings) has been declining since the Fed raised interest rates in 2022. In March 2022, 12 million new jobs were created. In August 2023 (the latest figure), this number had fallen to 9.6 million.

The excess supply of jobs in the US has diminished, as Figure 7 shows. I calculate the excess supply of jobs as the difference between the number of jobs available in the US (employment level plus job vacancies) and the civilian labour force, i.e. the number of people working or looking for a job. During the pandemic, there were 18 million people who were looking for a job but could not find one. The labour market recovered quickly. In March 2022, when the Fed started raising interest rates, the number of available jobs (employment + vacancies) exceeded the labour force by 6 million. Today, the excess supply is “only” 3 million. The labour market is still hot, as emphasized by the strong jobs report last Friday (link), but it is not as hot as a year or so ago, Figure 7 reveals.

Source: FRED of St. Louis Fed and J. Rangvid.

Something has happened. Just not as much as expected.

Conclusion

Economic activity has proved remarkably resilient during this period of monetary tightening. This is particularly true in the US, but also in many other countries.

The main reason that economic activity has held up so well is that households entered this tightening episode with large savings that they had accumulated during the pandemic. Therefore, the pandemic caused both inflation and the flare-up in interest rates and led to this amazingly resilient economy.

However, surplus savings will soon be used up, and at some point people will have to take out new mortgages at higher interest rates. Moreover, central banks have continued to raise interest rates in 2023 and will keep them high for longer. All this means that the full impact of this tightening episode has not yet been felt. So although economic activity has surprised on the upside, I do not rule out the possibility that this episode will end in recession.

This post has originally been published here.