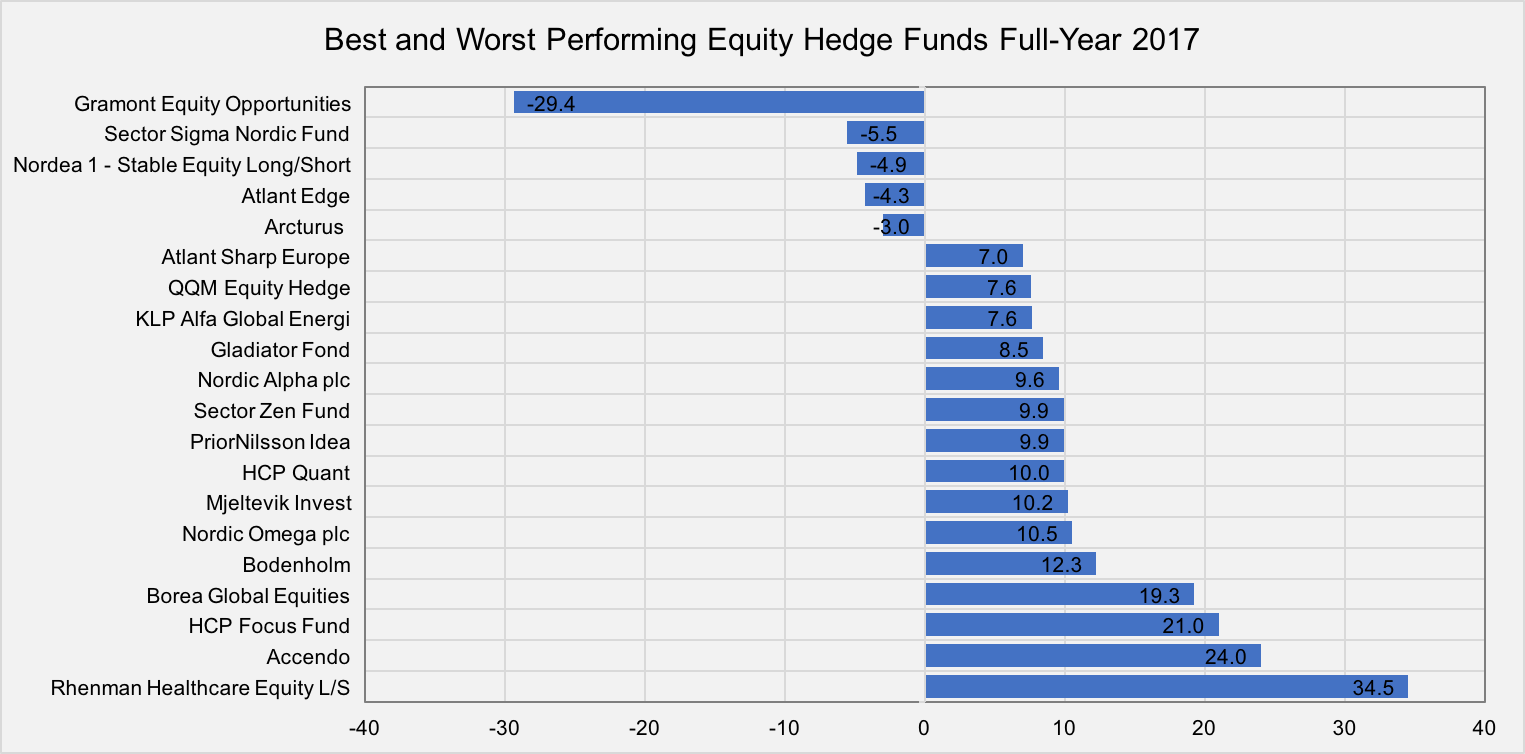

Stockholm (HedgeNordic) – Nordic equity hedge funds ended last year on a positive note after returning 0.8% on average in December (93% reported), recording their worst yearly performance since 2011. The NHX Equities Index, which tracks the performance of Nordic equity-focused hedge funds, advanced 3.7% in 2017, whereas global equities hedge funds were up 13.2% for the year – their best yearly performance in four years.

Nordic equity hedge funds performed in line with the market during the last month of 2017, as Nordic equity markets, as measured by the VINX Benchmark Index in Euro terms, advanced 0.7% in December. Global equity markets gained 0.9% in Euro terms, extending the full-year gains to 9.0%. Eurozone equities fell 0.7% in December, gaining 13.9% for the year – the best yearly performance since 2013. North American equities advanced 0.6% in Euro terms, with market indices hitting new record highs again. The Dow Jones Index punched through the 25,000-level.

