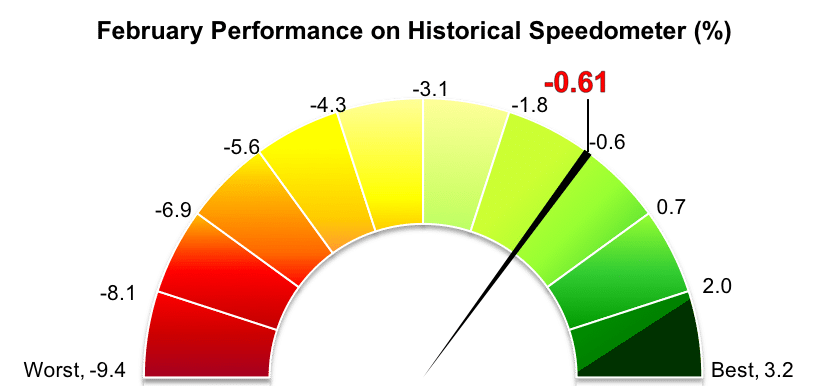

Stockholm (HedgeNordic) – The February market turmoil triggered by inflation and bond market concerns put an end to the 23-month streak of positive performance enjoyed by Nordic fixed-income hedge funds. The NHX Fixed Income Index fell 0.6 percent in February (92 percent reported), taking its year-to-date performance into negative territory at 0.1 percent.

International fixed-income hedge funds also recorded losses as a group in February, experiencing one of the worst months since early 2016. The Eurekahedge Fixed Income Hedge Fund Index, which tracks the performance of 344 fixed-income hedge funds, was down 0.5 percent in February (71 percent of funds reported as of March 22). The Eurekahedge index was up 0.5 percent in the first two months of the year. Market participants are getting nervous about inflation, as central banks may speed up the process of quantitative tightening. Higher inflation represents a serious risk to markets, mainly due to the sheer size of global central bank balance sheets.

