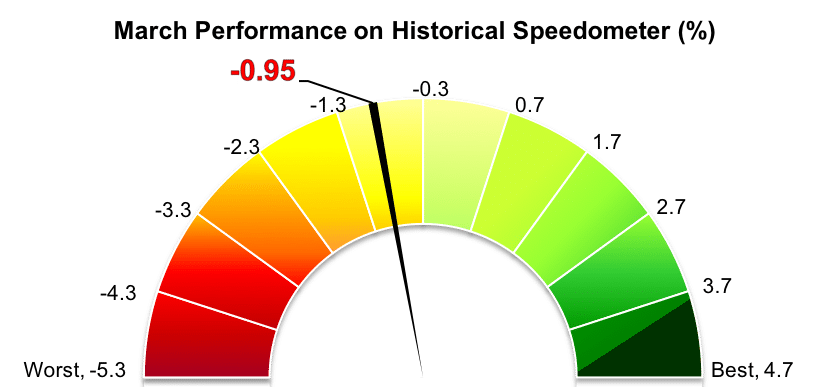

Stockholm (HedgeNordic) – Nordic equity hedge funds, as expressed by the NHX Equities Index, were down 1.0 percent in March (95 percent reported), partly reflecting increased volatility across equity markets caused by Donald Trump’s announcement of trade tariffs at the start of the month. Following the March performance, the NHX Equities Index is down 1.5 percent in the first quarter of 2018.

Despite experiencing one of the worst months of performance in the past two years or so, Nordic equity-focused hedge funds outperformed local and global stock market indices in March. The VINX Benchmark Index, constructed to represent all shares listed in the Nordic region, delivered a negative net total return of 2.6 percent in Euro terms last month. Global equity markets, as measured by the FTSE World Index, declined 2.8 percent in Euro terms, with Eurozone equities falling 2.1 percent and North American equities tumbling 2.4 percent in U.S. dollar terms and 3.2 percent in Euro terms. Equity markets across the globe reacted badly to Donald Trump’s announced plans to impose tariffs on steel and aluminum imports to the United States, which triggered fears of a global trade war.

International peers performed negatively on average, albeit marginally better than the equity-focused members of the NHX Composite. The Eurekahedge Long Short Equities Hedge Fund Index declined 0.6 percent (35 percent reported as of April 12) and the Barclay Equity Long/Short Index, another index that reflects the performance of international long/short equity funds, was down 0.2 percent (based on reported data from 213 funds).

