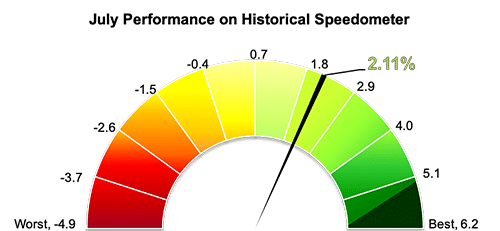

Stockholm (HedgeNordic) – Following a fruitful June, Nordic CTAs continued their positive performance in July. Nordic CTAs posted an average return of 2.1 percent for July (88 percent reported), extending the group’s year-to-date performance to 4.6 percent.

Nordic CTAs, as measured by the NHX CTA, outperformed the broader managed futures industry but trailed the world’s largest CTAs last month. The SG CTA Index, which reflects the performance of a pool of CTAs selected from the larger managers open to new investment, gained 3.5 percent in July. The 20-member SG CTA Index, which includes three members of the Nordic Hedge Index, was up 8.5 percent in the first seven months of 2019.

The Barclay BTOP50 Index, which tracks a similar group of large investable CTAs, booked a gain of 3.0 percent last month, which brought its year-to-date performance to 8.4 percent. The Broader CTA Index, which includes over 500 CTAs, gained 1.0 percent in July and was up 5.3 percent year-to-date through the end of July.

Ten of the 16 constituents in the NHX CTA posted positive returns for July. RPM Galaxy, a diversified multi-CTA that allocates to large and established managers with a solid track record, was last month’s best-performing member of the Nordic Hedge Index with a gain of 13.1 percent. This marked the fund’s second-best monthly performance since launching in April 2008. RPM Galaxy is up 10.2 percent in the first seven months of 2019.

SEB Asset Selection Opportunistic, a more aggressive version of trend-following vehicle SEB Asset Selection, followed suit with a monthly gain of 5.3 percent, which brought the fund’s year-to-date performance to 10.2 percent. In July, the Lynx Fund (Sweden) gained more than five percent for a second consecutive month, extending its year-to-date return to 19.3 percent. The Lynx Fund (Sweden) currently ranks as the best-performing member of the NHX CTA. Estlander & Partners Freedom and Estlander & Partners Alpha Trend II were up 4.4 percent and 3.5 percent last month, respectively.

Photo By Liv Oeian—shutterstock.com