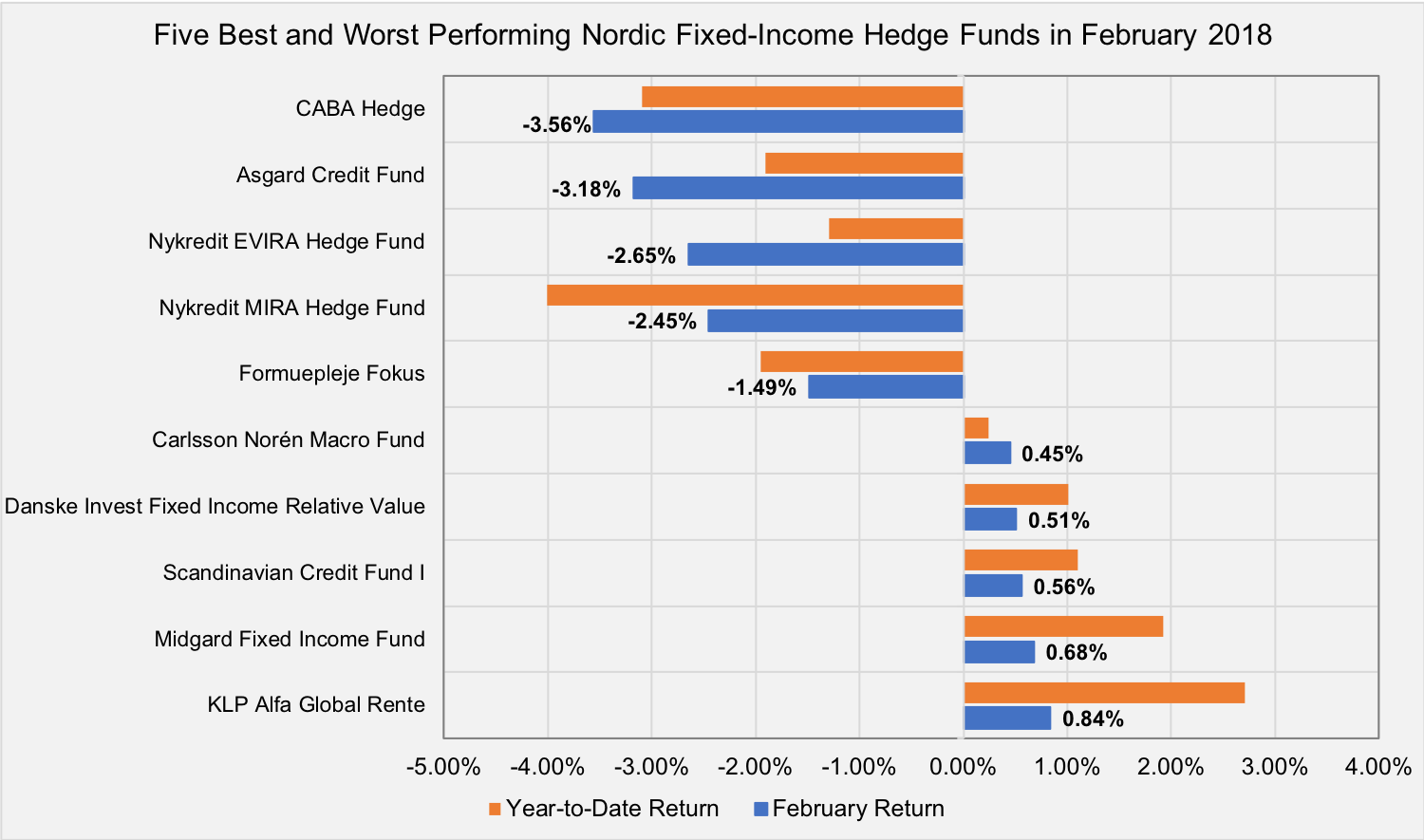

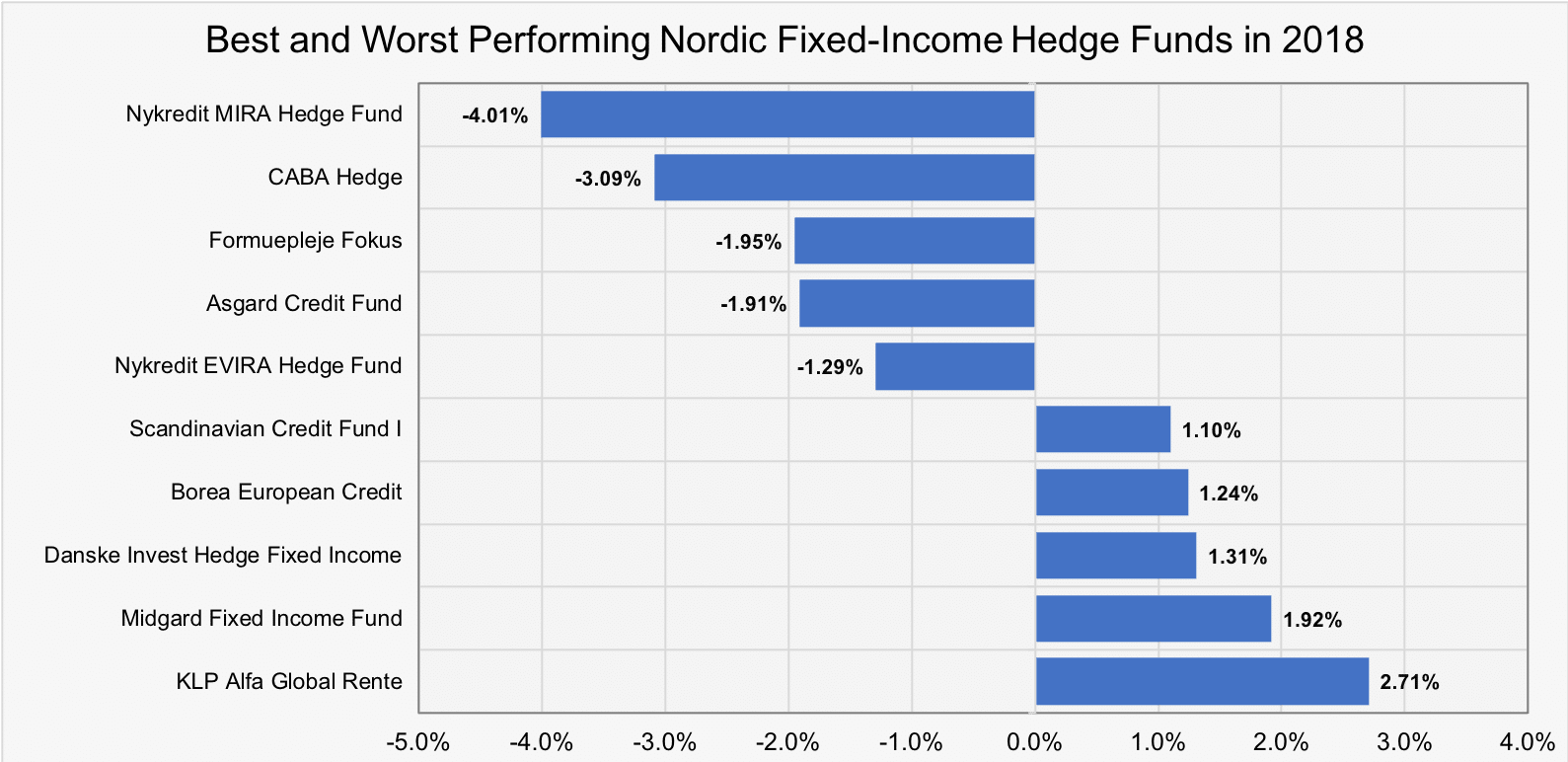

KLP Alfa Global Rente, a Norwegian fund seeking to exploit mispricing in fixed-income and foreign exchange markets, was the best performer in the NHX Fixed Income Index for two consecutive months. The fund was up 0.8 percent in February, bringing the performance for the two months of 2018 to 2.7 percent.

Europe-focused Midgard Fixed Income Fund, gained 0.7 percent last month (up 1.9 percent YTD). Scandinavian Credit Fund delivered a positive return for the 25th consecutive month after gaining 0.6 percent last month (up 1.1 percent YTD). Danske Invest Fixed Income Relative Value was up 0.5 percent in February and gained 1.0 percent in the first two months of 2018.

Fixed-income arbitrage fund CABA Hedge tumbled 3.6 percent in February, which brought the 2018 performance to a negative 3.1 percent. Asgard Credit Fund and two funds under the umbrella of Nykredit Asset Management did not enjoy a particularly good February either. Asgard Credit Fund was down 3.2 percent, while Nykredit EVIRA and Nykredit MIRA were fell 2.7 percent and 2.5 percent, respectively.

Picture © lchumpitaz – Shutterstock