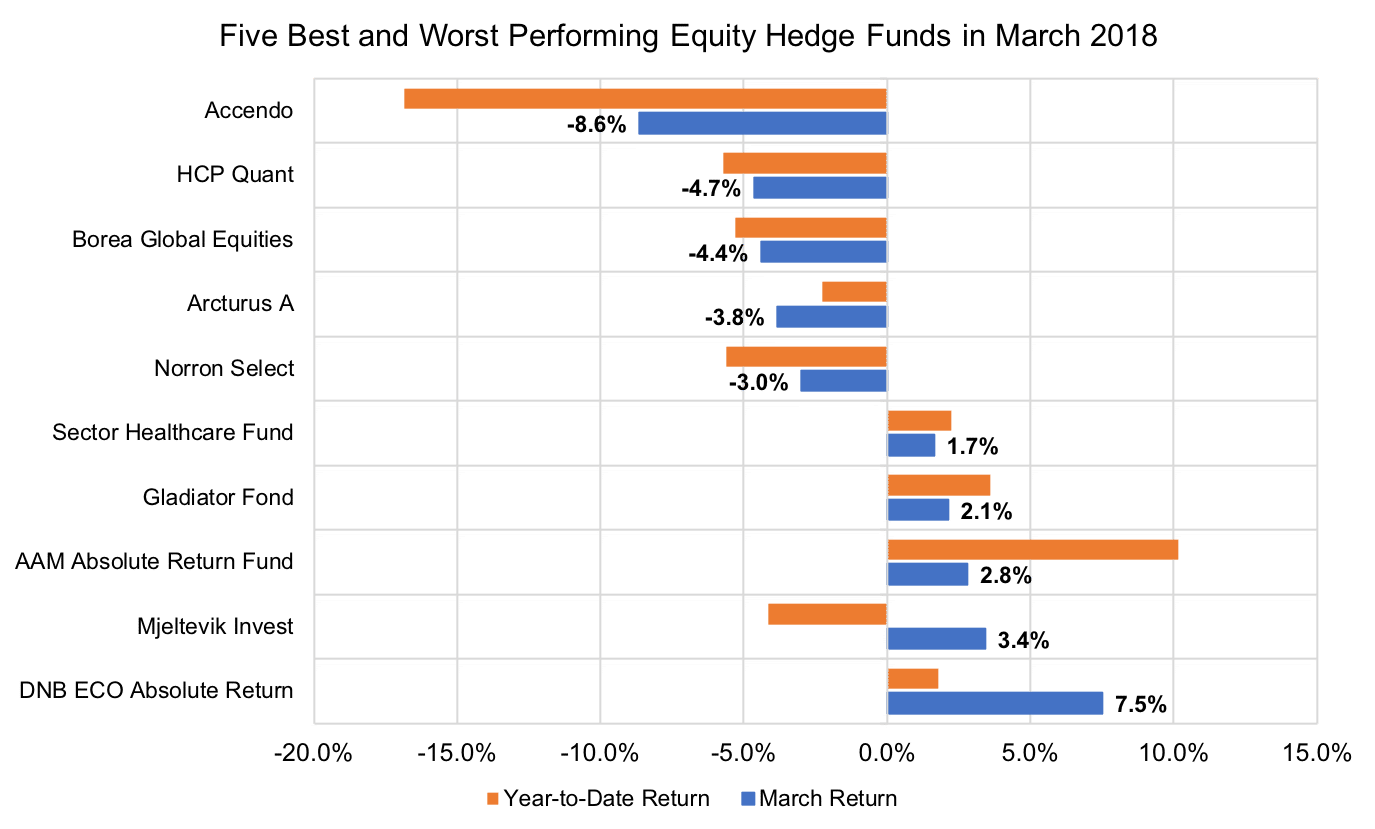

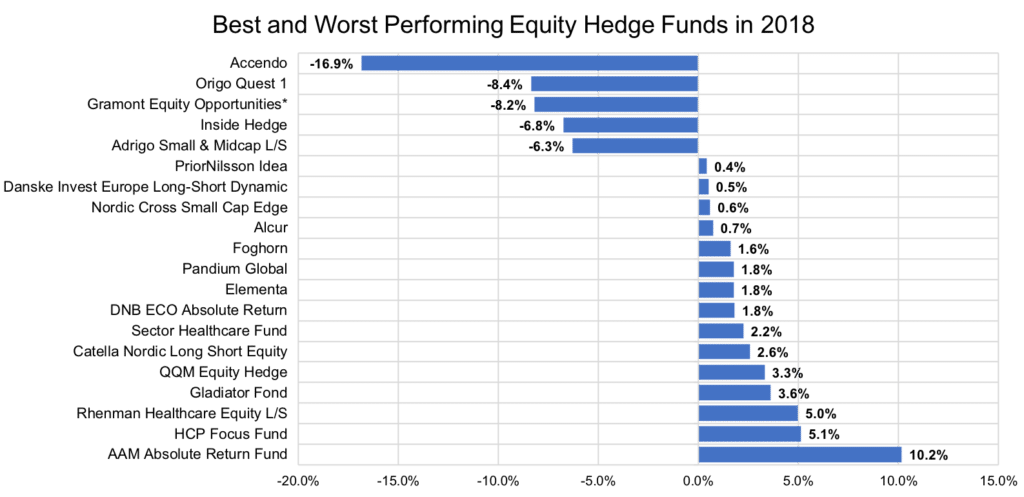

Only around 28 percent of the Nordic equity hedge funds that had reported performance figures for March generated positive returns last month. DNB ECO Absolute Return, a market-neutral fund focused on companies operating in or associated with renewable energy, was last month’s strongest performer in the NHX Equities Index with a gain of 7.5 percent (up 1.8 percent year-to-date). Mjeltevik Invest IS, which uses a systematic trend-following approach to trade Nordic equities, and AAM Absolute Return Fund, a long/short equity fund investing in companies related to global energy and natural resources, were up 3.4 percent and 2.8 percent, respectively. AAM Absolute Return Fund is up 10.2 percent in the first quarter of 2018, making it the second best-performing component of the NHX Composite.

Two of the four best-performing equity hedge funds of 2017 made last month’s list of worst performers. Activist fund Accendo Capital, which gained 24.0 percent last year, tumbled 8.6 percent in March, extending the steep losses from the previous two months (down 16.9 percent year-to-date). HCP Quant and Borea Global Equities were down 4.7 percent and 4.4 percent, correspondingly (down 5.7 percent and 5.3 percent year-to-date).