London (HedgeNordic) – Demand for equity research has reached record levels as the rapidly changing macro environment increases risk, uncertainty and opportunity. Interest rates have gone from zero to multi-year highs in just two years. Managers need the tools to harness vast volumes of information to their benefit.

Expanding Bandwidth and Coverage

A growing network of over 200 brokers contribute spreadsheet models on more than 14,700 companies globally for Visible Alpha. “In a small region like the Nordics, local hedge fund managers may have an information edge over their international competitors, but many find that they really need tools such as Visible Alpha to digest data and intelligence when investing outside the Nordics, and most players have a significant majority of their investments outside the region,” says London-based Markus Gronlund, who handles Visible Alpha’s sales for the Nordic region.

“…many find that they really need tools such as Visible Alpha to digest data and intelligence when investing outside the Nordics…”

In addition to collecting and distributing the analysts’ spreadsheets, Visible Alpha process the models on over 6,900 companies, extracting all of the data and forecasts from each analyst and allowing investors to compare and contrast the views of the different analysts on not only financial metrics and key drivers, but all the way down to the most granular segment and product level assumptions. Visible Alpha also creates “consensus” data on all of these metrics, providing a highly detailed view of market expectations for each company.

Nordic managers can invest across a wide investable universe, and they need the tools to punch above their weight. Visible Alpha is a force multiplier in terms of leveraging content from research providers, broadening an analyst or portfolio manager’s bandwidth so that they can efficiently and effectively handle the content from many more providers. Gaining a wider and deeper set of quantified views on companies allows managers to put their thesis into perspective: are they above or below consensus on business dynamics – and is their view an outlier? Visible Alpha acts as a yardstick to help investors understand where their own models fit into the range of opinions.

“While investors have always done their own research, the sheer scale of following markets today means that managers rely heavily on sell-side analysts to interview management, talk to competitors, pore through the financials and really get to know companies in detail,” points out US-based Scott Rosen, founder of Visible Alpha and Chief Research and Innovation Officer.

Discretionary and Quant

Many asset managers, corporations and sell-side firms find the service indispensable and use Visible Alpha’s data across their workflows. End users range from traditional fundamental discretionary managers to systematic investors using quantitative and data science approaches. “In business, and particularly in the markets, almost everyone’s job involves trying to predict the future with the mosaic of information and insights you have available. The better you can collect, process and interpret that information, the better your forecasts,” says Rosen.

Single-Company and Industry-Wide Analysis

In recent years, Visible Alpha has expanded its offering from company-specific data to include analysis of business peer groups, examining a host of detailed comparable metrics across companies, with KPIs tailored to each industry. Users can focus on growth trends, competitive positioning, relative revisions or sentiment changes, surprise analysis or other comparisons of companies within the same industry or sub-industry. These screens can be further filtered by geography or company size.

Industry Focus: Biopharma

In October 2023, Visible Alpha launched a new pharma and biotech service, offering insights specific to the healthcare sector. Visible Alpha Biopharma provides granular breakdowns of drug revenue estimates, including sales forecasts, addressable number of patients, indication, therapeutic areas, clinical phase, and mechanism of action (MOA). The service covers 6,700 drugs that treat over 1,000 indicators and leveraging 1,200 Mechanisms of Action.

