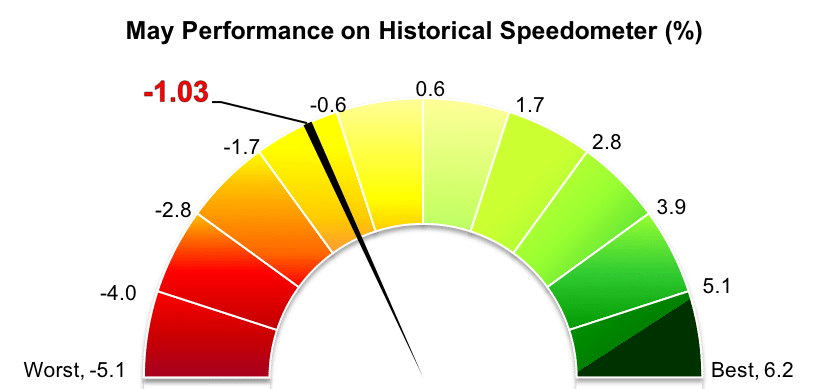

Stockholm (HedgeNordic) – Nordic CTAs, as measured by the NHX CTA Index, were down 1.0 percent in May (100 percent reported) as investor bullishness reversed sharply in the fourth week of the month after witnessing more of Donald Trump’s impulsiveness. This is the third monthly loss for the NHX CTA Index in the first five months of 2018, with the index down 3.2 percent year-to-date.

The largest global CTA programs underperformed their Nordic peers last month, with the Société Générale CTA Index falling 2.5 percent in May. The SG CTA Index, which tracks the performance of the largest 20 CTAs by assets under management, is down 5.2 percent in the first five months of the year. The Barclay BTOP50 Index, which reflects the performance of the 20 largest investable trading advisor programs, was down 2.0 percent last month. Meanwhile, the broader Barclay CTA Index, designed to broadly represent the performance of all CTA programs in the BarclayHedge database, declined an estimated 0.2 percent in May. The index is down 1.8 percent year-to-date.

Although the month of May started off with renewed bullishness, Donald Trump’s decision to call off the summit with North Korea and his threats of additional import tariffs that could hit the automotive industry triggered sharp reversals in the fourth week of the month. As a result, the fear gauge – the CBOE Volatility Index – rose sharply and equity markets tanked, while the increased demand for “haven” assets sent bond yields significantly lower. Going back to the trend-following industry, most short-term managers ended the month in the green, whereas trend-followers, systematic macro, and VIX managers recorded mixed performance.

Only six of the 20 members of the NHX CTA Index posted positive performance in May. Shepherd Energy Portfolio, a managed futures portfolio focusing on the Nordic power market, gained 3.5 percent in May, extending the gains for the first five months of the year to 9.2 percent. According to the fund’s latest monthly letter to investors, the Nordic power futures traded on Nasdaq OMX rose sharply due to seasonally very high temperatures (worsening the situation for hydro-power plants), as well as rising gas and coal prices (leading to increased input costs for fossil-fuel generators).

Volt Diversified Alpha Fund, a diversified trading program trading on more than 80 global futures markets across four major asset classes (commodities, currencies, fixed income and equities), was up 1.9 percent last month. Short and long positions in fixed income served as the largest contributors to performance, with the fund’s credit-oriented models capturing the sell-off in Italian bonds. The fund is down 3.6 percent year-to-date. MG Commodity advanced 1.4 percent, bringing the year-to-date performance back into positive territory at 0.9 percent.

Shifting focus to May’s list of laggards in the NHX CTA Index, Estlander & Partners Freedom and SEB Asset Selection Opportunistic both lost 5.1 percent last month (down 1.7 percent and down 14.8 percent YTD). Aktie-Ansvar Trendhedge was down 5.0 percent in May, bringing the year-to-date performance down to a negative 3.2 percent.

Picture: (c) suphakit73—shutterstock.com