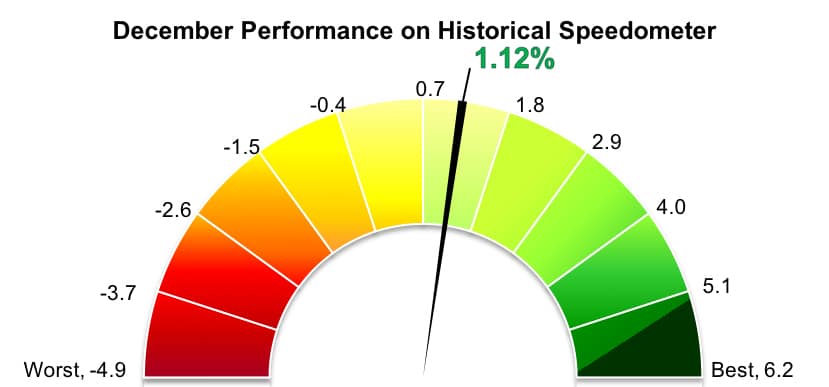

Stockholm (HedgeNordic) – Nordic trend-following hedge funds recouped some of their earlier losses after gaining 1.1 percent on average in December (90 percent reported). Out of the five Nordic Hedge Index (NHX) sub-categories, only the NHX CTA ended December in the green. The December gain did not help the NHX CTA avoid incurring its largest annual decline on record. The index was down 5.5 percent in 2018.

Nordic CTA vehicles performed broadly in line with their international counterparts last month. The Société Générale CTA Index, designed to track the performance of the world’s largest CTAs, gained 1.4 percent in December, cutting last year’s losses to 5.8 percent. The Barclay BTOP50 Index, which also seeks to reflect the performance of the 20 largest CTAs but has slightly different index components, was up 0.8 percent in December, ending 2018 at down 4.5 percent. The Barclay index includes two members of the NHX, while the SG index has three members of our index as components. The broader Barclay CTA Index was up 0.4 percent last month, which brought the performance for 2018 to down 2.7 percent.

Two in every three members of the NHX CTA posted gains in December, with Estlander & Partners’ most diversified program, Estlander & Partners Freedom, enjoying the highest return. Freedom, which combines two independently developed Estlander & Partners programs, was up 6.7 percent in December, cutting the loss for 2018 to down 9.2 percent.

Trend-followers SEB Asset Selection Opportunistic and Nordea 1 – Heracles Long/Short MI Fund gained 4.8 percent and 4.2 percent last month, respectively. Aktie-Ansvar Trendhedge, which was closed down before Christmas as a result of weak investor demand and performance, gained 4.2 percent from the beginning of December through December 20. Multi-CTA fund RPM Evolving CTA Fund advanced 3.8 percent last month, bringing the fund’s performance into positive territory for the year at 1.6 percent.

Picture © Jirsak—shutterstock