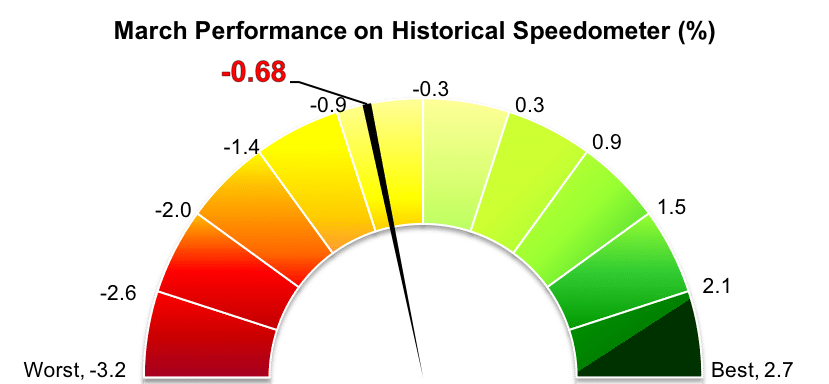

Stockholm (HedgeNordic) – Nordic multi-strategy hedge funds, the most diverse and inclusive NHX sub-category, experienced losses for a second consecutive month in March. The NHX Multi-Strategy Index was down 0.7 percent in March (97 percent reported), bringing the 2018 performance further into negative territory at 1.0 percent.

Despite the underwhelming performance, Nordic multi-strategy hedge funds performed very closely with peer funds in the global universe. To illustrate, the Eurekahedge Multi-Strategy Hedge Fund Index, an index tracking the performance of 262 global multi-strategy hedge funds, went down by an equal 0.7 percent in March (56% reported as of April 17). The Eurekahedge index is down 0.1 percent in the first quarter of 2018. Similarly, the Barclay Multi Strategy Index retreated 0.5 percent last month (based on reported data from 82 funds), taking the losses for the first quarter to 0.4 percent.

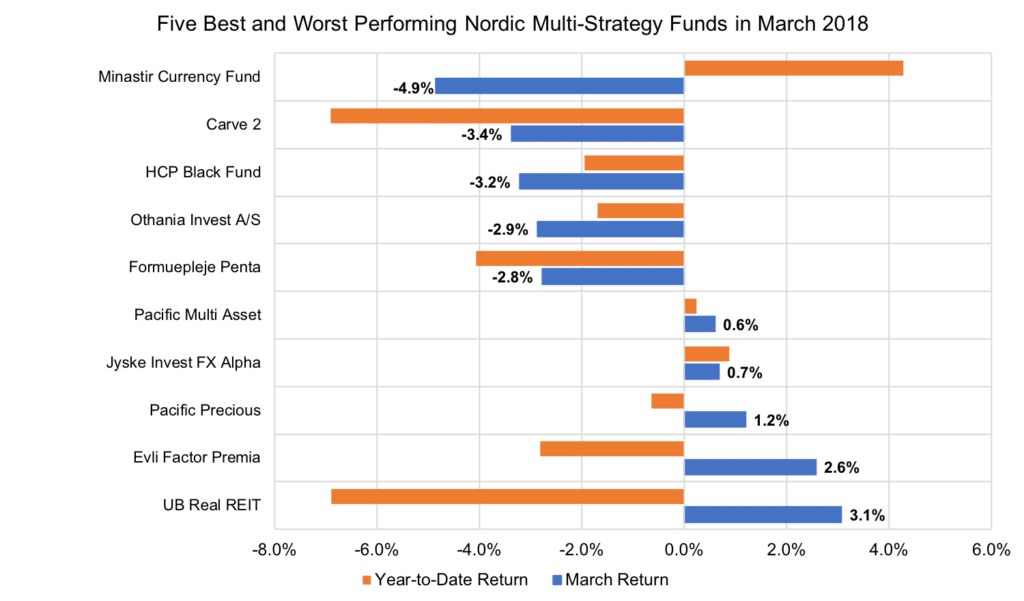

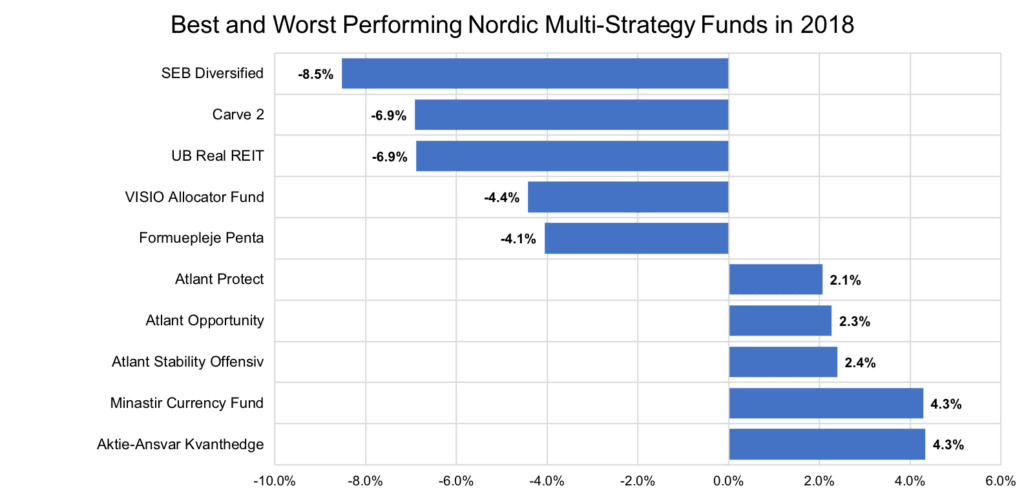

UB Real REIT, an alternative investment fund investing in REITs and property development companies, was the biggest gainer among Nordic multi-strategy funds in March, recouping some of the heavy losses incurred in the first two months of the year. The fund is down 6.9 percent year-to-date after gaining 3.1 percent in March.

Evli Factor Premia, an alternative investment fund that uses systematic market-neutral factor strategies within various asset classes, and Pacific Precious, a multi-strategy fund seeking long and short exposure to precious metals and companies within the previous metals sector, gained 2.6 percent and 1.2 percent, respectively (down 2.8 percent and 0.6 percent year-to-date).

Three multi-strategy hedge funds suffered losses of more than 3 percent last month. Currency hedge fund Minastir Currency Fund tumbled 4.9 percent in March, cutting the gains earned in the first two months of 2018 to 4.3 percent. Carve 2, a multi-strategy fund with an absolute return mandate, and HCP Black Fund were down 3.4 percent and 3.2 percent, respectively (down 6.9 percent and 2.0 percent year-to-date).

Picture: (c) Everett-Collection—shutterstock.com