Stockholm (HedgeNordic) – HedgeNordic undertakes great efforts to capture and reflect the entire universe of Nordic hedge funds and managers in its databases. Additional funds are added as soon as we become aware of them and / or, or when we gain access to required date and/or when the respective managers consent to be listed in the databases. Also, on a monthly basis, the databases are cleaned of inactive funds in order to keep data up to date and accurate.

Newly added funds in July 2016 were ALFA XO (ALFAKRAFT Fonder, Stockholm), AJ Value Hedge (AJ Fund Management, Helsinki) and Arcturus A, Idevall & Partners Fonder, Stockholm).

There are a number of funds listed in the HedgeNordic databases that are constituents of the Nordic Hedge Index Composite (NHX) and its respective sub-indices that have been giving reason for rethinking the composition of the NHX. Typically, these are funds that are leveraged versions of other listed funds or reflect different currency or investor/fee classes. The dilemma is that while we aim to capture the entirety of the Nordic hedge fund universe, and each fund / share class of course represents a legitimate vehicle to stand alone and be exposed, on an index level it may cause a false picture of reality having individual funds counted multiple times in different versions, for the better or worse of index performance.

As of July 31st 2016 the funds that fall into this category are:

- Brummer Multi-Strategy 2xL

- Coeli Multistrategi 2xL

- Graal Total 2xL

- Merrant Alpha Select USD

- SEB, AS Opportunistic

From August 1 2016, going forward, the funds above will be qualified as “listed” in the HedgeNordic database but no longer be constituents of the Nordic Hedge Index (NHX) or its respective sub-indices. Further, the funds will not be considered for the Nordic Hedge Award and its respective sub-categories. Statues for listing in the Nordic Hedge Index as well as terms and conditions for the Nordic Hedge Award will be adjusted accordingly. The historic data and prices of the NHX and sub-indices however will NOT be changed to reflect the alteration in index composition.

No funds were removed from the NHX during July for other reasons. Typically, funds are removed due to discontinuation of operations or failure to calculate or report NAVs for a period of six months.

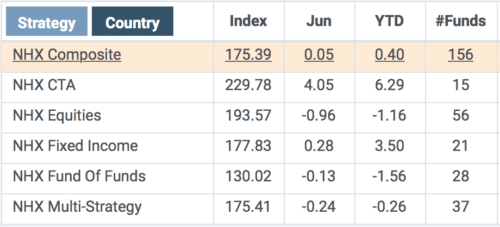

The total number of funds listed in the HedgeNordic database are therefor 156, of which 151 are NHX constituents.

Listing in the HedgeNordic databases is free of charges. Listing inquires can be addressed to NAV@hedgenordic.com.

Picture: (c) maigi—shutterstock.com