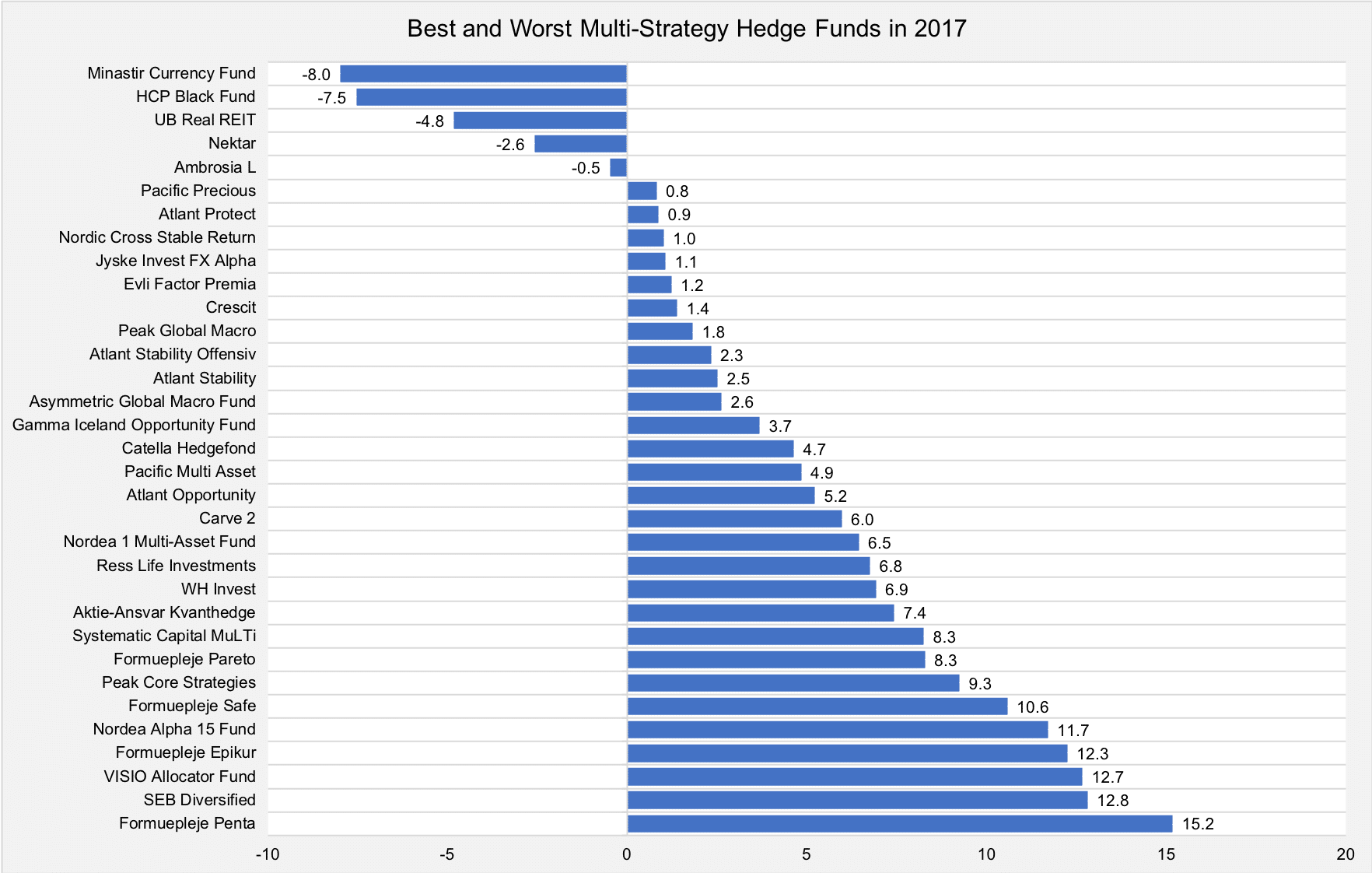

Stockholm (HedgeNordic) – Nordic multi-strategy funds, the most diverse group of funds within the NHX family, were nearly flat in December at a negative 0.04% (100% reported). The NHX Multi-Strategy Index gained 4.3% last year, becoming runner-up in the race of the best-performing NHX category of 2017.

The NHX Multi-Strategy Index contains a variety of strategies ranging from sector-specific strategies to programs investing in a broad range of asset classes. This NHX sub-category is therefore difficult to compare with any global benchmark. Worth mentioning, the Eurekahedge Multi-Strategy Hedge Fund Index, an equally-weighted index of 254 global multi-strategy funds, advanced 10.0% in 2017.

Atlant Protect, a hedge fund seeking to offer protection against periods of weak stock market performance by focusing on derivative strategies and fixed-income instruments, was the best-performing Nordic multi-strategy fund in December after gaining 1.2%. The low-single-digit return pushed the fund into positive territory for the year (0.9% for 2017). Peak Global Macro, a multi-strategy fund investing in a broad range of asset classes using a systematic approach, gained 1.2% in December and was up 1.8% for the year. Real estate-focused investment fund UB Real REIT was up 1.1% last month, putting an end to a string of five consecutive months of negative performance (-4.8% for 2017).

Asymmetric Global Macro Fund, a fund that enters long and short positions in equities, fixed income and currencies, lost 2.5% in December, cutting the full-year gains to 2.6%. Aktie-Ansvar Kvanthedge delivered a negative return of 1.4% last month, finishing the year up 7.4%. The fund uses a systematic approach to enter long and short positions in equity markets, fixed-income markets, and currency markets across the globe.

Picture © Pincasso – Shutterstock