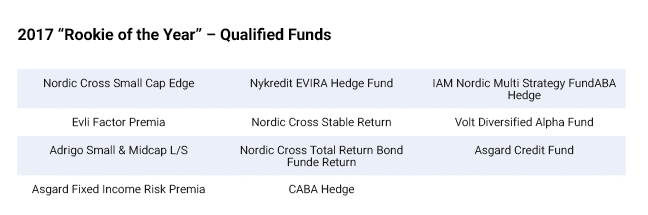

Stockholm (HedgeNordic) – The Rookie of the Year award was presented at the 2017 Nordic Hedge Award for the third time only. It is the youngest of the awards´ lineup and is supported by HedgeNordic. This prize rewards the most promising hedge fund launch of the year. In this year’s edition, any fund domiciled in one of the Nordic countries or with strong ties to the Nordics launch between 1 October 2016 and 30 September 2017 automatically qualified as a potential candidate for the award, provided the information on the fund was made available to Hedge Nordic.

For this special award, the usual selection process is not applicable as the methodology used in the other categories would not lead to meaningful results. First, the quantitative screening performed to nominate the funds in each category cannot be performed, as the rookies have, by definition, only a limited track record. Second, even if a quantitative screen were to be applied, the funds would not be comparable, as the length of their track-record, as well as the trading strategy, would likely, at least potentially, differ considerably. Therefore, the result relies solely on the expertise of a peer group jury composed of other Nordic hedge fund managers.

The members of the jury had the difficult task to assess which funds they would be most comfortable investing in, which ones would be most likely to reach their target performance and overall which ones were positioned to become billion Dollar funds or star managers. They were given full discretion in choosing which criteria they felt most comfortable with.

A few guiding questions were suggested such as: “How unique or original is the strategy?” or “How well does the past track record of the managers predispose them to be successful managing such a strategy?” or also “What is the quality of the supporting structure: number of people in the organization, proven track record or past experience of the back office and other key functions including risk management?”

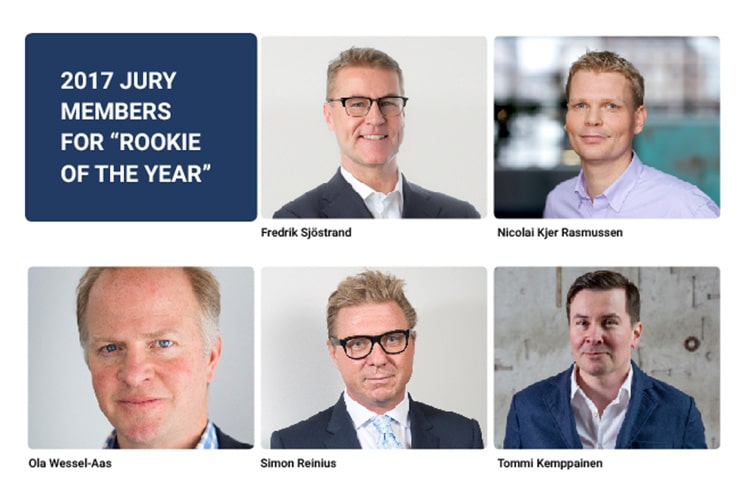

This year, the jury was composed of Nicolai Kjer Rasmussen, Chief Portfolio Manager at Danish Nykredit Asset Management (runner up as “Best Nordic Fixed Income Hedge Fund 2016”), Ola Wessel-Aas, Portfolio Manager at Norwegian Taiga Fund (last years´ “Best Nordic Equity Hedge Fund”); Simon reinius, CEO and Portfolio manager at Fund of Hedge Fund manager Optimized Portfolio Management, Tommi Kemppainen, CEO at Helsinki Capital Partners, and last but not least, Fredrik Sjöstrand, CIO and Founding Partner at Swedish Skandinaviska Kreditfonden, last year’s Rookie of the Year.

The Rookie of the year in 2017, are infact well known at the Nordic Hedge Award. The winners´ sister fund, winning four of the last five top spots as “Best Nordic Fixed Income Hedge Fund”, and twice took the trophy as “Best Nordic Hedge Fund Overall” back to Copenhagen.

AIFM, Moma Advisers, are entrepreneurs who set up their own company in Copenhagen, exclusively focused on hedge fund strategies, with no long only mandates. And they are doing something different in the fixed income space. Danish fixed income managers are most famous for fixed income arbitrage strategies that often focus on Nordic mortgage markets, and Asgard has an award-winning strategy in that area.

Asgard’s newest fund – Asgard Credit Fund – invests in corporate credits worldwide, and currently has most of its exposure in US corporate credit, which offers higher yields than European or Nordic names. “Moma has also turned cautious on European credit because the European Central Bank will at some stage stop buying credit” says CEO, Birger Dirhuus. Exposure to European investment grade credit was down to 14% as of March 2018. Cash bonds can be bought where they are more attractive than CDS, but no ABS, financials or CoCos or hybrids are in the book. “We offer clean credit exposure with minimal interest rate and currency risk,” says Durhuus. Interest rate duration is near zero.

Asgard Credit fund – an Irish ICAV with assets of EUR 130 million and capacity of EUR 750 million – made 7.29% in 2017, mainly from credit spreads on CDS positions, which have averaged net exposure of 370% since the fund started (somewhat below the 600% ceiling). Shorts unsurprisingly did not work well in 2017, and nor did a spread trade going short of European credit versus long of US credit. The strategy has seen some volatility in 2018, with a drawdown of 4%, which was largely recovered by April. Manager, Daniel Vesterbaek Pedersen, had a long, strong track record from PFA Pension, including the 2008 crisis, before being hired by Moma.

He is not afraid to express non-consensus views and argues that many large-cap US technology companies could be vulnerable to customers asserting control over data. The March newsletter says “Google, Facebook, Twitter, etc. are basically all companies that use private data and the selling of ads as a primary driver of income” and argues that their valuations are too high.

Reflecting its global investment mandate, the credit strategy is trading with 6-7 counterparties, most of which are global investment banks, but also including two Scandinavian banks.

“When Pedersen came here, he was very well respected and had strong relationships with good counterparties,” says Durhuus.

Moma is also distinguished by the diversity of its investment team. Given the long history of welfare, social, childcare and equal opportunities policies in Scandinavia, it is perhaps surprising that so few women are managing hedge funds in the region (though they are more active in allocation and non-investment roles). Asgard Credit may now have the youngest female portfolio manager in the Nordics, having just hired Christina Christensen, straight from a Maths degree at Aarhus University, to work under Pedersen.