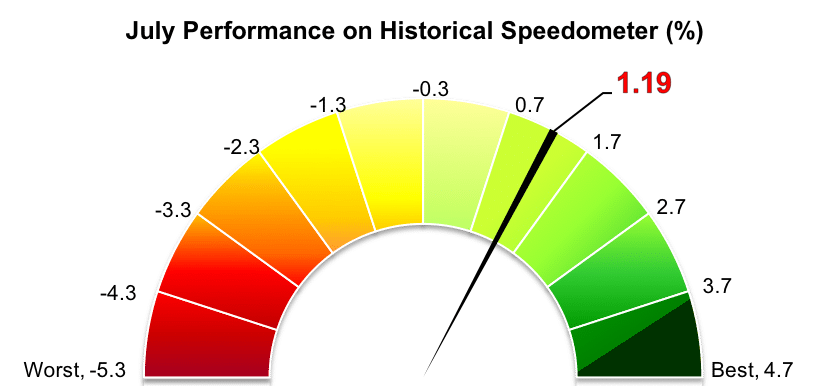

Stockholm (HedgeNordic) – On the back of strong second-quarter company earnings in both Europe and the United States, Nordic equity hedge funds gained 1.2 percent in July (93 percent reported). After topping the list as last month’s best-performing category in the Nordic Hedge Index (NHX), the NHX Equities Index ended the first seven months of the year in the green by 1.8 percent.

Despite their strong performance, Nordic equity-oriented hedge funds underperformed both local and global equity markets in July. The VINX All-share index, which includes all the shares listed on NASDAQ OMX Nordic Exchanges and Oslo Börs, posted a net return of 4.0 percent last month. Global equity markets, as expressed by the FTSE World Index, rose 3.0 percent in Euro terms as second-quarter earnings largely topped already elevated expectations. Eurozone equity markets, as measured by the FTSE Eurozone Index, rose 3.6 percent in July, while North American equities were up 3.5 percent in Euro terms. However, concerns on the evolving global trade war will likely remain top of mind despite enjoying a strong earnings season.

Nordic equity hedge funds bested the performance delivered by their international peers. For example, the Eurekahedge Long Short Equities Hedge Fund Index, comprised of 1016 international equity hedge funds, gained 0.9 percent in July, bringing the performance for the first seven months of 2018 up to 1.5 percent. The Barclay Equity Long/Short Index, meanwhile, gained an estimated 0.4 percent, with the preliminary figure calculated with reported data from 197 funds. The Barclay index was up 2.0 percent year-to-date through the end of July. The HFN Long/Short Equity Index, comprised of equity hedge funds from eVestment’s database, was up 1.0 percent last month, bringing its 2018 performance through July to a gain of 2.5 percent.

Around three-fourths of the 59 equity-focused members of the NHX delivered positive performance for July, with Inside Hedge topping the list as July’s best-performing member of the group with a gain of 5.6 percent. Inside Hedge, which invests in medium- and large-sized Swedish companies based on insider trading sentiment, performed strongly despite its oil and gold investments plunging by more than 13 percent. The fund’s largest contributors to performance were companies operating in the consumer goods sector. The fund managed by Gothenburg-based Erik Lidén (pictured) is up 9.8 percent in the first seven months of the year.

Nordics-focused long/short equity fund Norron Select closely followed suit with a gain of 5.4 percent, which brought the 2018 performance through July to 8.0 percent. The long/short equity hedge fund managed by Max Mitteregger Kapitalförvaltning AB, Gladiator Fond, is producing strong gains in 2018 after having gained 4.5 percent in July. The fund is up 18.0 percent year-to-date through the end of July, ranking as the best-performing member of the NHX thus far in 2018. Healthcare-focused Rhenman Healthcare Equity L/S was up 4.3 percent last month, bringing the 2018 performance to 15.5 percent.

*July figures not reported.

AAM Absolute Return, which had been this year’s best NHX performer prior to July, fell 5.4 percent last month, cutting year-to-date gains to 16.1 percent. Event-driven market-neutral fund Coeli Norrsken, now a Luxembourg-domiciled fund since the beginning of April of this year, was down 1.6 percent last month, extending 2018 losses to 7.1 percent. Catella Nordic Long Short Equity was also down 1.6 percent in July, reducing year-to-date gains through July to 3.1 percent.