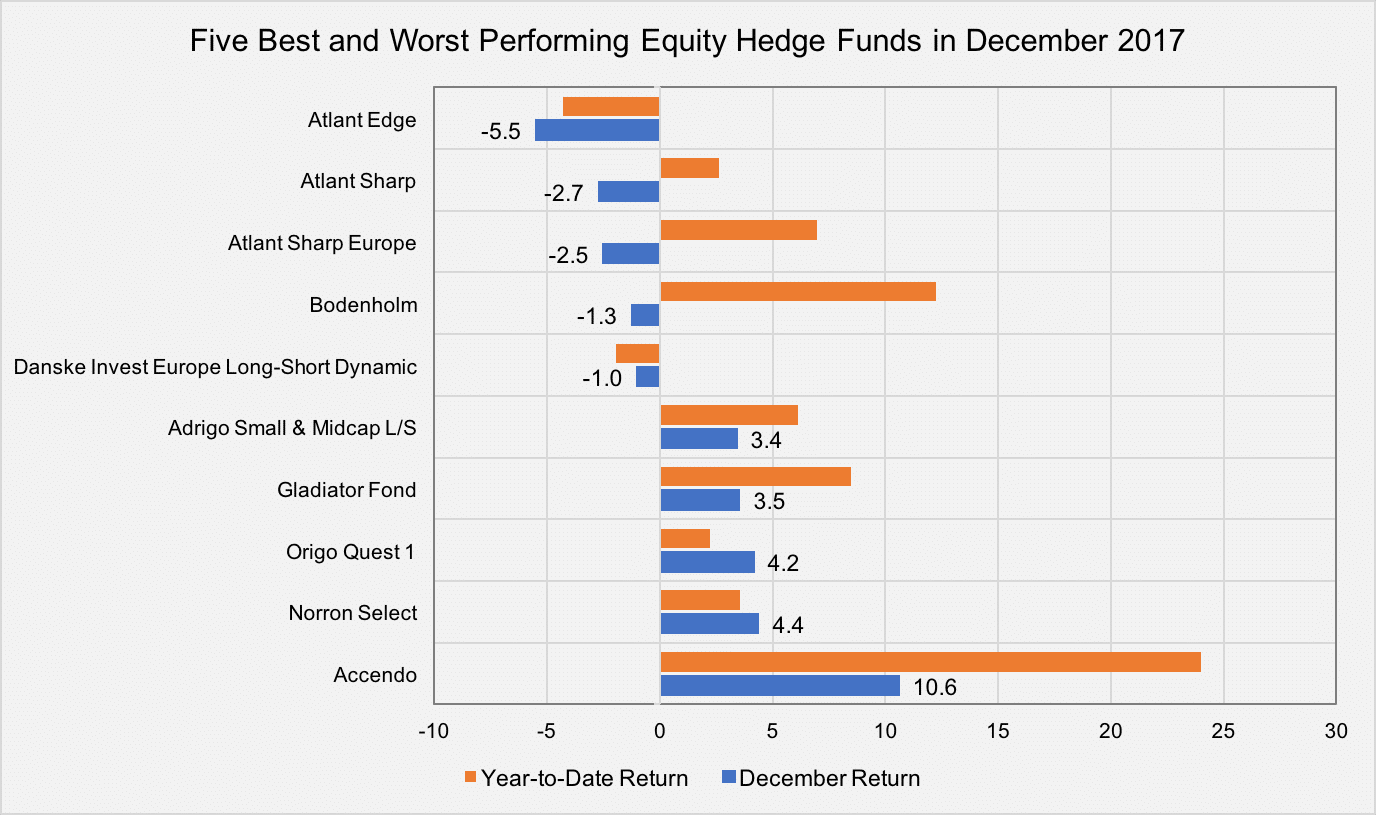

Activist hedge fund Accendo Capital was the best-performing fund within the NHX Equities category in December, after suffering two consecutive months of underwhelming performance. The fund gained 10.6% in the last month of 2017, bringing the full-year performance to 24.0%. Accendo generated returns of more than 20% for the third consecutive year and reclaimed its position as the second-best performing equity fund in 2017.

Nordic-focused long/short equity fund Norron Select was the runner-up on our list of best-performing equity funds, up 4.4% in December (3.5% for the full year). Small-cap specialist Origo Quest 1 returned 4.2% in December, bringing the full-year performance to 2.2%. The strong performance in the last month of 2017 helped the fund avoid a first-ever down year. Origo Quest 1 returned more than 10% in each of the last four years. Gladiator Fond, a long/short equity fund managed by Max Mitteregger Kapitalförvaltning AB, gained 3.5% in December and extended the full-year gains to 8.5%. Adrigo Small & Midcap L/S, a fund investing in Nordic small- and mid-cap companies, was among the top five performers within the NHX Equities category in both November and December. The fund managed by Stockholm-based asset manager Adrigo Asset Management AB gained 3.4% in December and generated 6.1% during the first two months of operations.

Turning our focus to lagging peers, the Atlant Fonder family of funds dominated the worst-performing equity funds. Atlant Edge incurred a loss of 5.5% in December after losing 7.8% in the prior month (-4.3% for the full year), Atlant Sharp and Atlant Sharp Europe fell by 2.7% and 2.5% (2.6% and 7.0% for 2017), respectively. Brummer-backed long/short equity fund Bodenholm lost 1.3% in December, erasing some of the gains generated throughout the year (12.3% for 2017). The fund recorded its best yearly performance since its inception in September 2015. Absolute return fund Danske Invest Europe Long-Short Dynamic incurred a loss of 1.0% (-2.0 for 2017).

Picture © Minerva-Studio – Shutterstock