Stockholm (HedgeNordic) – Efter att noterat breda nedgångar under juni studsade Nordens CTA-förvaltare upp igen under juli. NHX CTA steg med 1,58 procent under månaden och är därmed upp 0,68 procent på året.

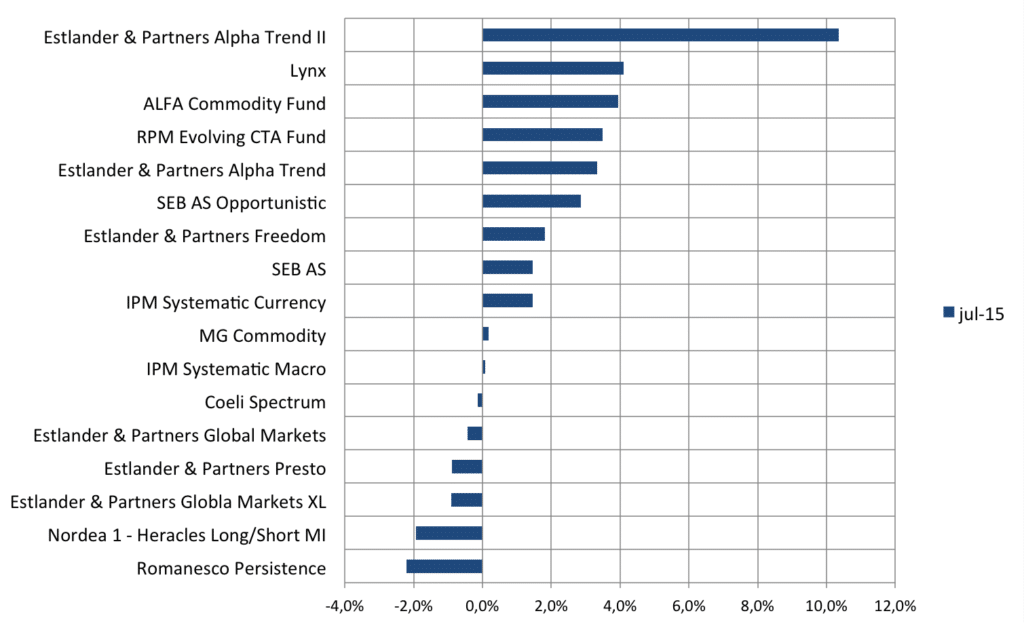

Bland individuella förvaltare presterade trendföljande strategier bäst med svenska Lynx i spetsen (+4,11%). Även Alfa Commodity Fund (+3,94%), Estlander Alpha Trend (+3,33%) och SEB Asset Selection (+1,46%) hakade på i uppgången. Multi-manager fonden RPM Evolving, också den med ett tydligt inslag av trendföljande strategier, steg med 3,5 procent.

Bland de program som hade det mer besvärlig märktes Estlander Presto (-0,88%) och Romanesco Persistence (-2,21%). Båda använder sig av strategier som handlar på kortare tidshorisont.

