Stockholm (HedgeNordic) – Nordic multi-strategy hedge funds, as expressed by the NHX Multi-Strategy Index, gained 0.6 percent on average in January (94 percent reported), with the entire group clinching the title of the second best-performing NHX sub-category. Around two-thirds of multi-strategy funds reported positive performance for the month.

Nordic multi-strategy funds underperformed international indices of similar strategies last month, partly reflecting the diverse composition of the NHX sub-category. For instance, the Eurekahedge Multi-Strategy Hedge Fund Index, an equally-weighted index comprising 268 global multi-strategy funds, gained 2.2 percent in January (63 percent reported as of February 22). The Barclay Multi Strategy Index, meanwhile, advanced 1.5 percent last month, based on reported data from 86 funds. Similar to the NHX Multi-Strategy Index, the Barclay Index comprises hedge funds that are not easily assigned to any traditional strategy.

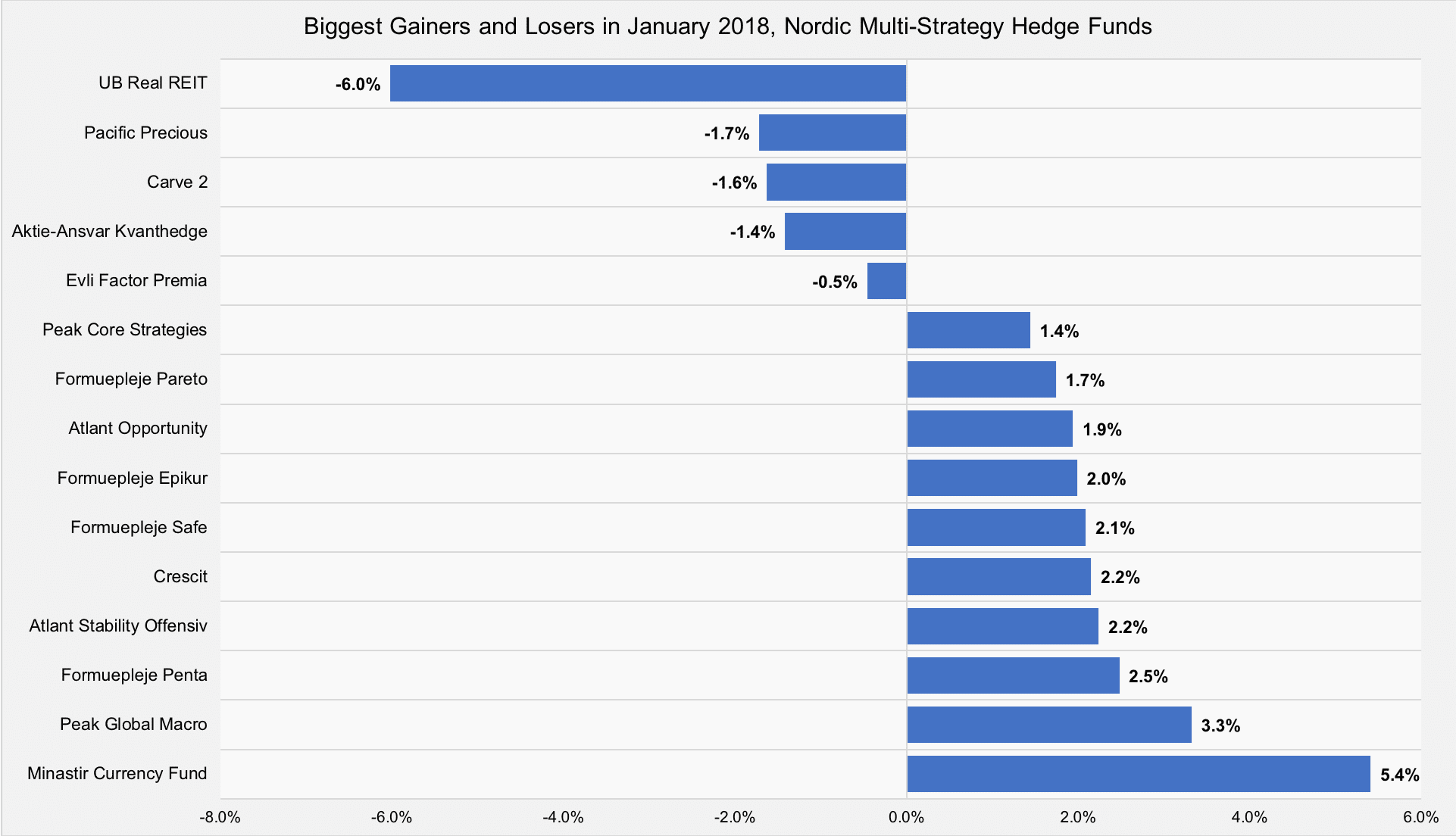

Minastir Currency Fund, a directional hedge fund that takes long and short positions in different currencies, produced the biggest monthly gain since its inception in October 2015. The fund was up 5.4 percent in January, making the fund the best-performing constituent in the multi-strategy group.

Peak Global Macro, which employs a systematic investment strategy to identify and capitalize on short- and medium-term trends across major asset classes, gained 3.3 percent last month. Formuepleje Penta, which has delivered annual returns of more than 10 percent for six consecutive years, also enjoyed a great start to 2018. The fund advanced 2.5 percent in January, after gaining 15.2 percent and 21.0 percent in 2017 and 2016, respectively.

Source: HedgeNordic.

Real estate-focused investment fund UB Real REIT was the biggest laggard among Nordic multi-strategy funds in January, after having reported a loss of 6.0 percent. Precious metals-focused Pacific Precious and Brummer-backed Carve 2 edged down 1.7 percent and 1.6 percent, correspondingly.

Picture © Sergey Nivens – Shutterstock