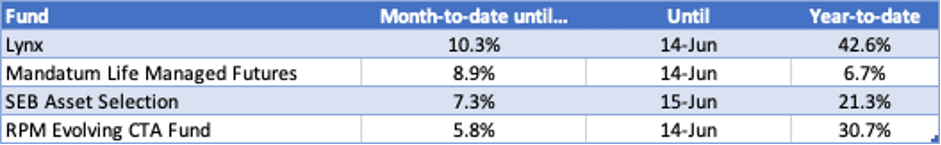

Stockholm (HedgeNordic) – After trends took a breather in May, Nordic trend-following CTAs are back at it again: back at successfully capturing trends. Four Nordic CTAs within the Nordic Hedge Index offering daily liquidity gained about eight percent on average in the first half of June, with Lynx Asset Management’s trend-following vehicle Lynx advancing 10.3 percent so far in June to take its year-to-date advance to over 42 percent.

The Lynx (Sweden) Fund launched in May 2000, one of the oldest members of the Nordic Hedge Index, gained 10.3 percent month-to-date through June 14 to bring the year-to-date advance to 42.6 percent. Lynx Asset Management’s systematic trend-following vehicle is on track to reach its sixth consecutive month of positive performance. The fund is powered by the Lynx Programme, which uses both trend-following models and diversifying models to catch trends across markets and reduce drawdowns in non-trending environments.

Mandatum Asset Management’s managed futures fund, meanwhile, gained 8.9 percent in the first half of June to bring its 2022 performance back into positive territory at 6.7 percent. Mandatum Managed Futures Fund, which was named the best performing fund over the previous two years in the category “Trend Follower (Flat Fee)” at the Hedge Fund Journal CTA and Discretionary Trader Awards 2022, uses machine learning algorithms that select the right combination of momentum-based models for a given environment.

SEB’s quant-driven trend-follower, SEB Asset Allocation, is up 7.3 percent month-to-date through June 15. The fund overseen by Otto Francke and Mikael Nilsson has gained 21.3 percent so far this year. RPM Evolving CTA Fund has gained 30.7 percent in 2022 through mid-June after advancing 5.8 percent in the first half of June. The fund managed by CTA specialist RPM Risk & Portfolio Management invests in a select group of young CTA managers in their “Evolving Phase.”

Photo by Ethan Robertson on Unsplash