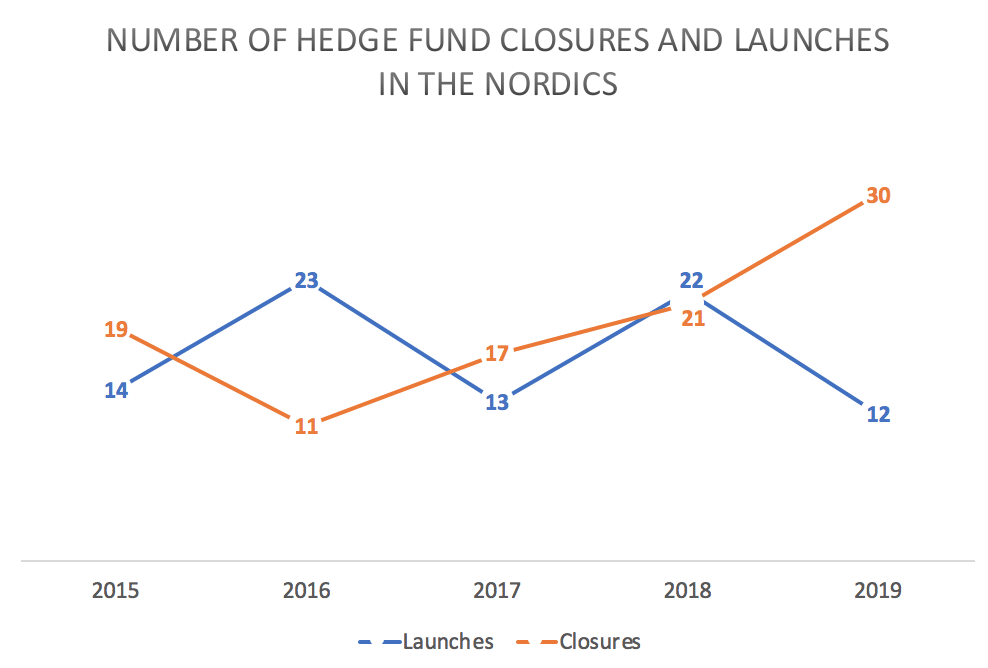

Stockholm (HedgeNordic) – A whopping total of 98 Nordic hedge funds tracked by HedgeNordic closed down or merged into other funds in the past five years between 2015 and 2019. The industry recorded more closures than launches in three of the past five years, with 2019 being one of the most painful years in terms of closures. No less than thirty funds were liquidated during 2019. In contrast, only 12 new funds were launched last year, the lowest annual number of launches in the past five years.

