Stockholm (HedgeNordic) – An increasing number of institutional investors believe equity markets have peaked and a market correction is imminent, according to a survey by Preqin, which has prompted investors to position their hedge fund portfolios more defensively. In a survey of 177 institutional investors, 64 percent of respondents are placing their hedge fund holdings for portfolio protection, almost double the percentage recorded a year ago in a similar survey.

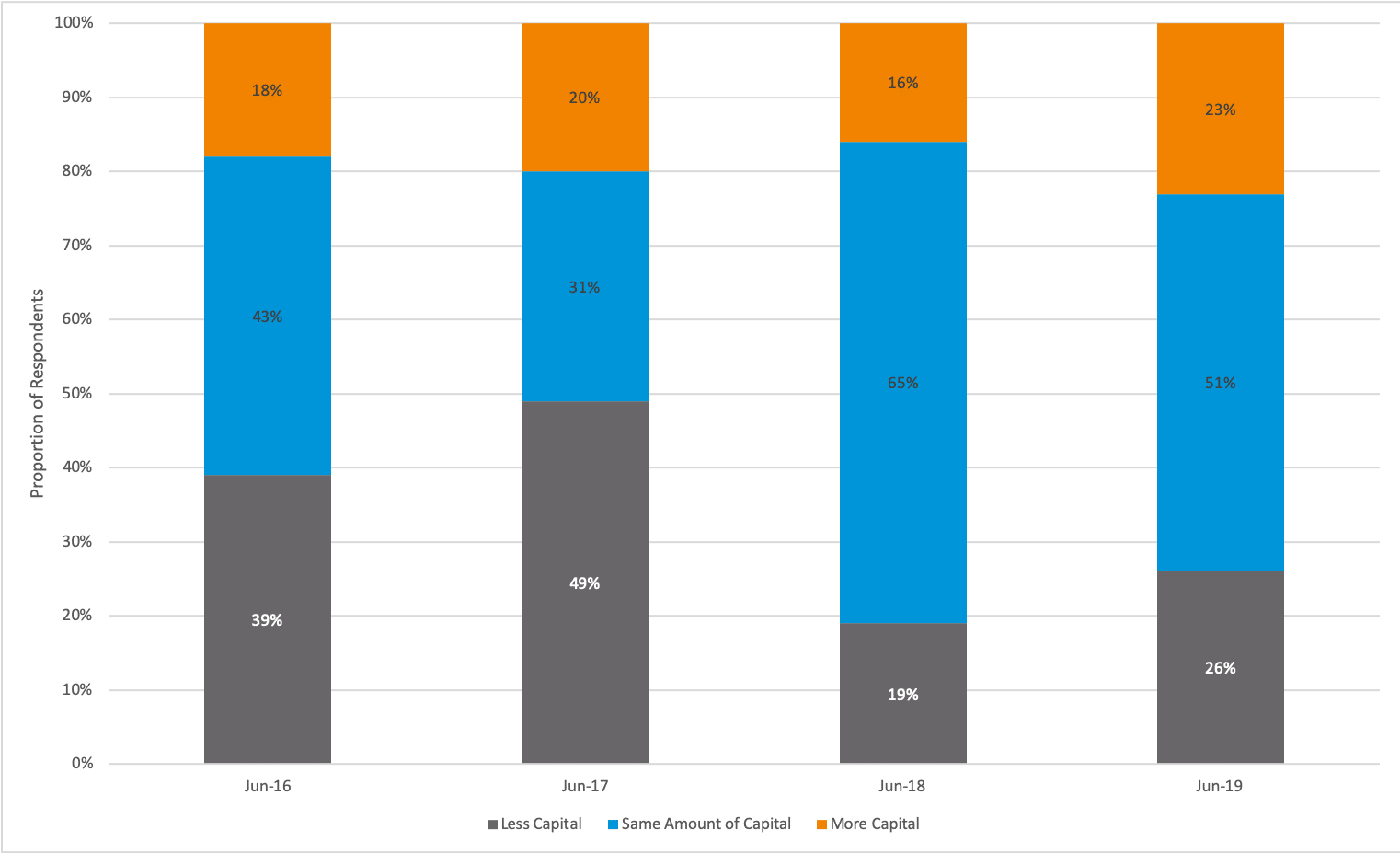

According to the Preqin Investor Update: Alternative Assets H2 2019 report, based on the results of a survey of 177 institutional investors, 23 percent of investors plan to increase their capital commitments to hedge funds in the next 12 months compared to the prior year. This compares with 16 percent recorded in June of last year. However, 26 percent of investors now plan to decrease their exposure to hedge funds over the next year, up from 19 percent registered in the previous year. About half of investors plan to keep their exposure to the industry unchanged.

With the S&P 500 up 17.4 percent year-to-date through the end of June, 64 percent of the investors surveyed in July indicated that their hedge fund holdings are being positioned for portfolio protection. This compares with only 33 percent a year ago. Only 5 percent of investors are looking for more aggressive strategies designed to boost asset growth.

