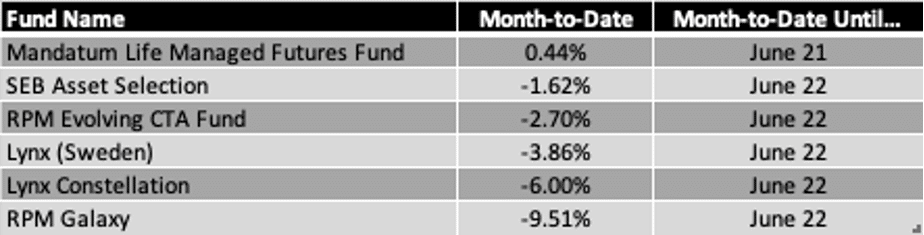

Stockholm (HedgeNordic) – After a solid May for a range of CTA strategies, from classic trend-followers to machine learning-driven programs, CTAs are not enjoying a great start to the summer. The SG CTA Index is down 2.8 percent month-to-date through June 22, while the SG CTA Trend Sub-Index following trend-followers is down 4.3 percent this month. Some Nordic CTAs are struggling too so far this month.

RPM Galaxy, the best performing member of the NHX CTA sub-index in the first five months of 2021 with a return of 17.2 percent, fell by 9.5 percent month-to-date through June 22. The fund is now up 5.8 percent for the year. The other fund under the umbrella of Stockholm-based CTA specialist RPM Risk & Portfolio Management, RPM Evolving CTA Fund, is down 2.7 percent month-to-date to trim the year-to-date advance to 5.2 percent.

Lynx Asset Management’s strategies are also struggling this month after a solid display in May. Machine learning-assisted Lynx Constellation, which advanced 3.2 percent last month, is down 6.0 percent this month through June 22 to extend year-to-date losses to 8.3 percent. Systematic trend-following fund Lynx (Sweden), meanwhile, fell by 3.9 percent month-to-date to trim its 2021 advance to 2.5 percent.

SEB Asset Selection, a purely quant-driven trend-follower that invests across four different asset classes, edged down 1.6 percent month-to-date through June 22 to cut its year-to-date advance to 4.7 percent. Artificial intelligence-assisted systematic Mandatum Managed Futures Fund, meanwhile, edged up 0.4 percent this month through June 21. Mandatum Life Managed Futures, which considers the changing nature of volatility and uses machine learning algorithms that select the right combination of trading models for a given environment, is now up 9.3 percent for the year.