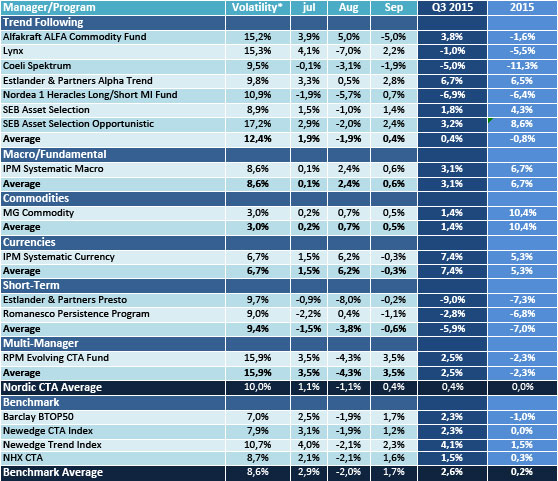

Stockholm (HedgeNordic) – As financial markets turned increasingly volatile in the third quarter, CTAs showed resilience. The NHX CTA index gained 1.5 percent during the period, slightly underperforming global industry benchmarks. Year to date, Nordic CTAs as represented by NHX, are up 0.3 percent.

Performance dispersion remained high as short term strategies continued to struggle while fundamental strategies had a solid month.

Among the large names, Lynx lost 1 percent during the quarter, with steep losses seen in August. SEB Asset Selection, on the other hand, gained 1.8 percent. Among the strongest performers were IPM Systematic Currency and Estlander Alpha Trend with gains of 7.4 percent and 6.7 percent respectively.

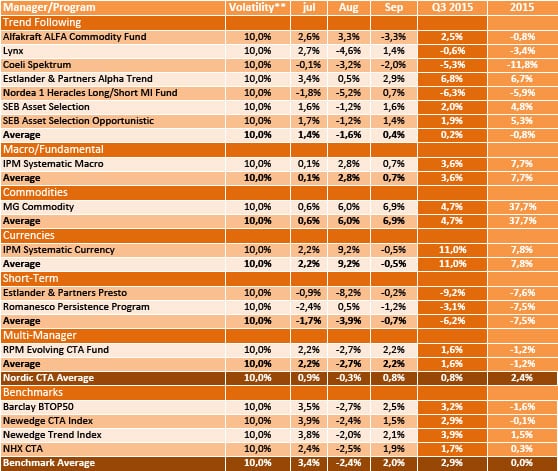

On the year, MG Commodity is by far the strongest performer, especially when adjusting for risk (see table 2 where all managers are adjusted to the average volatility level of Nordic CTAs).

Bild: (c) Minerva-Studio—shutterstock.com