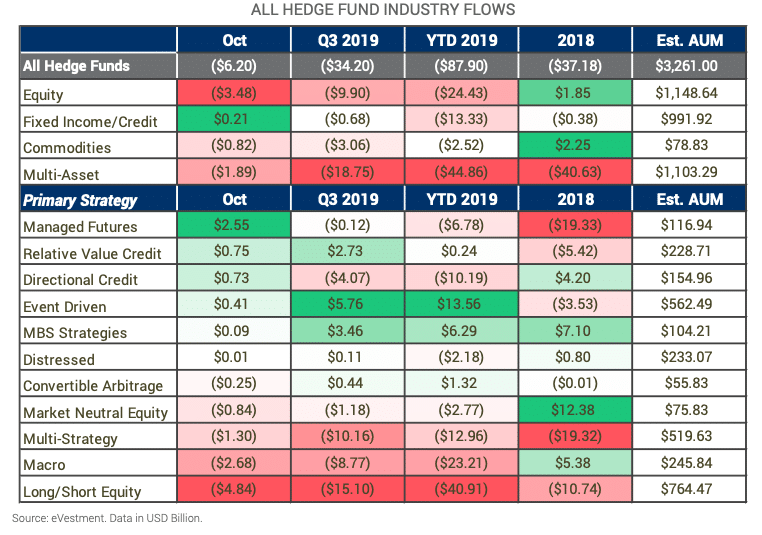

Stockholm (HedgeNordic) – Last month, investors pulled money out of hedge funds for the eighth consecutive month, according to eVestment. Following net redemptions of $6.2 billion in October, the global hedge fund industry experienced net outflows of $87.9 billion year-to-date to the end of October.

According to eVestment, the most recent eight-month period “marks the most prolonged redemption pressures on the industry since 2008/2009.” The last time the industry experienced so many consecutive months of net redemptions was the period between the third quarter of 2008 and April of 2009.

About 45 percent of hedge funds from eVestment’s database with reported figures received net inflows in October, yet redemptions outweighed new allocations. Long/short equity hedge funds continue to experience the highest volume of net redemptions. Investors redeemed an estimated $4.8 billion from long/short equity funds in October, which brought the year-to-date volume of net outflows to $40.9 billion. This amount accounts for 5.4 percent of the $764.5 billion managed by long/short equity funds at the end of October.

Following several months of good returns, managed futures funds received new money for a third consecutive month. Managed futures funds received net inflows of $2.6 billion in October, reducing the year-to-date volume of net outflows to $6.8 billion. However, around 55 percent of managed futures funds experienced net redemptions last month, as allocations continue to go to a select group of firms. For the year, nearly 70 percent of this group experienced net outflows.

According to eVestment, the managed futures funds that received inflows so far in 2019 appear to have performed better than peers both this year and last year. The ten largest inflows in 2019 went to products that returned nearly eight percent on average this year and incurred an average loss of less than one percent last year, compared to the average loss of almost six percent for the universe. “The last two months have been difficult for the strategy and even for many (but not all) of these favored products,” writes eVestment.

On aggregate, macro funds in eVestment’s database did not receive net inflows in any month of 2019. Investors redeemed a net $2.7 billion in October from macro funds, bringing the year-to-date volume of net redemptions to $23.2 billion. According to eVestment, macro funds oversee $245.8 billion as of the end of October.

eVestment’s Hedge Fund Asset Flows Report for October can be accessed below: