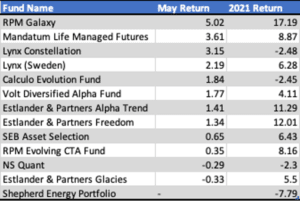

Stockholm (HedgeNordic) – With Nordic equity and fixed-income hedge funds down in May, it was the turn of CTAs to push the Nordic Hedge Index higher. Nordic CTAs advanced 1.7 percent on average last month (92 percent reported), bringing the group’s 2021 performance further into positive territory at 3.8 percent. Ten of the 12 members of NHX CTA with reported May figures posted gains last month.

According to a letter by Stockholm-based CTA specialist RPM Risk & Portfolio Management, the “trendiness” of markets was favorable at the beginning of May as US stocks “reached new record highs and commodities continued to boom.” Trends then reversed forcefully after a surprise jump in US inflation. “Global stocks and bond markets slumped intramonth and the VIX spiked after data showed the US inflation rate jumping to a 13-year high raising concerns that the Federal Reserve would be forced to tighten its monetary policy rate sooner than later,” writes RPM. “Whereas energies, industrial metals, and softs equally suffered from the abovementioned intramonth selloff, precious metals, in particular gold, soared uninterruptedly throughout the month as investors started to hedge against inflation.”

RPM Galaxy, one of the two vehicles under the umbrella of RPM, was the best performing member of the NHX CTA in May with an advance of 5.0 percent. “RPM Galaxy was up 5.0% despite difficult trading conditions, mainly due to profits in commodity and currency markets,” writes RPM. RPM Galaxy gained 17.2 percent in the first five months of 2021.

Artificial intelligence-assisted systematic Mandatum Managed Futures Fund followed suit with a monthly advance of 3.6 percent, which brought the fund’s 2021 performance to 8.9 percent. Mandatum Life Managed Futures, which considers the changing nature of volatility and uses machine learning algorithms that select the right combination of trading models for a given environment, has generated an annualized return of 9.8 percent since launching in December of 2019.

Lynx Asset Management’s strategies also turned in a solid performance last month. Machine learning-assisted Lynx Constellation advanced 3.2 percent last month to trim its losses for the first five months of 2021 to 2.5 percent. Systematic trend-following fund Lynx (Sweden), meanwhile, gained 2.2 percent in May to take its 2021 advance to 6.3 percent. Similar to RPM Galaxy, “Lynx was profitable in May as gains in foreign exchange and commodities outweighed losses in equities and fixed income,” Lynx Asset Management writes in an update to investors. Trend-following commodity fund Calculo Evolution Fund gained 1.84 percent in May, while diversified, fundamental macro manager Volt Diversified Alpha advanced 1.77 percent.

Photo by Chris Liverani on Unsplash