Orbituaries

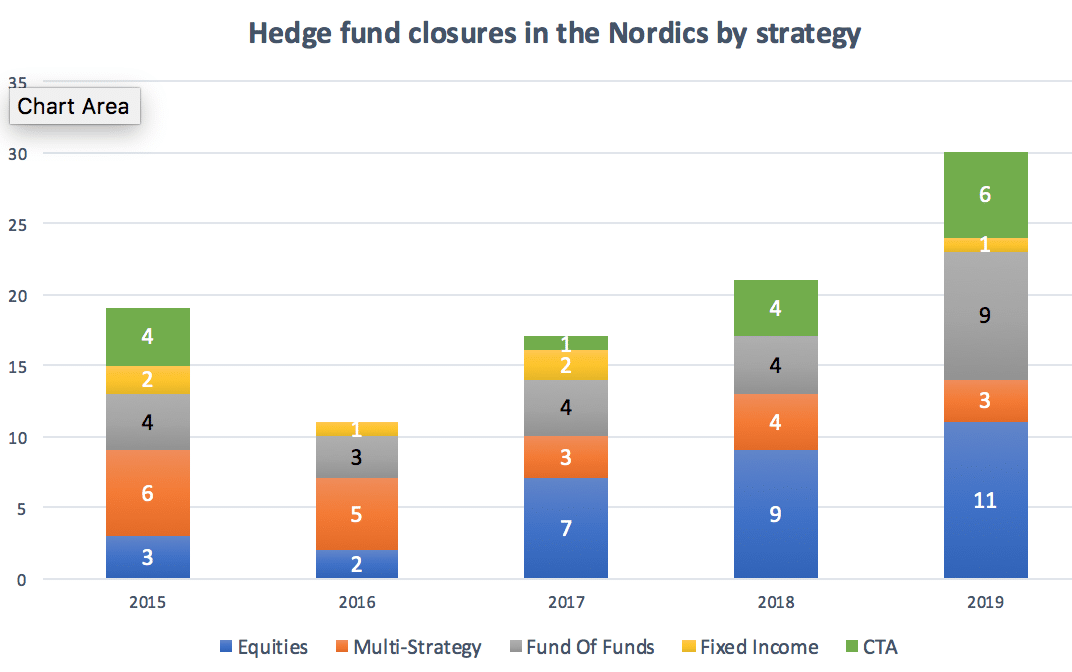

Of the 98 Nordic hedge funds that shut their doors during the past five years, 32 used equity strategies and 21 employed a multi-strategy approach to investing. On average, over the past five years, equity hedge funds accounted for about 37 percent of the Nordic hedge fund industry, whereas the fraction of closures in this strategy group out of the total number of closures over the past five years equals 33 percent. Multi-strategy funds, meanwhile, constituted about 22 percent of the industry on average, while the number of closures for this strategy group accounted for roughly 21 percent of all closures. Given the relatively high number of Nordic hedge funds categorized as pursuing equity and multi-strategy approaches to investing, the number of closures in these two strategy groups is not surprising.

The picture becomes grimmer for funds of hedge funds and CTAs. The number of active funds of hedge funds in the Nordic declined in each of the past five years, from 31 funds at the beginning of 2015 to only ten funds at the end of 2019. Over the past five years, a total of 24 Nordic funds of hedge funds closed down, with nine of those closures taking place in 2019 alone. The business model of funds of hedge funds has long been challenged because of high the double feelayer and underwhelming performance.

Based on the NHX Fund of Funds, which reflects the aggregate performance of both defunct and up-and-running funds of hedge funds in the Nordics, the group delivered an annualized return of about 0.1 percent in the past five years. On average, funds of hedge funds provided a negative cumulative return of 4.8 percent over the past three years. In contrast, the ten up-and-running members of the NHX Fund of Funds returned 4.4 percent on average during the past three years.

The Nordic hedge fund industry is housing some of the world’s largest, oldest and best established CTAs, including Lynx, SEB Asset Selection, Estlander & Partners and IPM (who´s systematic macro strategies are included in HedgeNordic´s CTA sub index). Following several years of poor performance for Nordic CTA, the number of funds using this approach declined from 22 at the beginning of 2015 to 16 at the end of last year. A total of 15 CTAs closed down during the past five years, with the industry recording four closures in 2018 and six closures last year.

The Danish dominated segment of the Nordic hedge fund industry focusing on fixed income instruments and strategies has been in a very healthy state for several years, as reflected by performance figures, the number of new launches and the number of closures (or the lack thereof). The fraction of fixed-income hedge funds out of the total number of active funds increased from about 14 percent at the beginning of 2015 to 20 percent at the end of last year. The total number of closures in this strategy category amounted to six in the past five years, with only one closure recorded in the past two years.

It´s a new Hedge Fund!

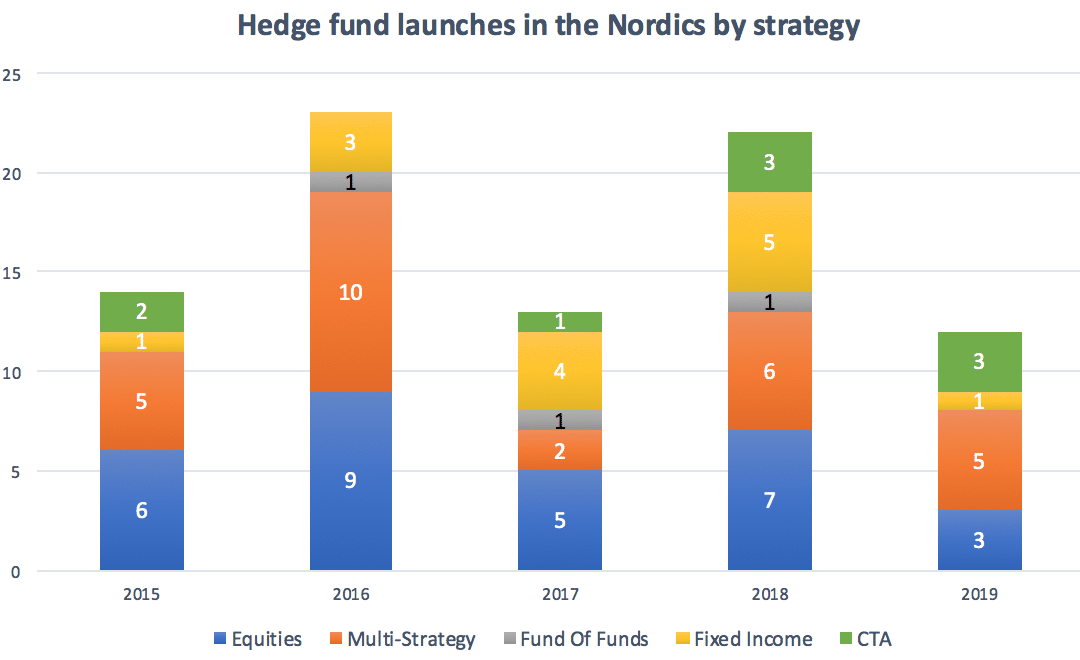

Hedge fund closures outpaced launches over the past five years, but there have been new launches in the Nordics too. While only 12 new hedge funds were launched in 2019, which is the lowest number of launches in the past five years, a total of 84 funds kicked off operations during that timeframe.