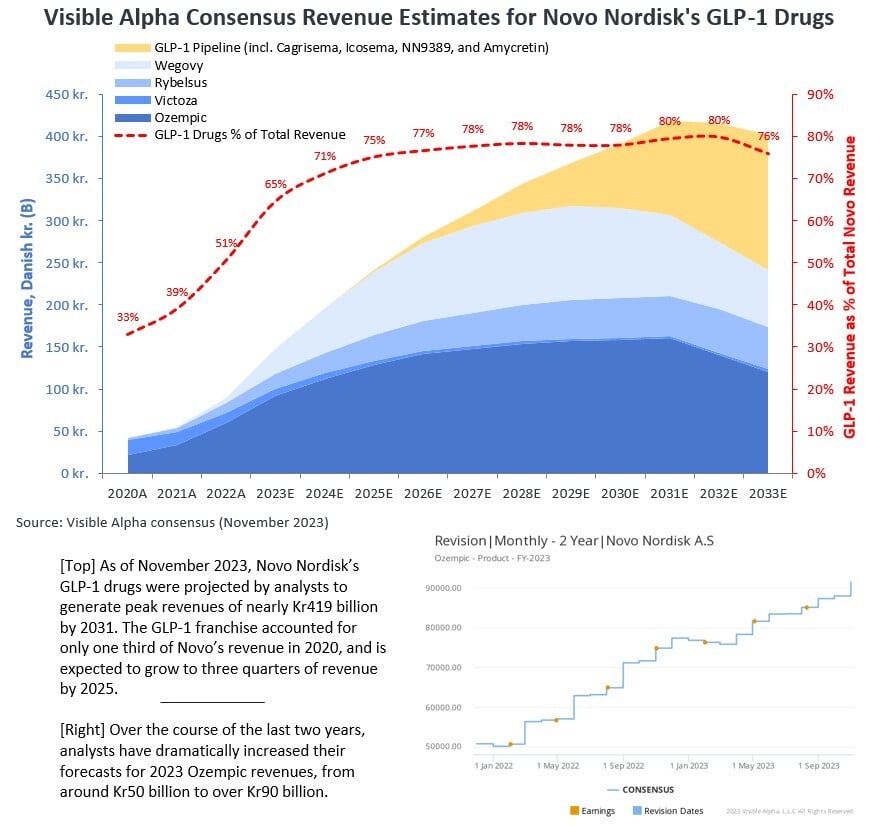

Stock Focus: Novo Nordisk

The largest stock by market capitalisation in the Nordics, Novo Nordisk, provides an interesting case study to highlight just a few key metrics. Visible Alpha can provide a granular breakdown of, for example, 2028 revenue forecasts for Nordisk’s Ozempic, which range from a low of USD 115 billion to a high of USD 228 billion, and have a mean of USD 154 billion. Regional breakdowns can also be provided. Of 6,700 drugs tracked by Visible Alpha, Ozempic is now the third largest – up from number 25 two years ago, thanks to licensing the GLP-1 agonist for weight loss. See the sidebar for additional information on Novo Nordisk’s GLP-1 portfolio.

Granularity and Fidelity of Data

Users of Visible Alpha can drill down to the deepest assumptions in a model (up to 1,000 for some companies), and each can be cross referenced against other companies using standardized line items per sector and industry. These include some important items that companies themselves may not report, but which analysts estimate, such as geographic or product-specific breakdowns. Investors can gauge consensus and dispersion in estimates, and expand their coverage.

“We use maximum granularity to track analyst forecasts from the ground up, from the lowest assumption all the way through the revenue build and the financial statements.”

“Clients focus on the fidelity and reliability of the data, which speaks to our methodology in collection and validation, allowing them to trust the numbers,” says Gronlund. “We use maximum granularity to track analyst forecasts from the ground up, from the lowest assumption all the way through the revenue build and the financial statements. This provides much greater insight and detailed understanding than any other vendor. We understand the individual nuances. We do not just gather top line numbers,” stresses Rosen.

Examples of Functionality

Visualisation tools flag up anomalies. Investors can identify the most accurate forecasts and forecasters, and most importantly, which analysts are the outliers among the range of estimates.

All data can be exported into Excel and compared with in-house forecasts. Investors can also view an audit trail, tracing every forecast back to the actual location of that number in a model or filings document.

The revisions analysis feature tracks the trajectory of individual or consensus estimates, for all line items and data points. Users can also be alerted to revisions that exceed a minimum threshold if they want to focus on larger changes.

Testimonials reveal that VA has saved huge amounts of time for clients. The average time saving in one survey was 8 hours per month, plus five hours from the Excel add-in, but some clients claim to save much greater amounts of time.

Many clients say that freeing up energy and bandwidth allows them more time for creative thinking and wider ranging analysis. Analysis that is itself deeper and richer for having access to the Visible Alpha service.