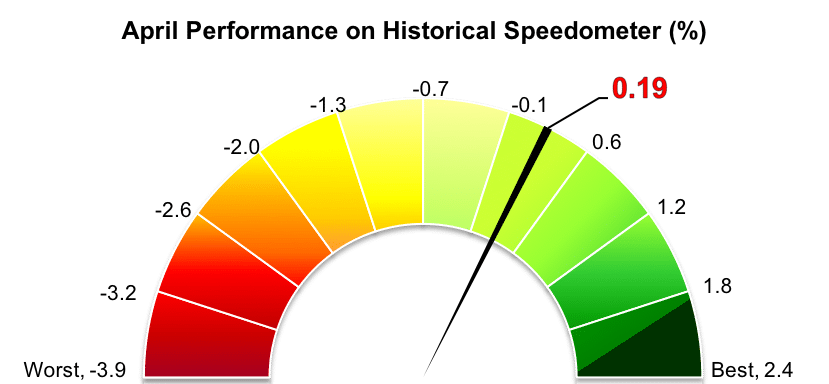

Stockholm (HedgeNordic) – Nordic funds of hedge funds, as expressed by the NHX Fund of Funds Index, gained 0.2 percent in April (87 percent reported), as Nordic hedge funds enjoyed one of their best months since early 2017. The NHX Fund of Funds is down 0.9 percent in the first four months of 2018.

Nordic FoHFs marginally underperformed their international counterparts, with the Eurekahedge Fund of Funds Index advancing a slightly higher 0.4 percent in April. The Eurekahedge index, which reflects the equally-weighted performance of 446 funds that exclusively invest in single-manager hedge funds, was up 0.5 percent in the first four months of the year. Meanwhile, the HFRI Fund of Funds Composite Index was up a similar 0.2 percent in April, taking its 2018 performance to 0.5 percent.

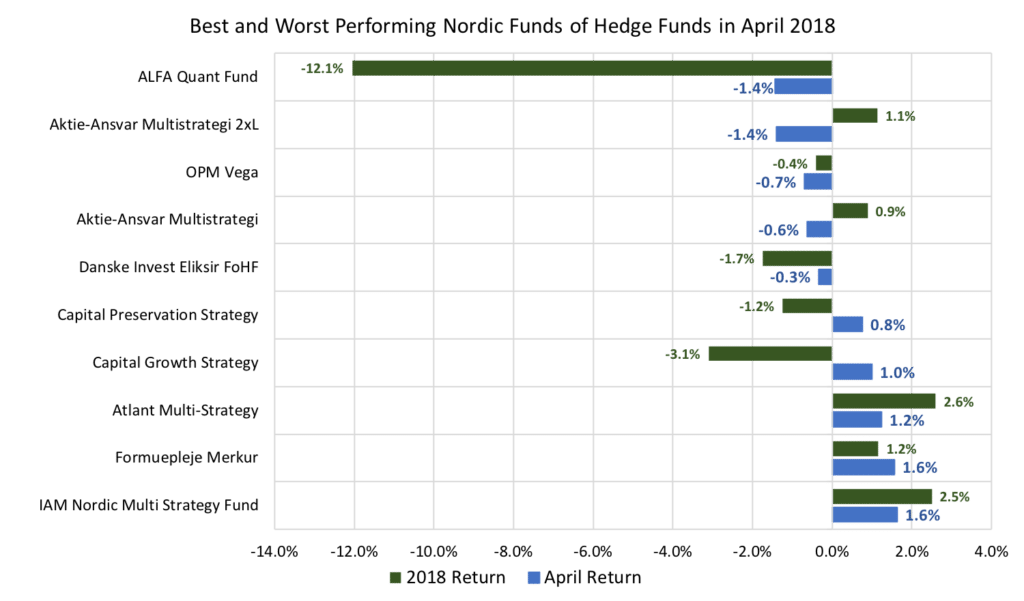

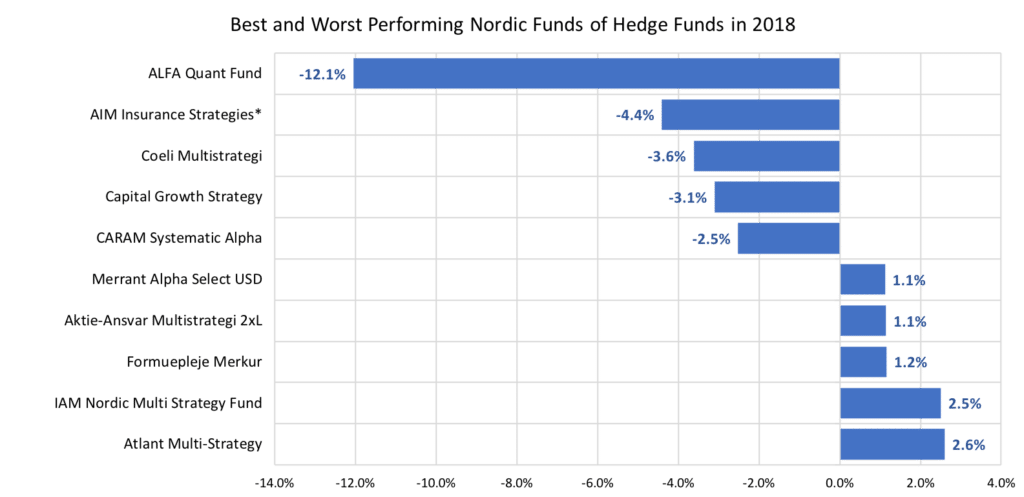

14 of the 20 funds of hedge funds which reported April performance figures posted gains in April. IAM Nordic Multi Strategy Fund, which invests in hedge funds tied to the Nordic countries, was the strongest performer among FoHFs in April with a gain of 1.6 percent. The fund is invested in four long/short equity funds, three global macro funds, and two equity market-neutral funds. Five out of its nine underlying hedge funds delivered positive returns for the month, with all four long/short equity funds contributing positively to performance. IAM Nordic Multi Strategy Fund allocated 36.4 percent of its capital to long/short equity funds at the end of April, with this strategy group returning 1.7 percent in April alone and 2.4 percent in the first four months of 2018. An additional 41.2 percent of assets was allocated to global macro funds, and the remaining 22.1 percent was invested in equity-market neutral funds. The fund is up 2.5 percent in 2018.

Formuepleje Merkur, a fund of funds that invests in hedge funds, alternative investment funds, and other similar vehicles, closely followed suit with a similar gain of 1.6 percent (up 1.2 percent YTD). Atlant Multi-Strategy, which predominantly invests in Atlant Fonder’s own hedge funds, gained 1.2 percent in April and is up 2.6 percent in the first four months of the year.

Alfa Quant Fund, the multi-strategy fund that invests in Alfakraft Fonder’s single-strategy funds, suffered yet another difficult month in April with a monthly loss of 1.4 percent. The fund is down 12.1 percent in the first four months of the year. Aktie-Ansvar Multistrategi 2xL, the double-leverage version of Aktie-Ansvar Multistrategi, was also down 1.4 percent in April (up 1.1 percent YTD).

Picture © Carlos-Caetano—shutterstock.com