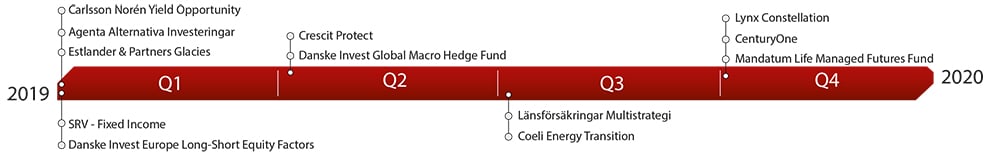

Five of the 12 funds launched last year set sail in the first quarter of last year, the busiest in terms of new launches. The second and third quarters saw two new launches each, while the final quarter of the year registered three new launches. Danske Bank Asset Management launched one multi-strategy and one equity hedge fund to complement its strong range of fixed income vehicles. Stockholm-based systematic manager Lynx Asset Management launched its third investment product since its inception in 1999. Lynx Constellation, powered by a pure machine learning strategy, was the biggest vehicle in terms of assets under management among last year’s new launches.

Origin and Strategy of New Launches

Swedish hedge funds account for the largest portion of the Nordic Hedge Index, with more than half of existing constituents being based in Sweden or having Swedish origins. Seven new Swedish hedge funds joined the Nordic hedge fund arena last year, making this the largest group among the Nordic countries. Three Danish and two Finnish hedge funds picked up operations last year. No Norwegian fund was launched in 2019.

Of last year’s 12 new launches, five vehicles employ a multi-strategy approach to investing. Three of the new launches invest mainly in equity markets, and one new vehicle invests in fixed-income markets. Three new trend-following CTAs were launched last year, while no new funds of funds joined the Nordic hedge fund universe.

Performance, Fees and Size

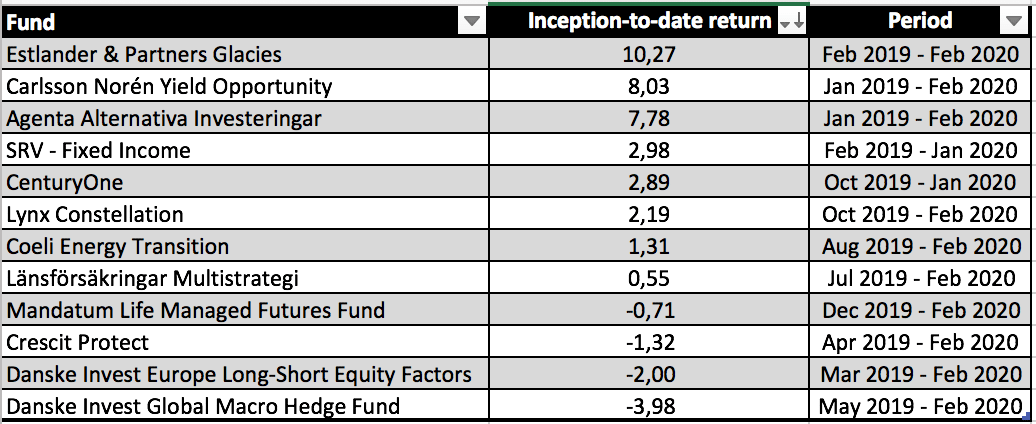

Estlander & Partners Glacies, a futures-based cross-asset multi-factor vehicle, returned 10.3 percent since launching in February 2019. Carlsson Norén Yield Opportunity, an alternative fixed-income fund focusing on hybrid securities, is up 8 percent since the fund launched in January of last year. Multi-strategy fund Agenta Alternativa Investeringar, meanwhile, gained 7.8 percent inception-to-date since its January launch.

Most of the hedge funds launched in the Nordics during 2019 use a “one and 20” fee structure. The average management fee charged by the 12 funds launched in 2019 equals 0.87 percent. This group also charges investors an average performance fee of 12.9 percent. It is important to note, however, that these quoted fees are associated with the main share class of each fund, which can include institutional or seed-investor share classes that may exhibit lower fees.

Several of last year’s rookie hedge funds currently oversee more than €50 million in assets under management. Lynx Constellation has €160 million in assets as of the end of January, while Copenhagen-based SRV – Fixed Income oversees €98 million as of the end of last year. Danske Invest Europe Long-Short Equity Factors managed about €54 million at the end of February, and Coeli Energy Transition had €46.3 million in assets under management at the end of January. The nine funds of the 12 rookies with reported AUM data in the HedgeNordic database collectively manage close to half a billion euro in assets.

Source for all numbers, stats and graphs is HedgeNordic´s Nordic Hedge Index Database.

Picture: (c) shutterstock.com—koya979