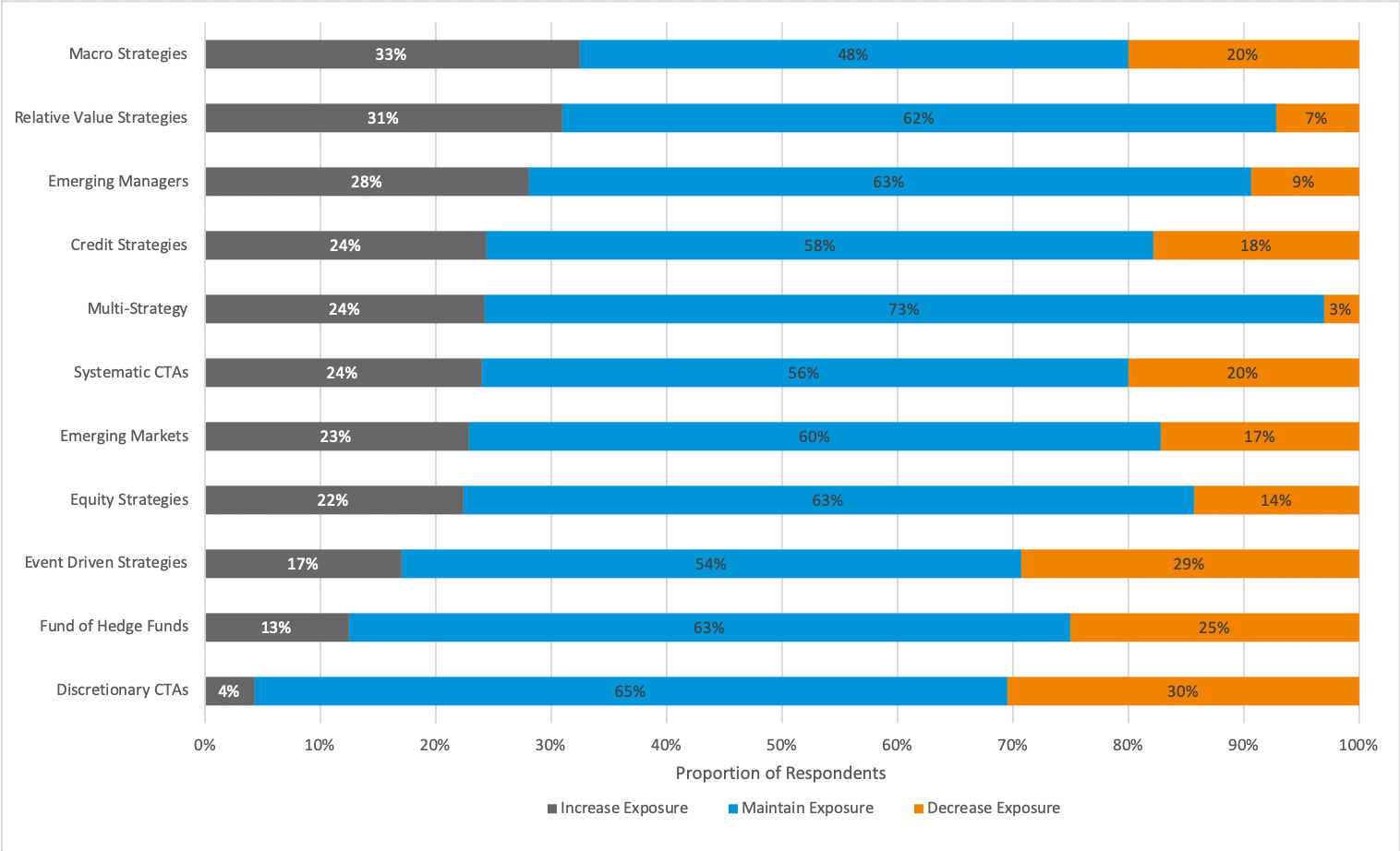

Although the Preqin team does not expect vast amounts of fresh capital to flow into the hedge fund industry, Preqin “are expecting plenty of activity as investors tactically rebalance.” Specifically, non-correlated strategies such as relative value and macro are sought by the highest proportion of investors, with 33 percent and 31 percent of respondents planning to increase their allocations to macro strategies and relative value strategies in the next 12 months, respectively.

At the same time, investors plan to decrease exposure to discretionary CTAs, funds of hedge funds, and event-driven strategies. Only 4 percent of respondents plan to increase exposure to discretionary CTAs, whereas 30 percent of them intend to decrease exposure to this strategy. Around 29 percent of respondents plan to weight off event-driven strategies, which may be negatively impacted by a correction in equity markets.

The Preqin Investor Update: Alternative Assets H2 2019 report can be downloaded below:

Photo by Markus Spiske on Unsplash