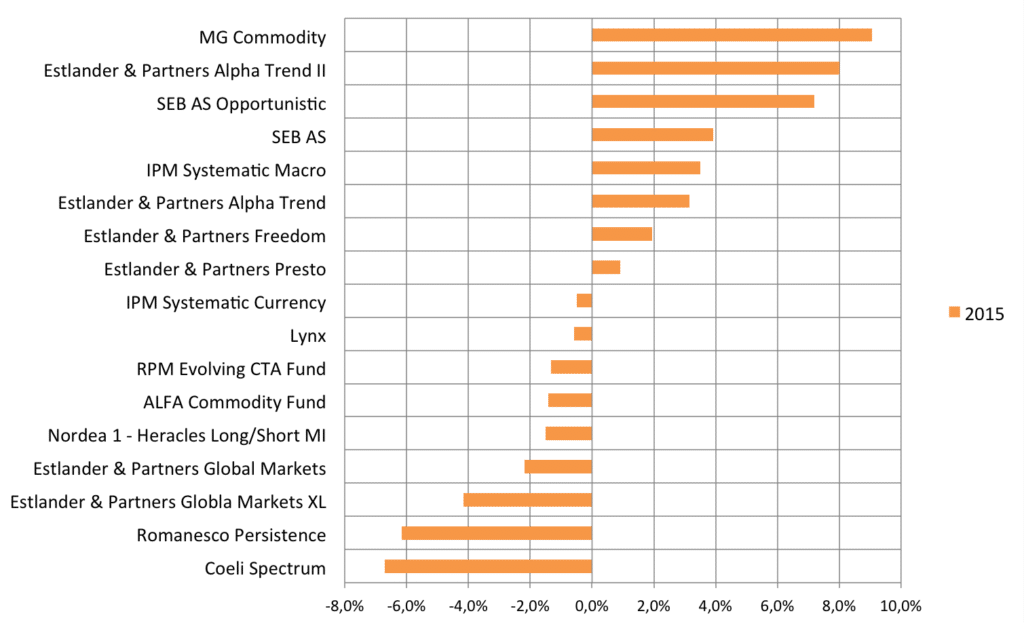

Graf 1 och 2 nedan sammanfattar utvecklingen för nordiska CTAs under juli och sedan årsskiftet. Värt att notera är den spretiga utvecklingen på året.

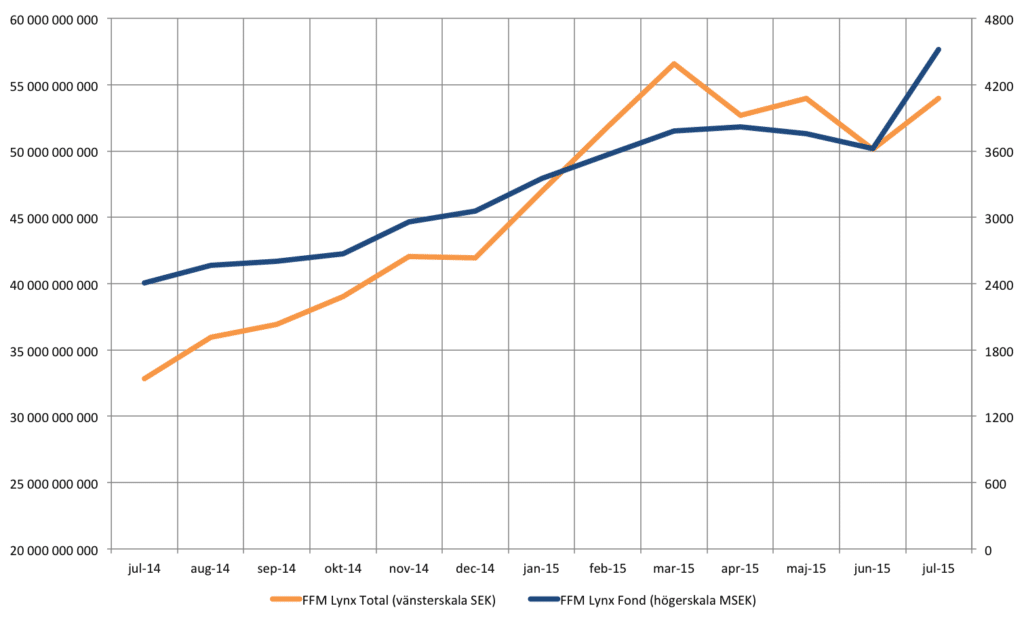

En annan noterbar händelse under juli var ett stort inflöde till Lynx-fonden som ökade sin fondförmögenhet med knappt 25 procent till drygt 4,5 miljarder SEK. Totalt förvaltar Lynx nu närmare 54 miljarder SEK, en uppgång med 65 procent från samma period förra året (se graf 3 nedan).

Graf 1. Nordiska CTAs – utveckling juli 2015

Graf 2. Nordiska CTAs – utveckling 2015

Graf 3. Utveckling fondförmögenhet Lynx – fond respektive totalt

Bild: (c) ramcreations-shutterstock